(Solved): You are considering making a movie. The movie is expected to cost \( \$ 10.7 \) million up front and ...

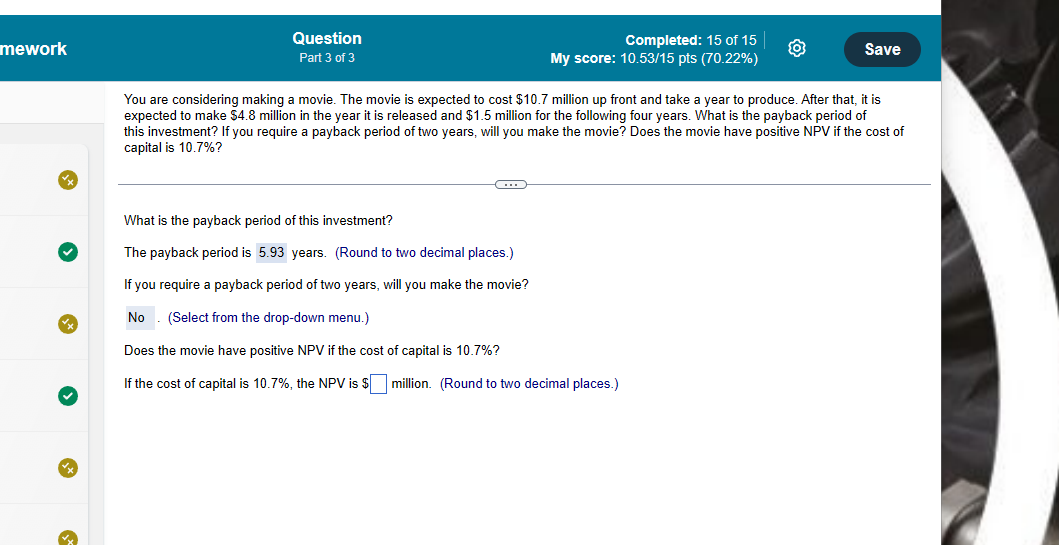

You are considering making a movie. The movie is expected to cost \( \$ 10.7 \) million up front and take a year to produce. After that, it is expected to make \( \$ 4.8 \) million in the year it is released and \( \$ 1.5 \) million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is \( 10.7 \% \) ? What is the payback period of this investment? The payback period is years. (Round to two decimal places.) If you require a payback period of two years, will you make the movie? (Select from the drop-down menu.) Does the movie have positive NPV if the cost of capital is \( 10.7 \% \) ? If the cost of capital is \( 10.7 \% \), the NPV is \( ? \) million. (Round to two decimal places.)