Home /

Expert Answers /

Finance /

you-are-attempting-to-value-a-put-option-with-an-exercise-price-of-108-and-one-year-to-exp-pa215

(Solved): You are attempting to value a put option with an exercise price of \( \$ 108 \) and one year to exp ...

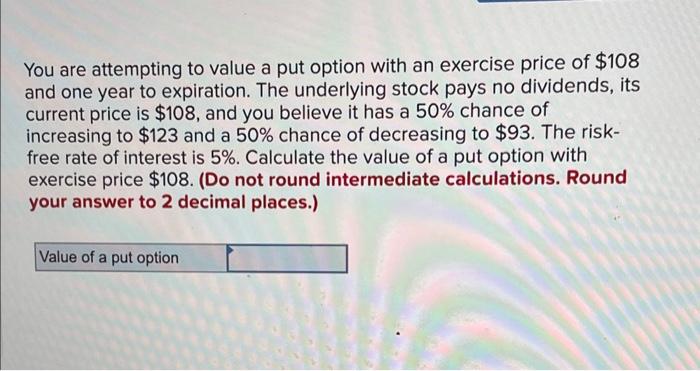

You are attempting to value a put option with an exercise price of \( \$ 108 \) and one year to expiration. The underlying stock pays no dividends, its current price is \( \$ 108 \), and you believe it has a \( 50 \% \) chance of increasing to \( \$ 123 \) and a \( 50 \% \) chance of decreasing to \( \$ 93 \). The riskfree rate of interest is \( 5 \% \). Calculate the value of a put option with exercise price \$108. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Expert Answer

Calculate expected value of put on