Home /

Expert Answers /

Finance /

what-is-the-risk-adjusted-npv-of-project-a-what-is-the-risk-adjusted-nps-of-project-b-risk-ad-pa483

(Solved): What is the risk-adjusted NPV of project A? What is the risk-adjusted NPS of project B? (Risk-ad ...

What is the risk-adjusted NPV of project A?

What is the risk-adjusted NPS of project B?

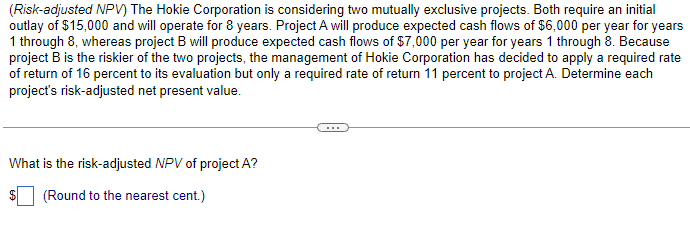

(Risk-adjusted NPV) The Hokie Corporation is considering two mutually exclusive projects. Both require an initial outlay of \( \$ 15,000 \) and will operate for 8 years. Project A will produce expected cash flows of \( \$ 6,000 \) per year for years 1 through 8 , whereas project \( B \) will produce expected cash flows of \( \$ 7,000 \) per year for years 1 through 8 . Because project \( B \) is the riskier of the two projects, the management of Hokie Corporation has decided to apply a required rate of return of 16 percent to its evaluation but only a required rate of return 11 percent to project \( A \). Determine each project's risk-adjusted net present value. What is the risk-adjusted NPV of project A? \( \$ \quad \) (Round to the nearest cent.)

Expert Answer

NPV is one of the best method of e