Home /

Expert Answers /

Accounting /

what-are-campbell-39-s-cash-collections-from-customers-following-adjusting-entries-what-are-campbell-pa142

(Solved): What are Campbell's Cash Collections from Customers following adjusting entries? What are Campbell's ...

What are Campbell's net cash inflows (-outflows) from operating activities?

What are Campbell's net cash inflows (-outflows) from financing activities?

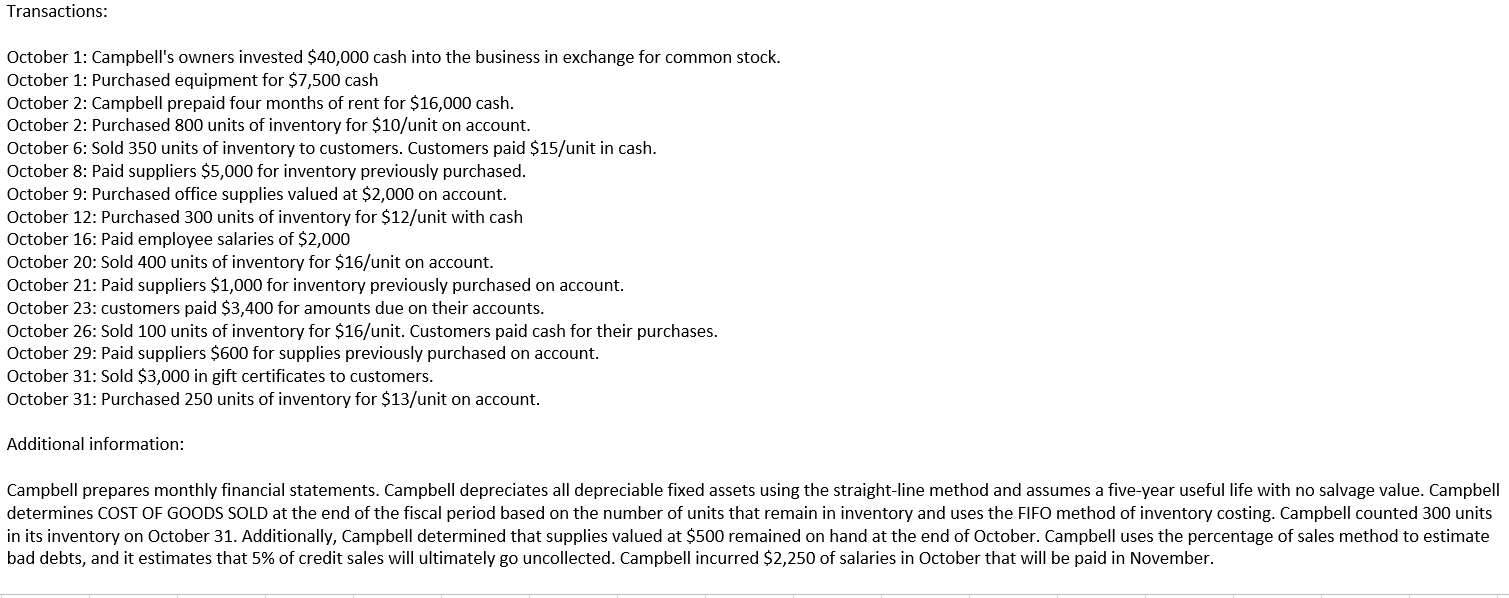

October 1: Campbell's owners invested \( \$ 40,000 \) cash into the business in exchange for common stock. October 1: Purchased equipment for \( \$ 7,500 \) cash October 2: Campbell prepaid four months of rent for \( \$ 16,000 \) cash. October 2: Purchased 800 units of inventory for \( \$ 10 \) /unit on account. October 6: Sold 350 units of inventory to customers. Customers paid \( \$ 15 / \) unit in cash. October 8: Paid suppliers \( \$ 5,000 \) for inventory previously purchased. October 9: Purchased office supplies valued at \( \$ 2,000 \) on account. October 12: Purchased 300 units of inventory for \( \$ 12 \) /unit with cash October 16: Paid employee salaries of \( \$ 2,000 \) October 20: Sold 400 units of inventory for \( \$ 16 \) /unit on account. October 21: Paid suppliers \( \$ 1,000 \) for inventory previously purchased on account. October 23: customers paid \( \$ 3,400 \) for amounts due on their accounts. October 26: Sold 100 units of inventory for \( \$ 16 \) /unit. Customers paid cash for their purchases. October 29: Paid suppliers \( \$ 600 \) for supplies previously purchased on account. October 31: Sold \( \$ 3,000 \) in gift certificates to customers. October 31: Purchased 250 units of inventory for \( \$ 13 \) /unit on account. Additional information: Campbell prepares monthly financial statements. Campbell depreciates all depreciable fixed assets using the straight-line method and assumes a five-year useful life with no salvage value. Campbell determines COST OF GOODS SOLD at the end of the fiscal period based on the number of units that remain in inventory and uses the FIFO method of inventory costing. Campbell counted 300 units in its inventory on October 31. Additionally, Campbell determined that supplies valued at \( \$ 500 \) remained on hand at the end of October. Campbell uses the percentage of sales method to estimate bad debts, and it estimates that \( 5 \% \) of credit sales will ultimately go uncollected. Campbell incurred \( \$ 2,250 \) of salaries in October that will be paid in November.

Expert Answer

Cash flows statement is one of the importan