Home /

Expert Answers /

Accounting /

vaughn-company-comparative-balance-sheets-december-31-assets-cash-accounts-receivable-inventory-lan-pa681

(Solved): VAUGHN Company Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Lan ...

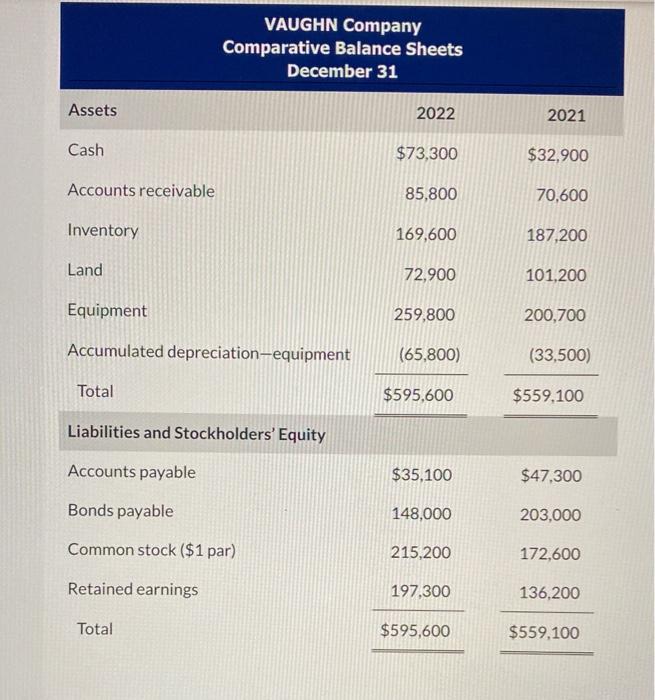

VAUGHN Company Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Land Equipment \( \begin{array}{rr}2022 & 2021 \\ \$ 73,300 & \$ 32,900 \\ 85,800 & 70,600\end{array} \) \( 169,600 \quad 187,200 \) \begin{tabular}{lrrr} Equipment & 259,800 & & 200,700 \\ Accumulated depreciation-equipment & \( (65,800) \) & \( (33,500) \) \\ \cline { 4 - 4 } \cline { 4 - 5 } Total & \( \frac{\$ 595,600}{} \) & & \( \$ 559,100 \) \\ \hline \end{tabular} Liabilities and Stockholders' Equity Accounts payable Bonds payable \( 72,900 \quad 101,200 \) Common stock (\$1 par)

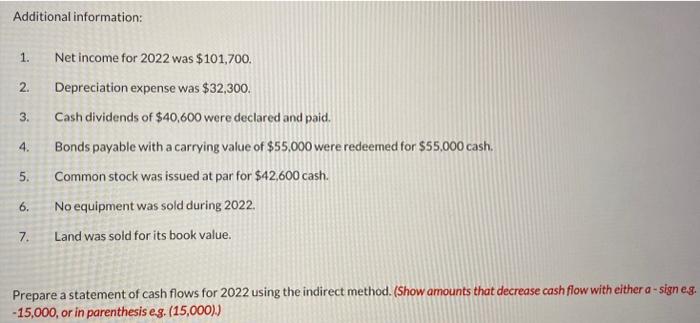

Additional information: 1. Net income for 2022 was \( \$ 101,700 \). 2. Depreciation expense was \( \$ 32,300 \). 3. Cash dividends of \( \$ 40,600 \) were declared and paid. 4. Bonds payable with a carrying value of \( \$ 55.000 \) were redeemed for \( \$ 55.000 \) cash. 5. Common stock was issued at par for \( \$ 42,600 \mathrm{cash} \). 6. No equipment was sold during 2022. 7. Land was sold for its book value. Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sign eg. \( -15,000 \), or in parenthesis e.g. \( (15,000)) \)

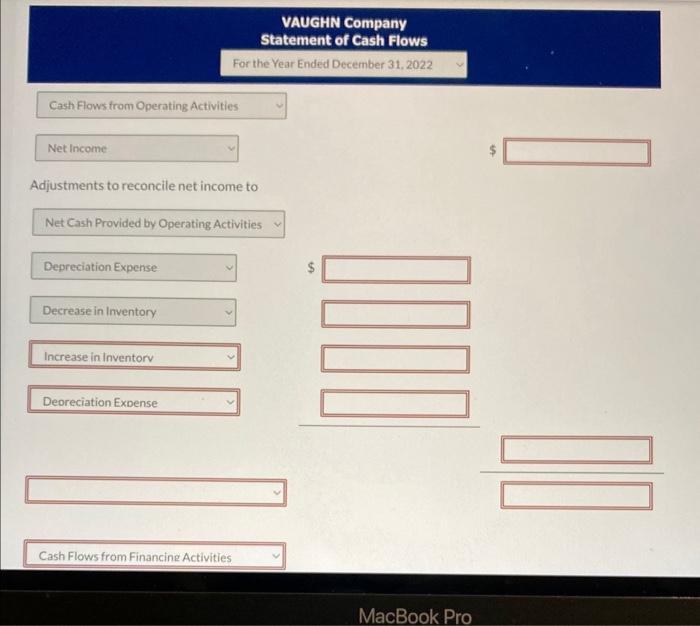

VAUGHN Company Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows from Operating Activities: Net income Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense Decrease in Inventory Increase in Inventorv Deoreciation Expense Cash Flows from Financine Activities

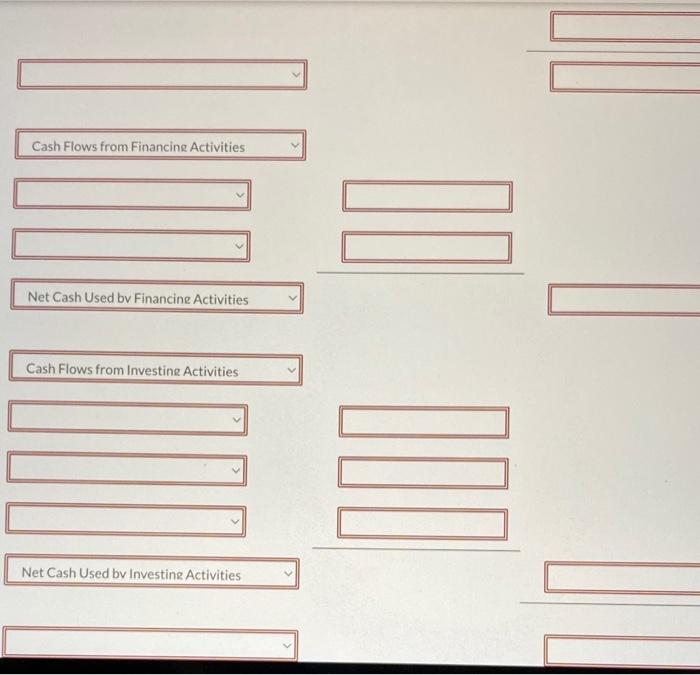

Cash Flows from Financing Activities Net Cash Used bv Financine Activities Cash Flows from Investine Activities Net Cash Used bv Investine Activities

Expert Answer

Step 1 A cash flow statement indicates cash inflow and outflow information for a particular time pe