Home /

Expert Answers /

Accounting /

valley-company-39-s-adjusted-account-balances-from-its-general-ledger-on-august-31-its-fiscal-year-e-pa268

(Solved): Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-en ...

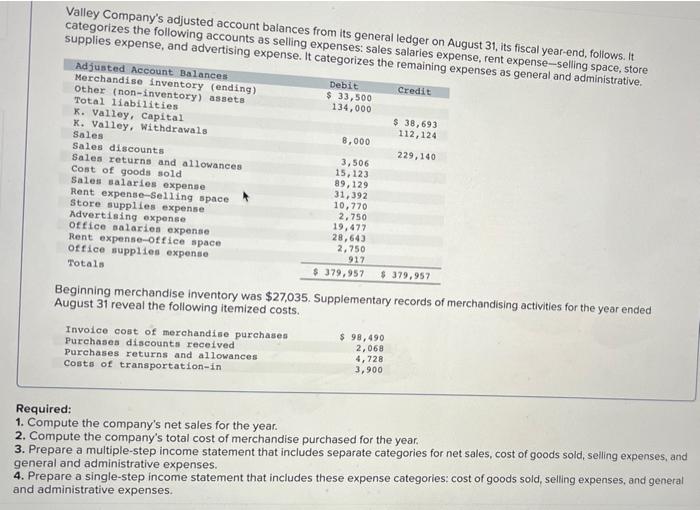

Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Adjusted Account Balances Merchandise inventory (ending) Other (non-inventory) assets Total liabilities Debit $ 33,500 Credit 134,000 K. Valley, Capital $ 38,693 112,124 K. Valley, Withdrawals Sales 8,000 Sales discounts 229,140 3,506 Sales returns and allowances Cost of goods sold 15,123 89,129 Sales salaries expense 31,392 10,770 2,750 Rent expense-Selling space Store supplies expense Advertising expense office salaries expense Rent expense-Office space office supplies expense 19,477 28,643 2,750 917 Totals $ 379,957 $ 379,957 Beginning merchandise inventory was $27,035. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Invoice cost of merchandise purchases $ 98,490 Purchases discounts received 2,068 4,728 Purchases returns and allowances Costs of transportation-in 3,900 Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses.

Expert Answer

1 Sales 229,140 Less: Sales discounts (3,506) Less: Sales returns and allowances (15,123) Net sales 210,511 2 Cost of Merchandise Purchased Invoice cost of merchandise purchased 98,490 Purchase discounts received (2,068) Purchase returns and allowanc