Home /

Expert Answers /

Accounting /

using-the-married-filing-jointly-status-and-their-income-and-expense-statement-calculate-the-2017-pa958

(Solved): Using the married filing jointly status and their income and expense statement, calculate the 2017 ...

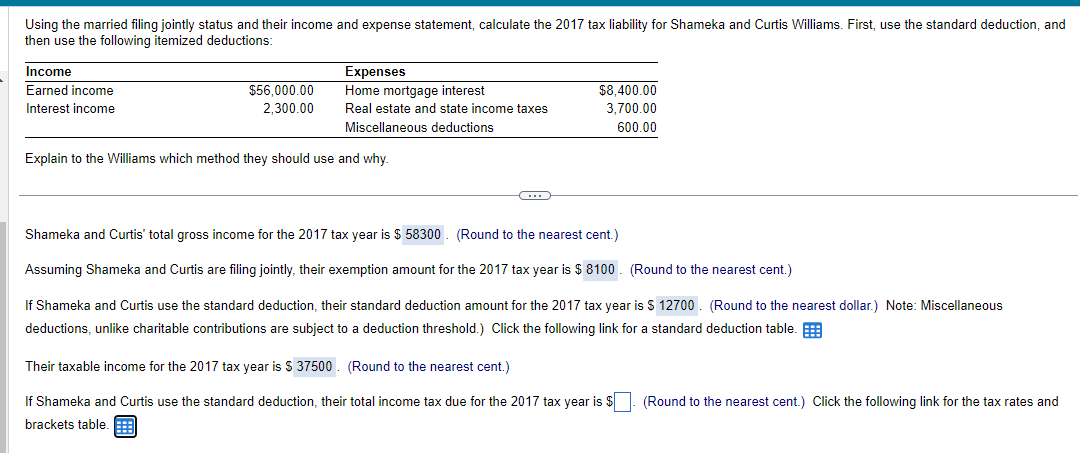

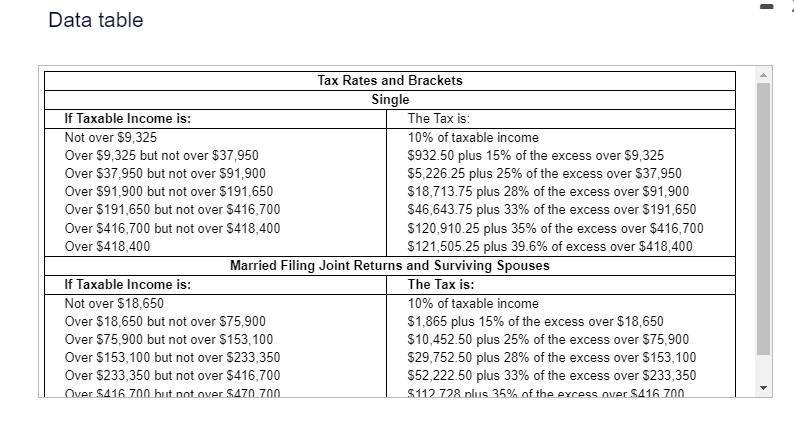

Using the married filing jointly status and their income and expense statement, calculate the 2017 tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the following itemized deductions: Explain to the Williams which method they should use and why. Shameka and Curtis' total gross income for the 2017 tax year is \( 9 \quad \) (Round to the nearest cent.) Assuming Shameka and Curtis are filing jointly, their exemption amount for the 2017 tax year is \( \$ \) (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their standard deduction amount for the 2017 tax year is \( \$ \) (Round to the nearest dollar.) Note: Miscellaneous deductions, unlike charitable contributions are subject to a deduction threshold.) Click the following link for a standard deduction table. Their taxable income for the 2017 tax year is \( ? \) (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their total income tax due for the 2017 tax year is \( \$ \). (Round to the nearest cent.) Click the following link for the tax rates and brackets table.

Data table

Expert Answer

1) Total Gross Income :- Total gross income content income received from any source. Some tax free interests are not considered in total gross income.