Home /

Expert Answers /

Finance /

using-table-36-calculate-the-marginal-and-average-tax-rates-for-a-single-taxpayer-with-the-followi-pa802

(Solved): Using Table 36, calculate the marginal and average tax rates for a single taxpayer with the followi ...

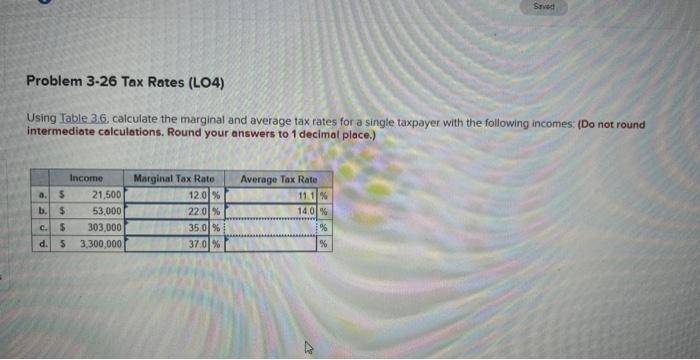

Using Table 36, calculate the marginal and average tax rates for a single taxpayer with the following incomes: (Do not round intermediate calculations. Round your answers to 1 decimal place.)

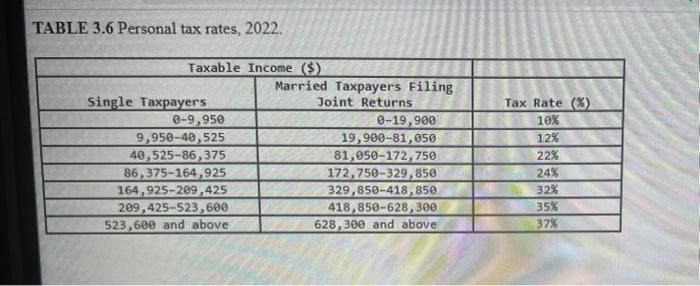

TABLE 3.6 Personal tax rates, 2022

Expert Answer

Income Marginal Tax rate Average tax rate a 21500 12% 11.1% b 53000 22% 14.0% c 303000 35% 34.9% d 3300000 37% 34.3% e Tax Slab Tax rate on income slab tax on income slab A- 0-9950 9950*10% 995 21500-9950 (21500-9950)*12% 1386 total taxes paid 2381 a