Home /

Expert Answers /

Finance /

use-the-following-income-statement-and-balance-sheet-information-to-put-together-a-statement-of-ca-pa952

(Solved): Use the following income statement and balance sheet information to put together a statement of ca ...

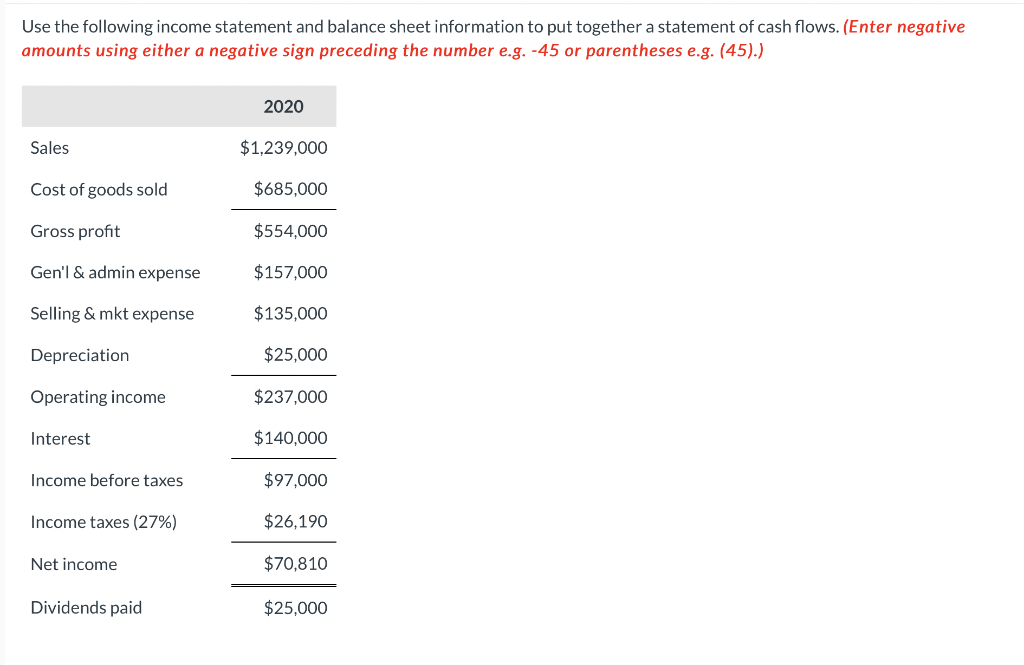

Use the following income statement and balance sheet information to put together a statement of cash flows. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 2020 Sales $1,239,000 Cost of goods sold $685,000 Gross profit $554,000 Gen'l & admin expense $157,000 Selling & mkt expense $135,000 Depreciation $25,000 Operating income $237,000 Interest $140,000 Income before taxes $97,000 Income taxes (27%) $26,190 Net income $70,810 Dividends paid $25,000

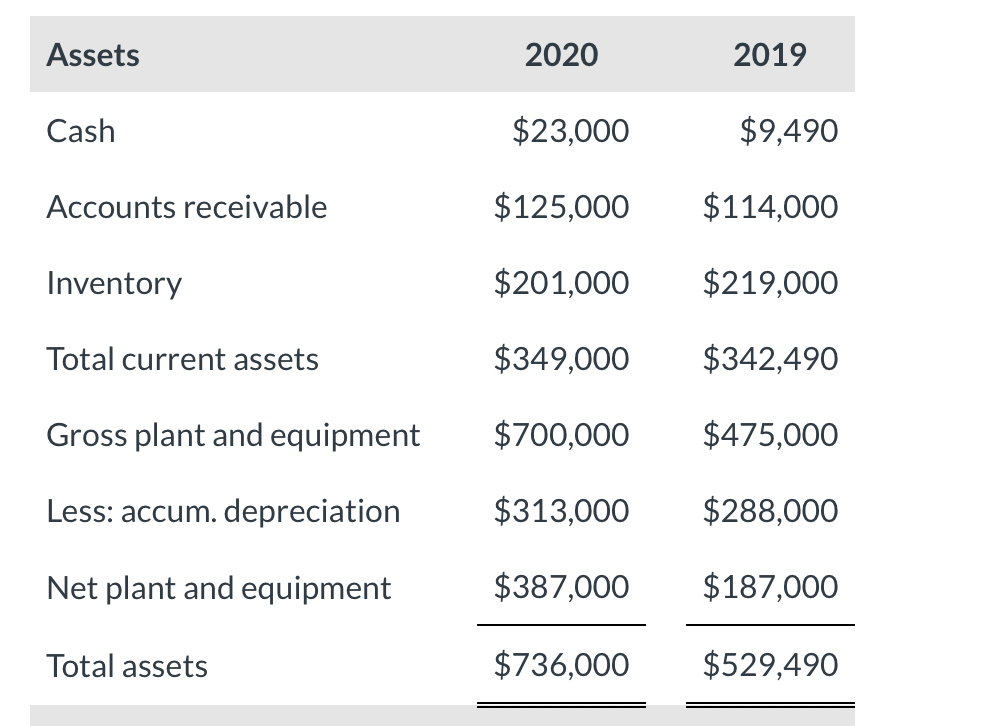

Assets Cash Accounts receivable Inventory Total current assets Gross plant and equipment Less: accum. depreciation Net plant and equipment Total assets 2020 2019 $23,000 $9,490 $125,000 $114,000 $201,000 $219,000 $349,000 $342,490 $700,000 $475,000 $313,000 $288,000 $387,000 $187,000 $736,000 $529,490

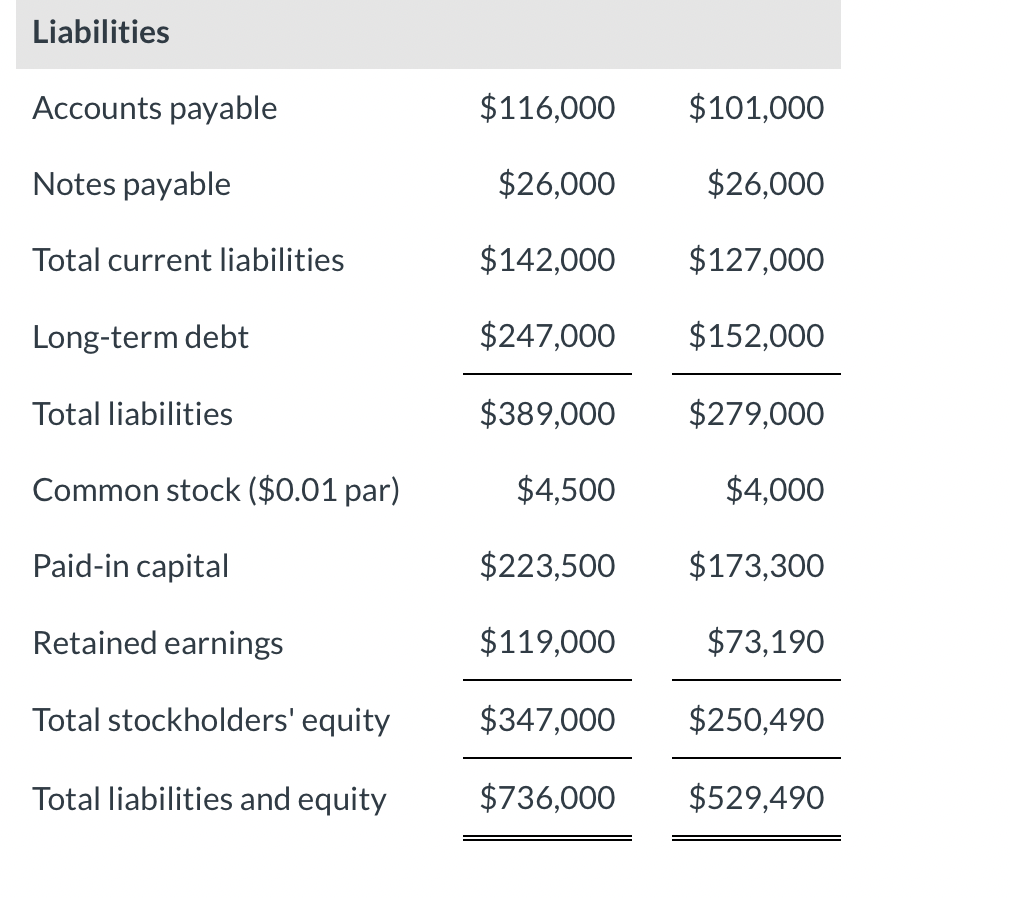

Liabilities Accounts payable Notes payable Total current liabilities Long-term debt Total liabilities Common stock ($0.01 par) Paid-in capital Retained earnings Total stockholders' equity Total liabilities and equity $116,000 $101,000 $26,000 $26,000 $142,000 $127,000 $247,000 $152,000 $389,000 $279,000 $4,500 $4,000 $223,500 $173,300 $119,000 $73,190 $347,000 $250,490 $736,000 $529,490

Statement of Cash Flows 2020 LA

A