Home /

Expert Answers /

Finance /

use-the-2021-marginal-tax-rates-to-compute-the-income-tax-owed-by-the-following-person-filing-statu-pa415

(Solved): Use the 2021 marginal tax rates to compute the income tax owed by the following person. Filing statu ...

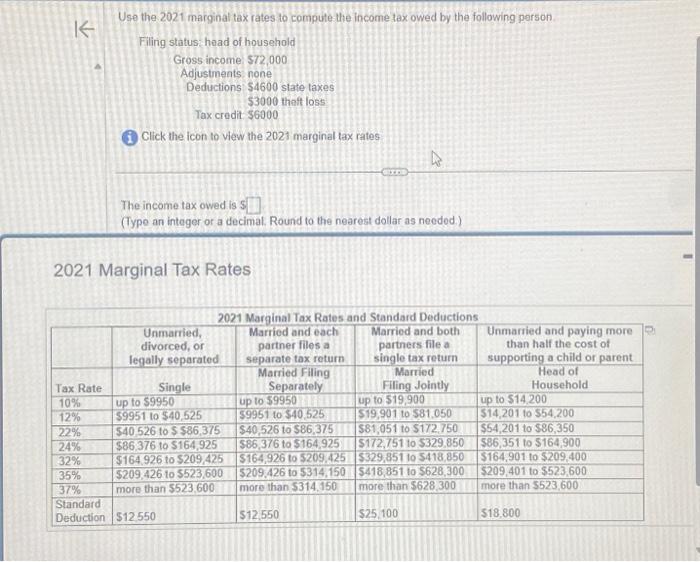

Use the 2021 marginal tax rates to compute the income tax owed by the following person. Filing status: head of household Gross income: $72,000 Adjustments: none Deductions: $4600 state taxes Tax credit: $6000 Click the icon to view the 2021 marginal tax rates. The income tax owed is S (Type an integer or a decimal. Round to the nearest dollar as needed.) 2021 Marginal Tax Rates $3000 theft loss Unmarried, divorced, or legally separated Tax Rate 10% 12% 22% 24% 32% 35% 37% Standard Deduction $12,550 Single 2021 Marginal Tax Rates and Standard Deductions Married and each Married and both partner files a partners file a single tax return separate tax return Married Filing Separately up to $9950 $9951 to $40,525 $40,526 to $86,375 $86,376 to $164,925 $164,926 to $209,425 $209,426 to $314,150 more than $314,150 Married Filing Jointly up to $19,900 $19,901 to $81,050 $81,051 to $172,750 $172,751 to $329,850 $329,851 to $418,850 $418,851 to $628,300 more than $628,300 up to $9950 $9951 to $40,525 $40,526 to $ $86,375 $86,376 to $164,925 $164,926 to $209,425 $209,426 to $523,600 more than $523,600 $12,550 $25,100 Unmarried and paying more than half the cost of supporting a child or parent Head of Household up to $14,200 $14,201 to $54,200 $54,201 to $86,350 $86,351 to $164,900 $164,901 to $209,400 $209,401 to $523,600 more than $523,600 $18,800

Use the 2021 marginal tax rates to compute the income tax owed by the following person. Filing status head of household Gross income Adjustments none Deductions. state taxes that loss Tax credit Click the icon to view the 2021 marginal tax rates The income tax owed is (Type an integer or a decimal. Round to the nearest dollar as needed.) 2021 Marginal Tax Rates