Home /

Expert Answers /

Accounting /

urgent-pro-forma-balance-sheet-basic-loonard-industries-wiahes-to-prepare-a-pro-forma-bulance-sh-pa453

(Solved): URGENT !!! Pro forma balance sheet-Basic Loonard Industries wiahes to prepare a pro forma bulance sh ...

URGENT !!!

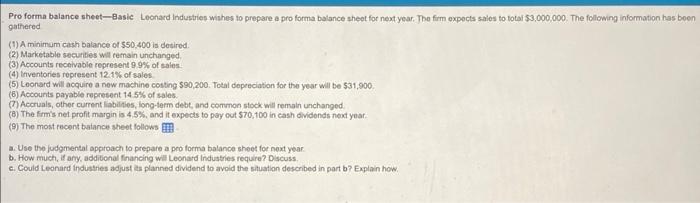

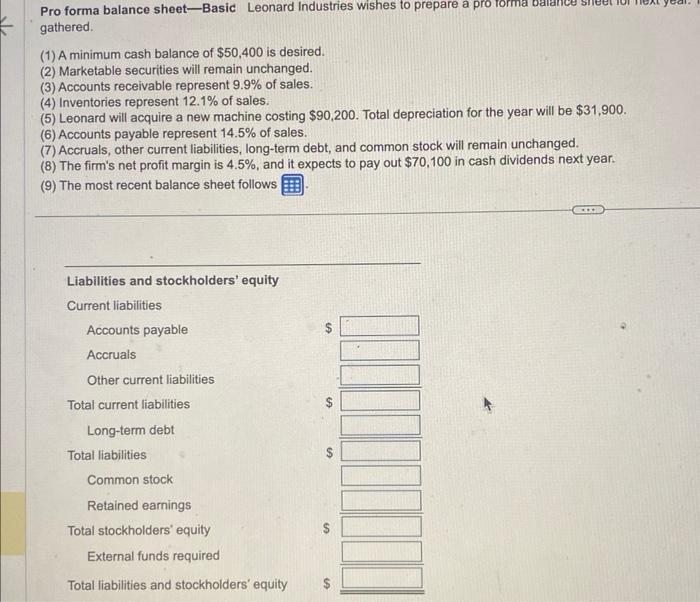

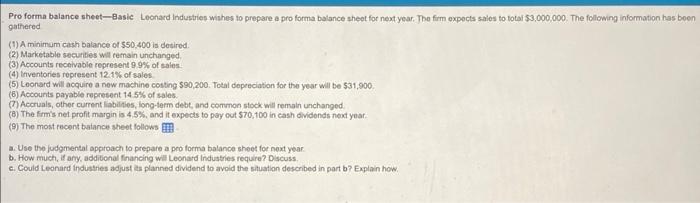

Pro forma balance sheet-Basic Loonard Industries wiahes to prepare a pro forma bulance sheet for next year. The firm oxpocts salos to totai . The following information has been gathered (1) A minimum cash balance of 550,400 is desired. (2) Marketable securtites will remain unchanged. (3) Accounts receivable represent of sales (4) linventories represent of sales. (5) Loonard will acquire a now machine costing . Tetal depeeciation for the year will be . (6) Accounts payable represent of sales. (7) Accruals, other current liabilities, ilong-term debt, and common stock will remath unchanged. (B) The firmis net profit margin is , and it expects to poy cut in cash didends next year: (9) The most recent balance sheet follows a. Use the judgmental approach to prepare a pro forma balance sheet for noxt year. b. How much, If ary, additional financing will Leonard tndustries require? Discuss. c. Could Leonard industies adjust as planned dividend to avoid the situation described in part b? Explain how.

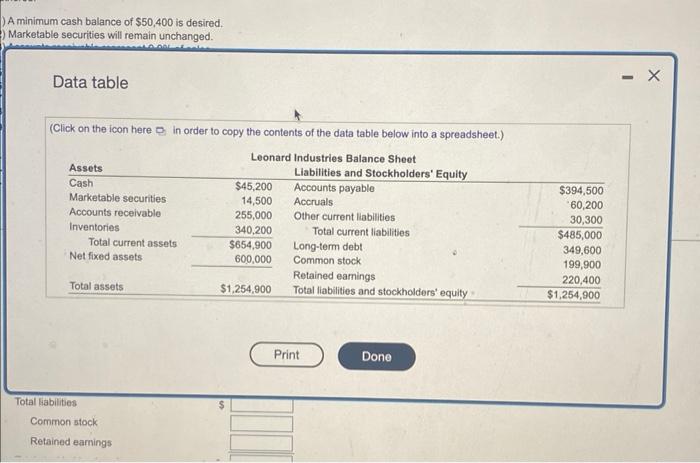

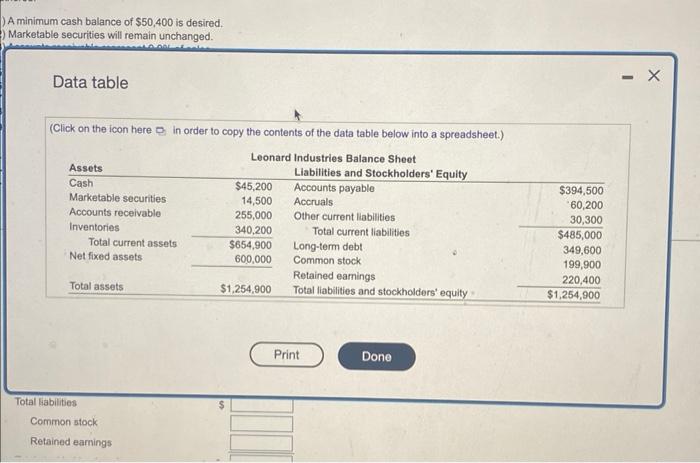

A minimum cash balance of is desired. Marketable securities will remain unchanged. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.

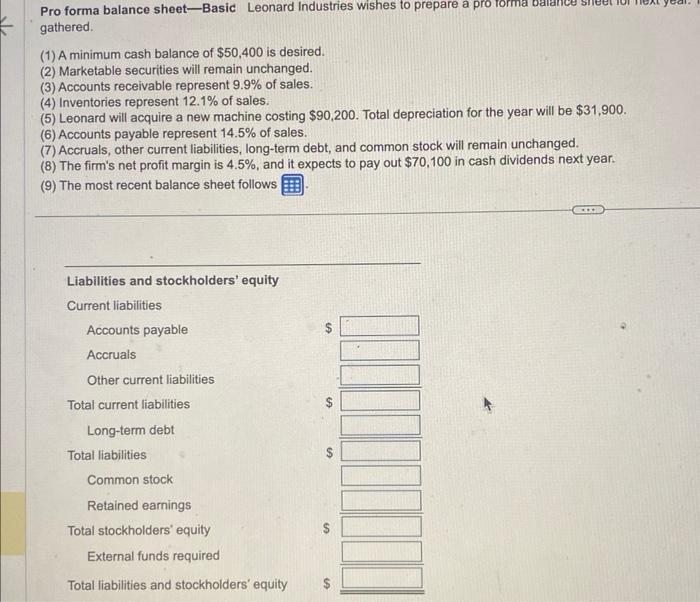

Pro forma balance sheet-Basic Leonard industries wishes to prepare a pro rommadidice gathered. (1) A minimum cash balance of is desired. (2) Marketable securities will remain unchanged. (3) Accounts receivable represent of sales. (4) Inventories represent of sales. (5) Leonard will acquire a new machine costing . Total depreciation for the year will be . (6) Accounts payable represent of sales. (7) Accruals, other current liabilities, long-term debt, and common stock will remain unchanged. (8) The firm's net profit margin is , and it expects to pay out in cash dividends next year. (9) The most recent balance sheet follows

Expert Answer

Working :Expected sales = $3,000,000(1) Minimum cash balance required = $50,400(2) Accounts receivables = $3,000,000