Home /

Expert Answers /

Accounting /

trevor-is-a-single-individual-who-is-a-cash-method-calendar-year-taxpayer-for-each-of-the-next-two-pa527

(Solved): Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two ...

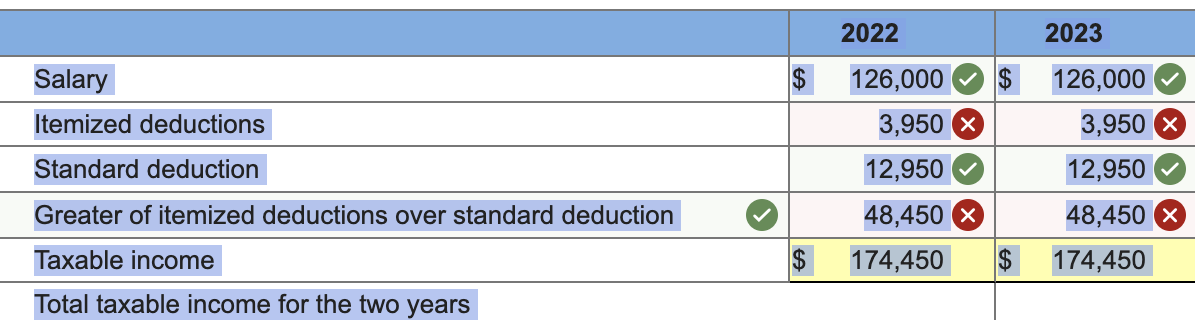

Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2022 and 2023), Trevor expects to report salary of $126,000, contribute $7,900 to charity, and pay $3,950 in state income taxes.

- Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $4,300 and $44,500, respectively, each year. Assume that Trevor makes the charitable contribution for 2023 in December of 2022. Estimate Trevor's taxable income for 2022 and 2023 using the 2022 amounts for the standard deduction. Reconcile the total taxable income to your solution to part (c)

Total taxable income for the two years