Home /

Expert Answers /

Accounting /

transactions-on-june-1-of-the-current-year-chris-bates-established-a-business-to-manage-rental-pro-pa191

(Solved): Transactions On June 1 of the current year, Chris Bates established a business to manage rental pro ...

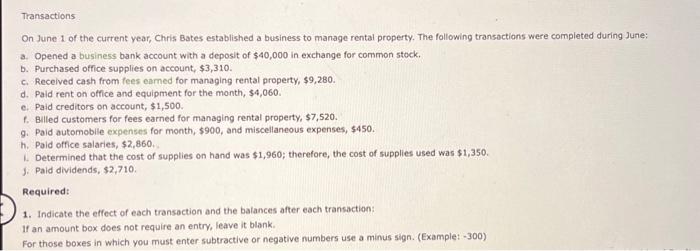

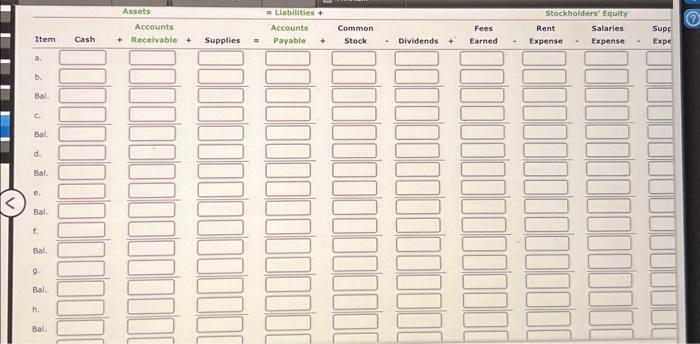

Transactions On June 1 of the current year, Chris Bates established a business to manage rental property. The following transactions were completed during June: a. Opened a business bank account with a deposit of in exchange for common stock. b. Purchased office supplies on account, . c. Received cash from fees earned for managing rental property, . d. Paid rent on office and equipment for the month, . c. Paid creditors on account, . f. Billed customers for fees earned for managing rental property, . 9. Paid automoblle expenses for month, , and miscellaneous expenses, . h. Paid office salaries, . 1. Determined that the cost of supplies on hand was ; therefore, the cost of supplies used was . J. Paid dividends, . Required: 1. Indicate the effect of each transaction and the balances after each transaction: If an amount box does not require an entry, leave it blank. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: - 300

Assets = Liabinities Stockholders' Equity. Cash + Rece ounts

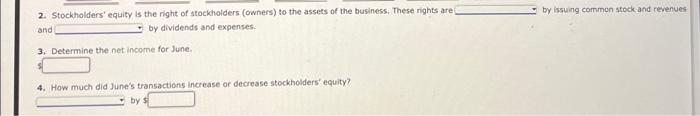

2. Stockholders' equity is the right of stockholders (owners) to the assets of the business: These rights are by issuing commen stock and revenues and : by dividends and expenses. 3. Determine the net incorne for June. 4. How much did June's transactions increase or decrease stockholders' equity? by