Home /

Expert Answers /

Finance /

tony-begay-at-saguaro-funds-tony-begay-a-currency-trader-for-chicago-based-saguaro-funds-uses-th-pa388

(Solved): Tony Begay at Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses th ...

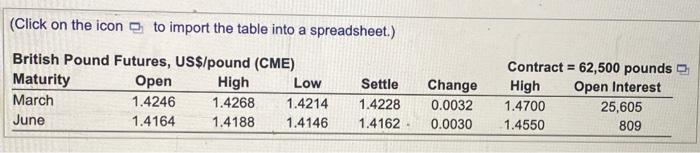

Tony Begay at Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses the following futures quotes, , on the British pound \( (£) \) to speculate on the value of the pound. a. If Tony buys 5 June pound futures, and the spot rate at maturity is \( \$ 1.3981 / £ \), what is the value of her position? b. If Tony sells 12 March pound futures, and the spot rate at maturity is \( \$ 1.4556 / \mathcal{E} \), what is the value of her position? c. If Tony buys 3 March pound futures, and the spot rate at maturity is \( \$ 1.4556 / £ \), what is the value of her position? d. If Tony sells 12 June pound futures, and the spot rate at maturity is \( \$ 1.3981 / £ \), what is the value of her position?

(Click on the icon \( \square \) to import the table into a spreadsheet.)

Expert Answer

a. Spot rate at maturity = $1.3981/£ Future = 1.4162 No of Futures = 5 Size = £62,500 Notional principal=No of futures?size=5×62,500=312,500 Value of