Home /

Expert Answers /

Accounting /

this-year-diane-intends-to-file-a-married-joint-retum-diane-received-177-500-of-salary-an-pa290

(Solved): This year Diane intends to file a married-joint retum. Diane received \( \$ 177,500 \) of salary an ...

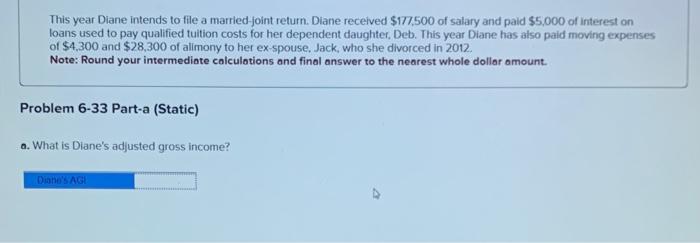

This year Diane intends to file a married-joint retum. Diane received \( \$ 177,500 \) of salary and paid \( \$ 5,000 \) of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of \( \$ 4,300 \) and \( \$ 28,300 \) of alimony to her ex-spouse. Jack, who she divorced in 2012. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Problem 6-33 Part-a (Static) o. What is Diane's adjusted gross income?

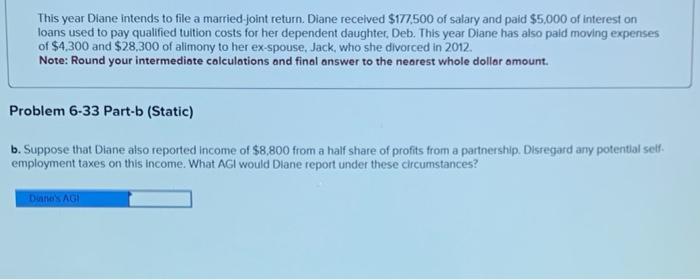

This year Diane intends to file a married-joint return. Diane recelved \( \$ 177,500 \) of salary and paid \( \$ 5,000 \) of interest on loans used to pay qualified tuition costs for her dependent daughter. Deb. This year Diane has also pald moving expenses of \( \$ 4,300 \) and \( \$ 28,300 \) of alimony to her ex-spouse, Jack, who she divorced in 2012. Note: Round your intermediote colculations and final answer to the nearest whole dollor amount. Problem 6-33 Part-b (Static) b. Suppose that Diane also reported income of \( \$ 8,800 \) from a half share of profits from a partnership. Disregard any potential self. employment taxes on this income. What AGl would Dlane report under these circumstances?

Expert Answer

Answer : From the year 2018 & 2019 MAGI phaseout Limit for student loan is ($135000 - $165000) and (140000 - 170000) (a) Year 2018 Year 2019 Salary $1