Home /

Expert Answers /

Other Math /

this-table-shows-the-u-s-federal-income-tax-rates-from-2013-source-internal-revenue-service-e-pa275

(Solved): This table shows the U.S. federal income tax rates from 2013. (Source: Internal Revenue Service) E ...

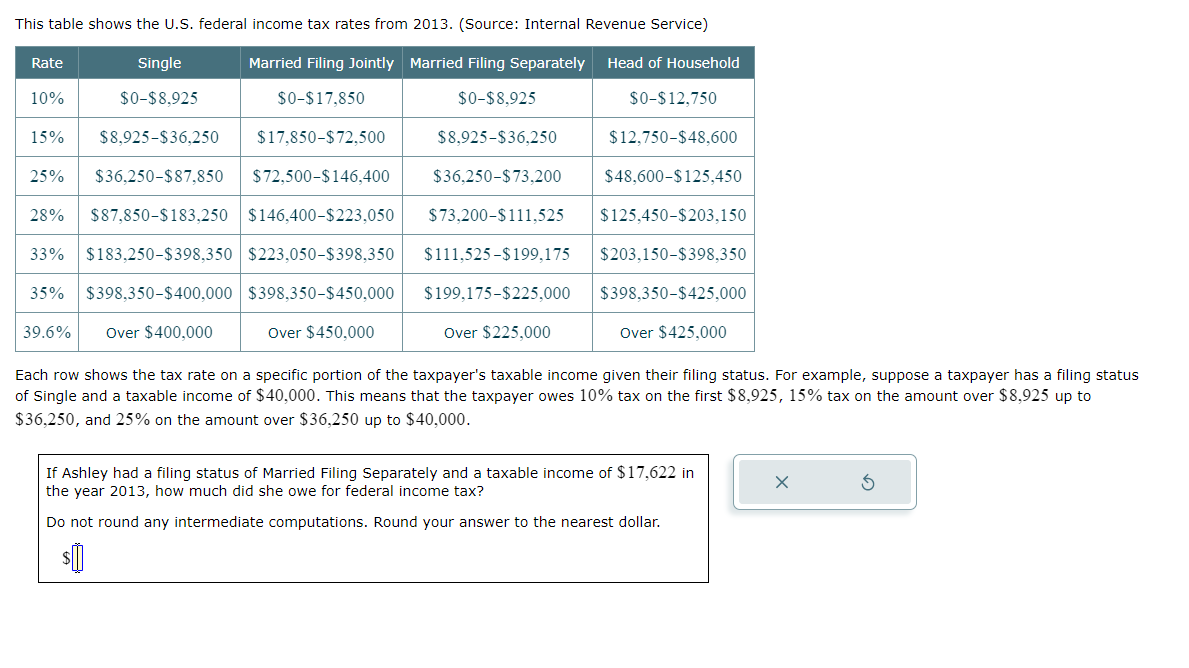

This table shows the U.S. federal income tax rates from 2013. (Source: Internal Revenue Service) Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of . This means that the taxpayer owes tax on the first tax on the amount over up to , and on the amount over up to . If Ashley had a filing status of Married Filing Separately and a taxable income of in the year 2013 , how much did she owe for federal income tax? Do not round any intermediate computations. Round your answer to the nearest dollar.

Expert Answer

Solution?Taxable income =$17,622married filling