(Solved): The transactions of Spade Company appear below. a. K. Spade, owner, invested $12,250 cash in the com ...

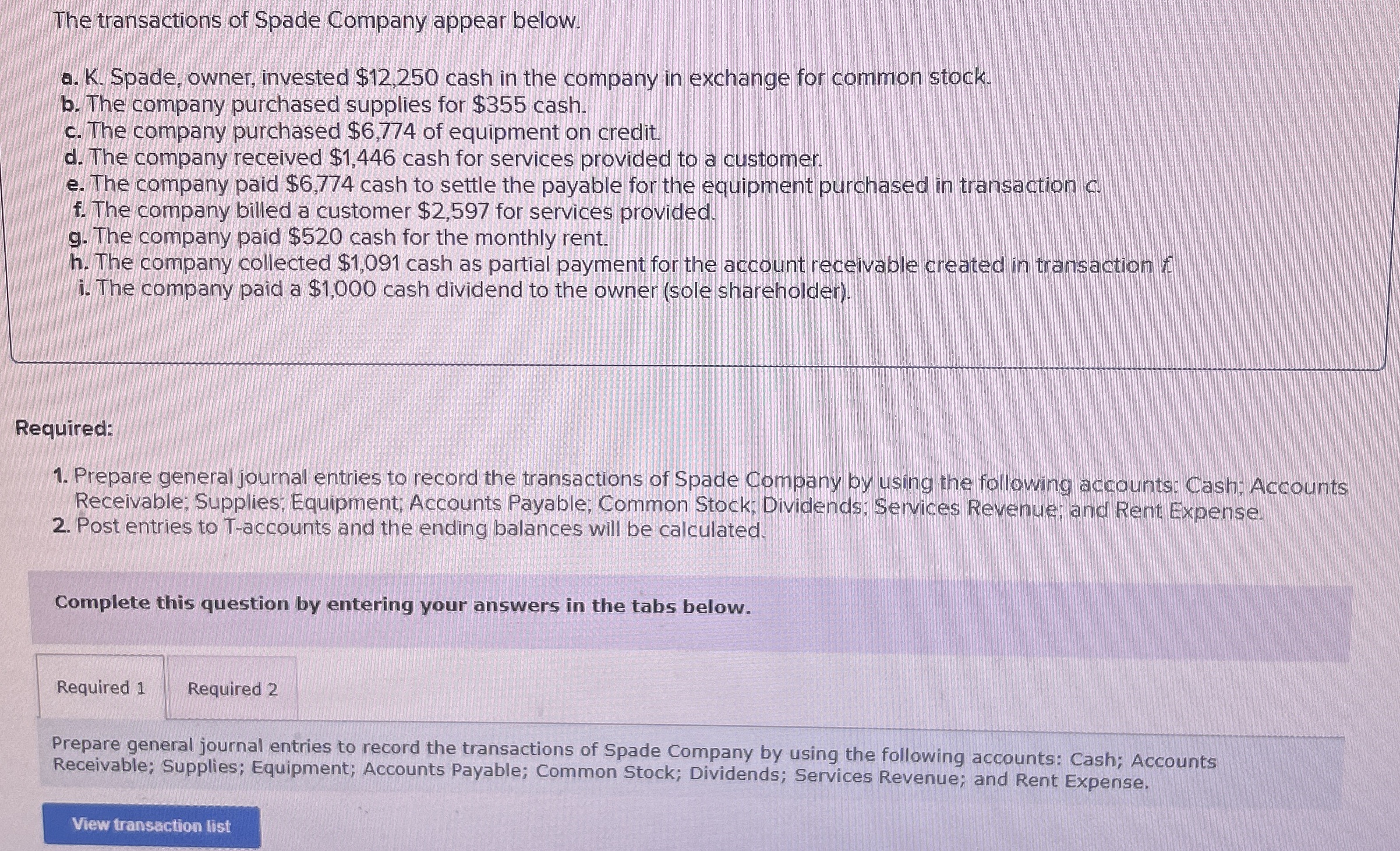

The transactions of Spade Company appear below. a. K. Spade, owner, invested $12,250 cash in the company in exchange for common stock. b. The company purchased supplies for

$355cash. c. The company purchased

$6,774of equipment on credit. d. The company received

$1,446cash for services provided to a customer. e. The company paid

$6,774cash to settle the payable for the equipment purchased in transaction

c. f. The company billed a customer

$2,597for services provided. g. The company paid

$520cash for the monthly rent. h. The company collected

$1,091cash as partial payment for the account receivable created in transaction

f. i. The company paid a

$1,000cash dividend to the owner (sole shareholder). Required: Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense. Post entries to T-accounts and the ending balances will be calculated. Complete this question by entering your answers in the tabs below. Prepare general journal entries to record the transactions of Spade Company by using the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Common Stock; Dividends; Services Revenue; and Rent Expense.