Home /

Expert Answers /

Finance /

the-rise-of-globalization-is-due-to-the-many-companies-that-have-become-multinational-corporati-pa630

(Solved): The rise of globalization is due to the many companies that have become multinational corporati ...

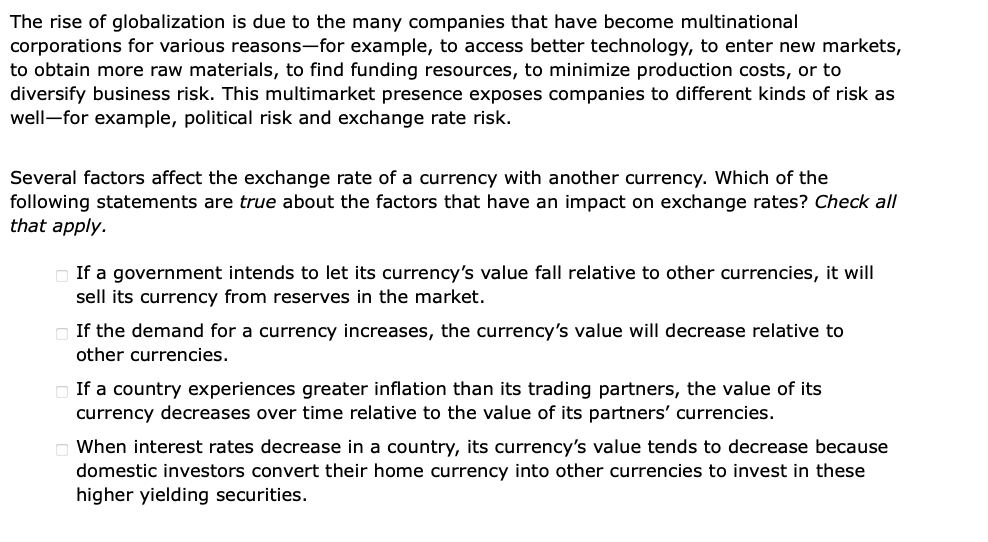

The rise of globalization is due to the many companies that have become multinational corporations for various reasons-for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversify business risk. This multimarket presence exposes companies to different kinds of risk as well-for example, political risk and exchange rate risk. Several factors affect the exchange rate of a currency with another currency. Which of the following statements are true about the factors that have an impact on exchange rates? Check all that apply. If a government intends to let its currency's value fall relative to other currencies, it will sell its currency from reserves in the market. If the demand for a currency increases, the currency's value will decrease relative to other currencies. If a country experiences greater inflation than its trading partners, the value of its currency decreases over time relative to the value of its partners' currencies. When interest rates decrease in a country, its currency's value tends to decrease because domestic investors convert their home currency into other currencies to invest in these higher yielding securities.

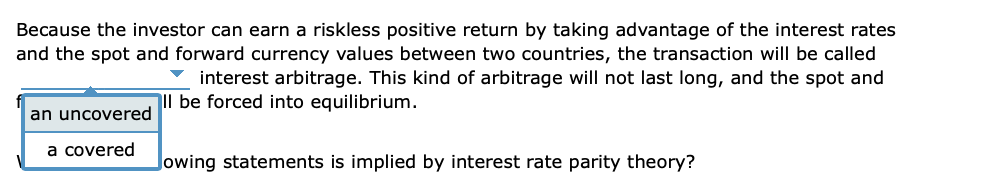

Because the investor can earn a riskless positive return by taking advantage of the interest rates and the spot and forward currency values between two countries, the transaction will be called interest arbitrage. This kind of arbitrage will not last long, and the spot and II be forced into equilibrium. owing statements is implied by interest rate parity theory?

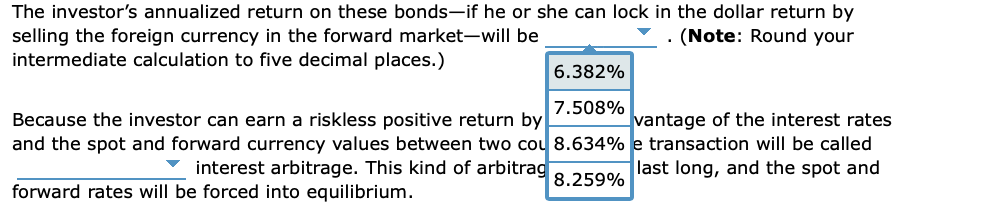

The investor's annualized return on these bonds-if he or she can lock in the dollar return by selling the foreign currency in the forward market-will be (Note: Round your intermediate calculation to five decimal places.) Because the investor can earn a riskless positive return by and the spot and forward currency values between two col interest arbitrage. This kind of arbitrac forward rates will be forced into equilibrium. lantage of the interest rates ! transaction will be called last long, and the spot and

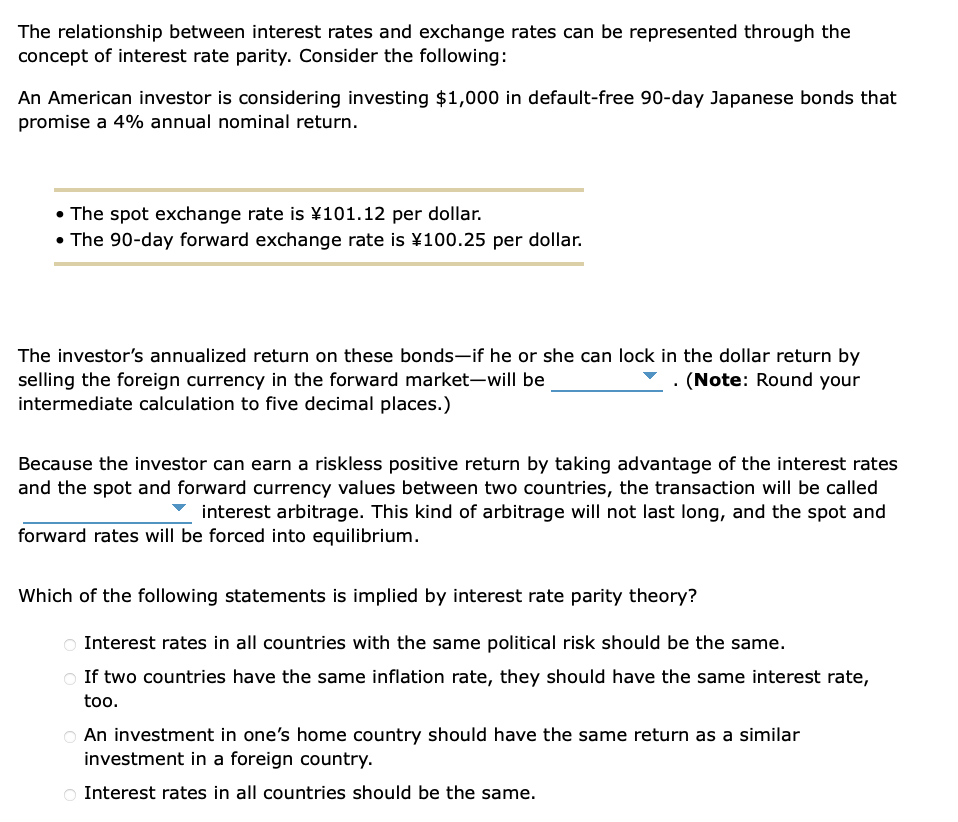

The relationship between interest rates and exchange rates can be represented through the concept of interest rate parity. Consider the following: An American investor is considering investing in default-free 90 -day Japanese bonds that promise a annual nominal return. - The spot exchange rate is per dollar. - The 90-day forward exchange rate is per dollar. The investor's annualized return on these bonds-if he or she can lock in the dollar return by selling the foreign currency in the forward market-will be . (Note: Round your intermediate calculation to five decimal places.) Because the investor can earn a riskless positive return by taking advantage of the interest rates and the spot and forward currency values between two countries, the transaction will be called interest arbitrage. This kind of arbitrage will not last long, and the spot and forward rates will be forced into equilibrium. Which of the following statements is implied by interest rate parity theory? Interest rates in all countries with the same political risk should be the same. If two countries have the same inflation rate, they should have the same interest rate, too. An investment in one's home country should have the same return as a similar investment in a foreign country. Interest rates in all countries should be the same.