Home /

Expert Answers /

Finance /

the-real-risk-free-rate-r-is-2-8-and-is-expected-to-remain-constant-inflation-is-expected-to-be-pa804

(Solved): The real risk-free rate (r) is 2.8% and is expected to remain constant. Inflation is expected to be ...

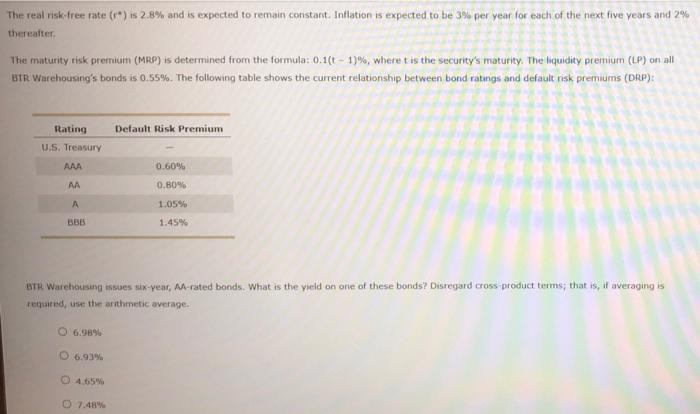

The real risk-free rate (r) is 2.8% and is expected to remain constant. Inflation is expected to be 3% per year for each of the next five years and 2% thereafter, The maturity risk premium (MRP) is determined from the formula: 0.1(t-1) %, where t is the security's maturity. The liquidity premium (LP) on all BTR Warehousing's bonds is 0.55%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Rating Default Risk Premium U.S. Treasury AAA 0.60% AA 0.80% A 1.05% BBB 1.45% BTR Warehousing issues six-year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average. 6.98% O 6.93% O4.65% O 7.48%

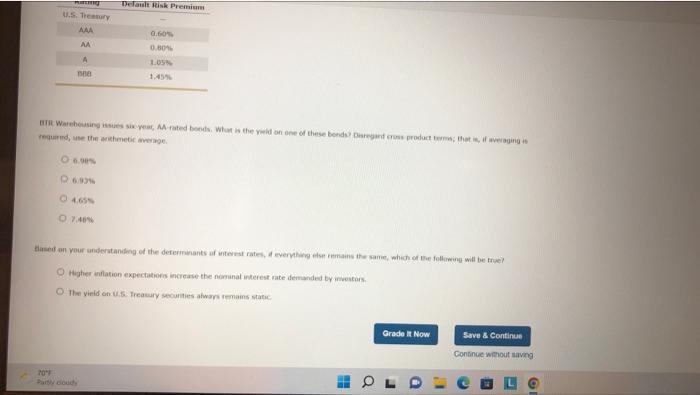

Default Risk Premium U.S. Treasury AMA 0.60% MA 0.00% A 1.05% 000 1.45% BTR Warehousing issues six year, AA-rated bonds. What is the yield on one of these bonds? Disregard cross product terms; that is, if averaging is required, use the arithmetic average. 86.90% 0 6.93% ? 4.65% 0 7.4% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? O Higher inflation expectations increase the nominal interest rate demanded by investors. O The yield on U.S. Treasury securities always remains static Grade It Now Save & Continue Continue without saving 70°F OLD Partly cloudy

Expert Answer

Yield on 6 year AA rated BTR bonds = riskfree rate + inflation rate + maturity risk premium + default risk premium+ liquidity premium =