Home /

Expert Answers /

Economics /

the-production-function-for-aggregate-output-y-is-y-k-3n2-3-where-k-is-the-capital-stock-and-n-pa790

(Solved): The production function for aggregate output Y is Y = K/3N2/3, where K is the capital stock and N ...

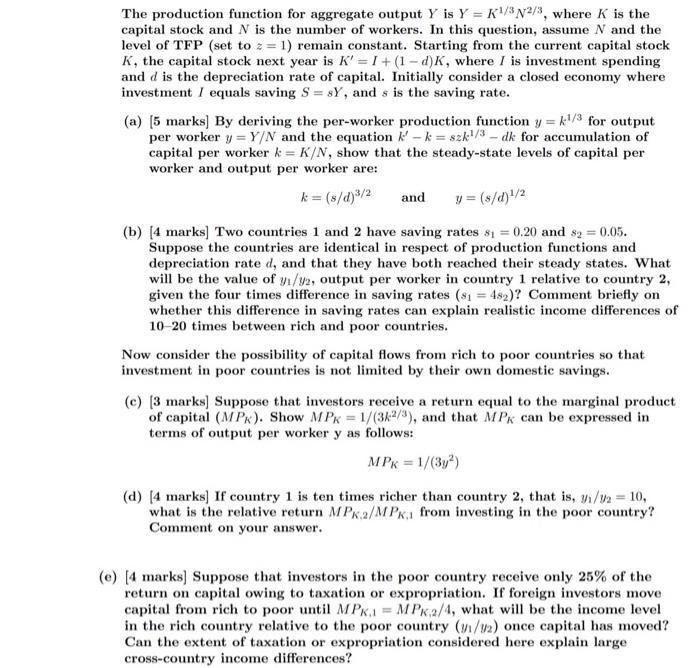

The production function for aggregate output Y is Y = K¹/3N2/3, where K is the capital stock and N is the number of workers. In this question, assume N and the level of TFP (set to z = 1) remain constant. Starting from the current capital stock K, the capital stock next year is K' = I+ (1 - d)K, where I is investment spending and d is the depreciation rate of capital. Initially consider a closed economy where investment I equals saving S = sY, and s is the saving rate. (a) [5 marks] By deriving the per-worker production function y = k¹/3 for output per worker y = Y/N and the equation k' - k = szk¹/3 dk for accumulation of capital per worker k = K/N, show that the steady-state levels of capital per worker and output per worker are: k = (s/d)³/2 and y = (s/d) ¹/2 (b) [4 marks] Two countries 1 and 2 have saving rates s? = 0.20 and s? = 0.05. Suppose the countries are identical in respect of production functions and depreciation rate d, and that they have both reached their steady states. What will be the value of y?/y2, output per worker in country 1 relative to country 2, given the four times difference in saving rates (s? = 482)? Comment briefly on whether this difference in saving rates can explain realistic income differences of 10-20 times between rich and poor countries. Now consider the possibility of capital flows from rich to poor countries so that investment in poor countries is not limited by their own domestic savings. (c) [3 marks] Suppose that investors receive a return equal to the marginal product of capital (MPK). Show MPK = 1/(3k2/3), and that MPK can be expressed in terms of output per worker y as follows: MPK = 1/(3y²) (d) [4 marks] If country 1 is ten times richer than country 2, that is, y?/y2 = 10, what is the relative return MPK,2/MPK,1 from investing in the poor country? Comment on your answer. (e) [4 marks] Suppose that investors in the poor country receive only 25% of the return on capital owing to taxation or expropriation. If foreign investors move capital from rich to poor until MPK,1 = MPK,2/4, what will be the income level in the rich country relative to the poor country (y1/92) once capital has moved? Can the extent of taxation or expropriation considered here explain large cross-country income differences?

The production function for aggregate output is , where is the capital stock and is the number of workers. In this question, assume and the level of TFP (set to ) remain constant. Starting from the current capital stock , the capital stock next year is , where is investment spending and is the depreciation rate of capital. Initially consider a closed economy where investment equals saving , and is the saving rate. (a) [5 marks] By deriving the per-worker production function for output per worker and the equation for accumulation of capital per worker , show that the steady-state levels of capital per worker and output per worker are: (b) [4 marks] Two countries 1 and 2 have saving rates and . Suppose the countries are identical in respect of production functions and depreciation rate , and that they have both reached their steady states. What will be the value of , output per worker in country 1 relative to country 2 , given the four times difference in saving rates ? Comment briefly on whether this difference in saving rates can explain realistic income differences of 10-20 times between rich and poor countries. Now consider the possibility of capital flows from rich to poor countries so that investment in poor countries is not limited by their own domestic savings. (c) [3 marks] Suppose that investors receive a return equal to the marginal product of capital . Show , and that can be expressed in terms of output per worker as follows: (d) [4 marks] If country 1 is ten times richer than country 2 , that is, , what is the relative return from investing in the poor country? Comment on your answer. [4 marks] Suppose that investors in the poor country receive only of the return on capital owing to taxation or expropriation. If foreign investors move capital from rich to poor until , what will be the income level in the rich country relative to the poor country once capital has moved? Can the extent of taxation or expropriation considered here explain large cross-country income differences?