Home /

Expert Answers /

Finance /

the-prices-of-zero-coupon-bonds-with-various-maturities-are-given-in-the-following-table-suppose-t-pa843

(Solved): The prices of zero-coupon bonds with various maturities are given in the following table. Suppose t ...

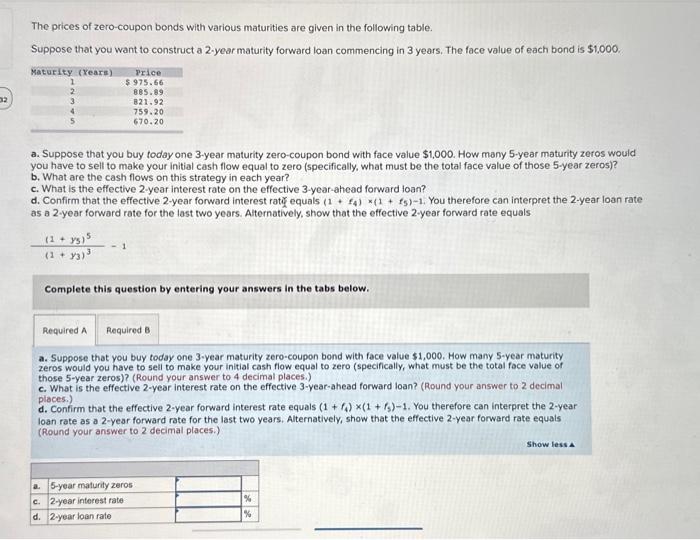

The prices of zero-coupon bonds with various maturities are given in the following table. Suppose that you want to construct a 2-year maturity forward loan commencing in 3 years. The face value of each bond is . a. Suppose that you buy today one 3-year maturity zero-coupon bond with face value . How many 5 -year maturity zeros would you have to sell to make your initial cash flow equal to zero (specifically, what must be the total face value of those 5 -year zeros)? b. What are the cash flows on this strategy in each year? c. What is the effective 2 -year interest rate on the effective 3 -year-ahead forward ioan? d. Confirm that the effective 2 -year forward interest ratê equals . You therefore can interpret the 2-year loan rate as a 2-year forward rate for the last two years. Alternatively, show that the effective 2-year forward rate equals Complete this question by entering your answers in the tabs below. a. Suppose that you buy today one 3-year maturity zero-coupon bond with face value . How many 5-year maturity zeros would you have to sell to make your initial cash flow equal to zero (specifically, what must be the total face value of those 5 -year zeros)? (Round your answer to 4 decimal places.) c. What is the effective 2-year interest rate on the effective 3-year-ahead forward loan? (Round your answer to 2 decimal places.) d. Confirm that the effective 2 -year forward interest rate equals . You therefore can interpret the 2 -year loan rate as a 2 -year forward rate for the last two years. Alternatively, show that the effective 2 -year forward rate equals (Round your answer to 2 decimal places.)