Home /

Expert Answers /

Economics /

the-mwatex-textile-company-is-considering-two-mutually-exclusive-electronic-control-systems-for-its-pa129

(Solved): The Mwatex Textile Company is considering two mutually exclusive electronic control systems for its ...

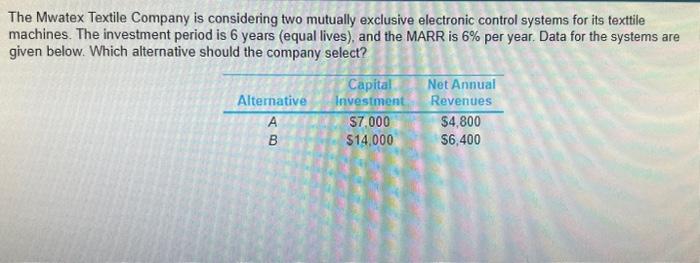

The Mwatex Textile Company is considering two mutually exclusive electronic control systems for its texttile machines. The investment period is 6 years (equal lives), and the MARR is \( 6 \% \) per year. Data for the systems are given below. Which alternative should the company select?

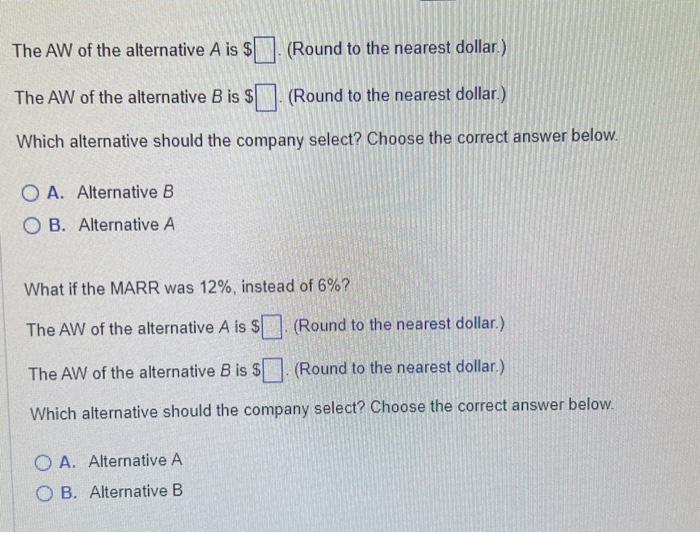

The \( A W \) of the alternative \( A \) is \( \$ \) (Round to the nearest dollar.) The AW of the alternative \( B \) is \( \$ \) (Round to the nearest dollar.) Which alternative should the company select? Choose the correct answer below. A. Alternative \( B \) B. Alternative \( A \) What if the MARR was \( 12 \% \), instead of \( 6 \% \) ? The \( A W \) of the alternative \( A \) is \( \$ \) (Round to the nearest dollar.) The AW of the alternative \( B \) is \( \$ \) (Round to the nearest dollar.) Which alternative should the company select? Choose the correct answer below. A. Alternative A B. Alternative B

Expert Answer

Scenario 1 : For Alternative A ; Capital investment ( P ) = $7,000 Net annual revenue ( A ) = $4,800 Investment period ( n ) = 6 years Rate of interes