Home /

Expert Answers /

Finance /

the-irr-is-defined-as-a-the-discount-rate-that-makes-the-npv-equal-to-zero-b-the-difference-betw-pa178

(Solved): The IRR is defined as: A. The discount rate that makes the NPV equal to zero B. The difference betw ...

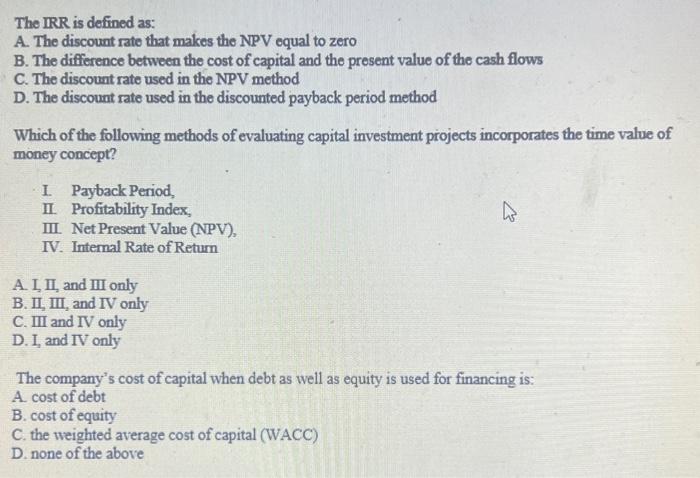

The IRR is defined as: A. The discount rate that makes the NPV equal to zero B. The difference between the cost of capital and the present value of the cash flows C. The discount rate used in the NPV method D. The discount rate used in the discounted payback period method Which of the following methods of evaluating capital investment projects incorporates the time value of money concept? I Payback Period, II Profitability Index, III. Net Present Value (NPV), IV. Internal Rate of Return A. I, II, and III only B. II, III, and IV only C. III and IV only D. I, and IV only The company's cost of capital when debt as well as equity is used for financing is: A. cost of debt B. cost of equity C. the weighted average cost of capital (WACC) D. none of the above

Expert Answer

1) IRR is the internal rate of return generated from the