Home /

Expert Answers /

Accounting /

the-following-were-selected-from-among-the-transactions-completed-by-essex-company-during-july-of-t-pa167

(Solved): The following were selected from among the transactions completed by Essex Company during July of t ...

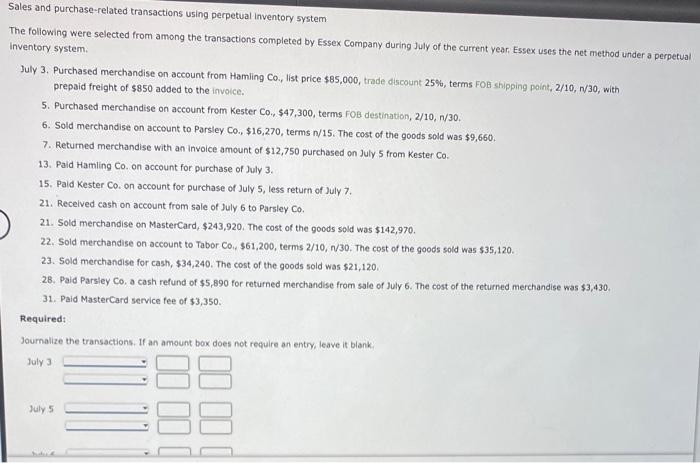

The following were selected from among the transactions completed by Essex Company during July of the current year. Essex uses the net method under a perpetu inventory system. July 3. Purchased merchandise on account from Hamling Co., list price \( \$ 85,000 \), trade discount 25\%, terms FOQ shipping point, \( 2 / 10, n / 30 \), with prepaid freight of \( \$ 850 \) added to the invoice. 5. Purchased merchandise on account from Kester Co., \( \$ 47,300 \), terms FOB destination, \( 2 / 10, n / 30 \). 6. Sold merchandise on account to Parsley Co., \( \$ 16,270 \), terms \( n / 15 \). The cost of the goods sold was \( \$ 9,660 \). 7. Returned merchandise with an invoice amount of \( \$ 12,750 \) purchased on July 5 from Kester \( C 0 \). 13. Paid Hamling \( C \). on account for purchase of July 3. 15. Paid Kester Co. on account for purchase of July 5 , less return of July 7. 21. Recelved cash on account from sale of July 6 to Parsley \( C \). 21. Sold merchandise on MasterCard, \( \$ 243,920 \). The cost of the goods sold was \( \$ 142,970 \). 22. Sold merchandise on account to Tabor Co, \( \$ 61,200 \), terms \( 2 / 10 \), n/30. The cost of the goods sold was \( \$ 35,120 \). 23. Sold merchandise for cash, \( \$ 34,240 \). The cost of the goods sold was \( \$ 21,120 \). 28. Paid Parsley Co, a cash refund of \( \$ 5,890 \) for returned merchandise from sale of July 6 . The cost of the returned merchandise was \( \$ 3,430 \). 31. Paid MasterCard service fee of \( \$ 3,350 \). Required:

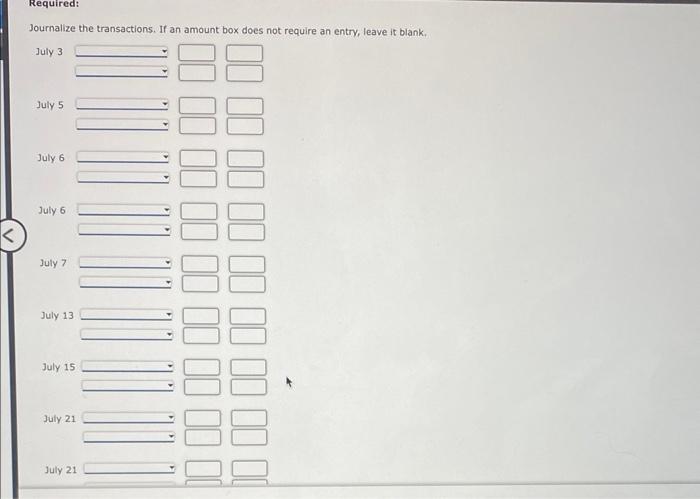

Journalize tha transartinne. if an amnint hav dnan nak require an entry, leave it blank.

July 21 July 21 July 22 July 22 July 23 July 23 July 28 July 28 July 31

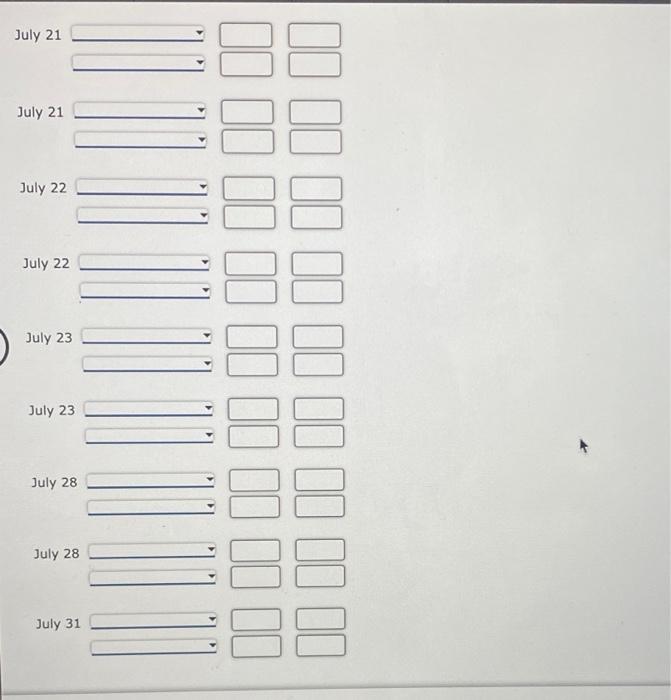

The following selected transactions were completed during April between Swan Company and Bird Company. Both companies use the net method under a perpetua inventory system. Apr. 2. Swan Company sold merchandise on account to Bird Company, \( \$ 55,200 \), terms \( F 08 \) shipping point, 2/10, n/30. Swan paid freight of \( \$ 1,840 \), Which was added to the invoice. The cost of the goods sold was 533,480 . 8. Swan Company sold merchandise on account to Bird Company, \( \$ 52,100 \), terms Fo8 destination, 1/15, n/eom. The cost of the goods sold was \( \$ 30,020 \). 8. Swan Company paid freight of \( \$ 1,180 \) for delivery of merchandise soid to Eird Company on April 8 . 12. Bird Company paid Swan Company for purchase of April 2. 23. Bird Company paid Swan Company for purchase of April 8 . 24. Swan Company soid merchandise on account to Bird Company, \( \$ 70,980 \), terms FO8 shipping point, n/eom, The cost of the goods sold was \( \$ 38,320 \). 25. Swan Company paid Bird Company a cash refund of \( \$ 2,220 \) for damaged merchandise in the April 8 sale. Bird Company kept the merchandise. 26. Bird Company paid freight of \( \$ 805 \) on Aprit 24 purchase from Swan Company, 30. Bird Company paid Swan Company on account for purchase of April 24.

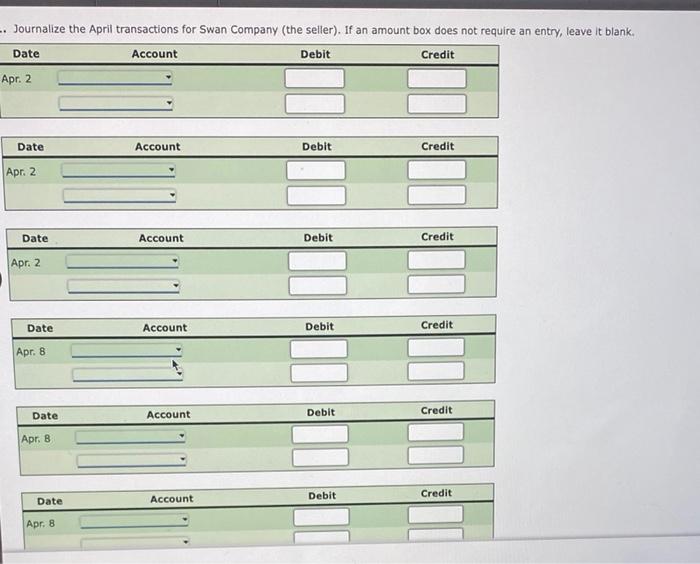

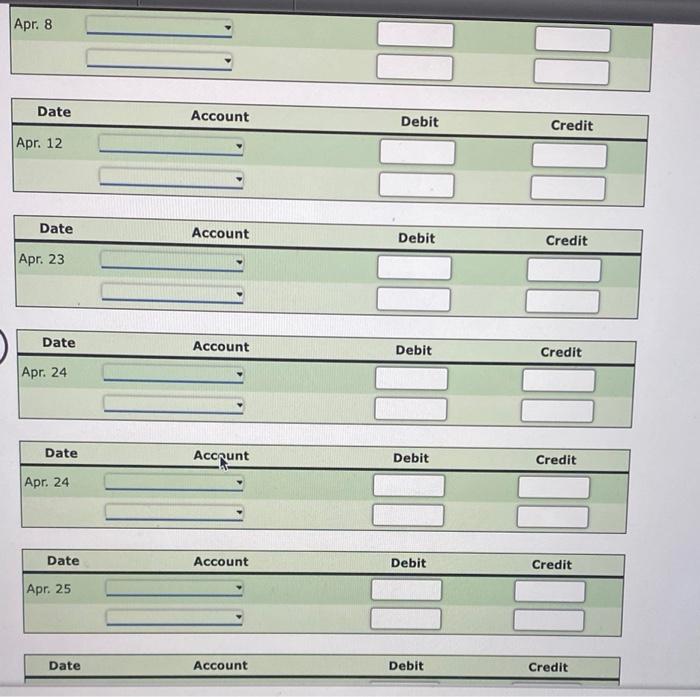

Journalize the April transactions for Swan Company (the seller). If an amount box does not require an entry, leave it blank. \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 2 & & \( \square \) \\ \hline \end{tabular} \begin{tabular}{|crcc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 2 & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 8 & & \\ \hline \end{tabular} \begin{tabular}{|crcc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 8 & \( \sim \) & \( \square \) \\ \hline & & \\ \hline \end{tabular}

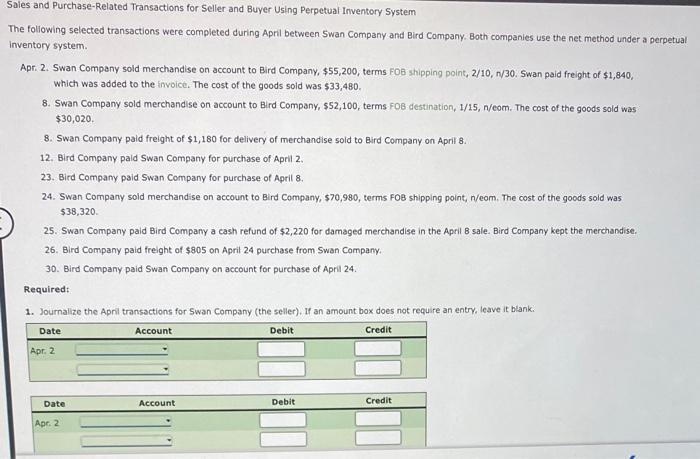

Apr. 8 \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 25 & & \\ \hline & & \\ \hline \end{tabular}

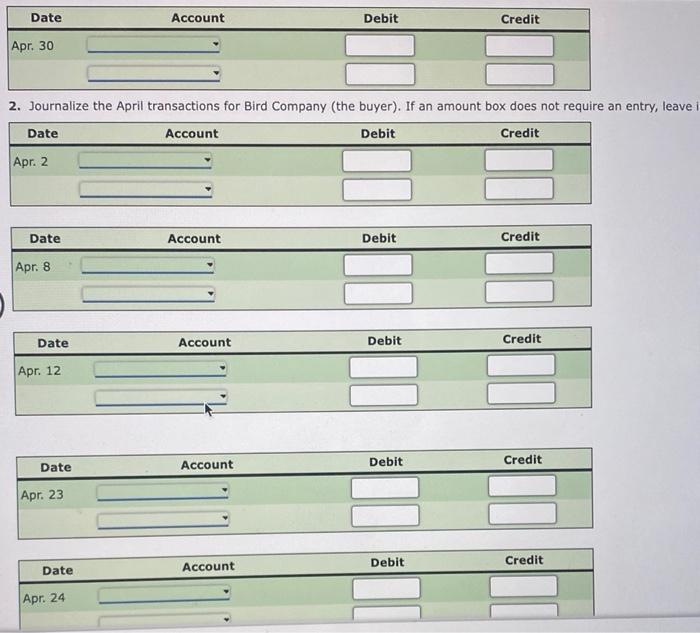

2. Journalize the April transactions for Bird Company (the buyer). If an amount box does not require an entry, leave i \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 8 & \( - \) & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 12 & & \\ \hline \end{tabular} \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 23 & & \\ \hline & & \\ \hline \end{tabular}

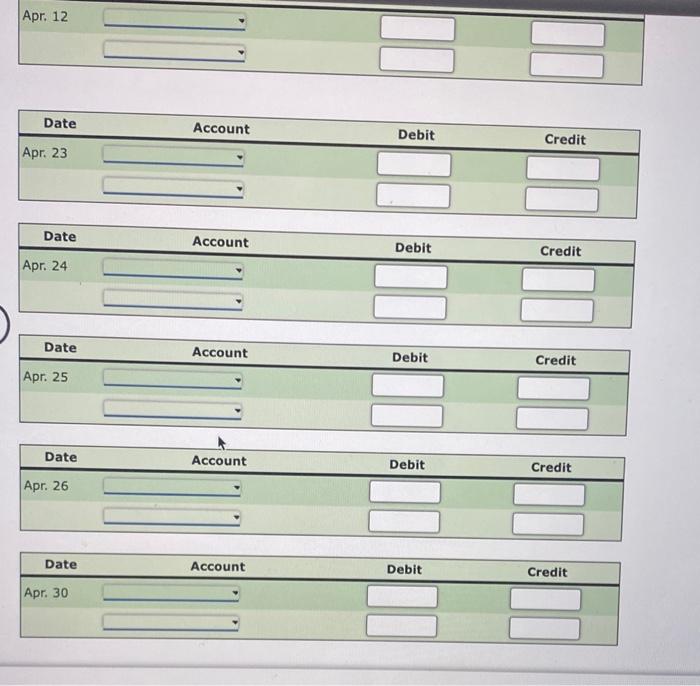

Apr. 12 \begin{tabular}{|crcc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 23 & \( - \) & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|cccc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 25 & & & \\ \hline Date & Account & \\ \hline Apr. 26 & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|crcc|} \hline Date & Account & Debit & Credit \\ \hline Apr. 30 & \( - \) & \( \square \) & \\ \hline & & & \\ \hline \end{tabular}

Expert Answer

Answer 1: Following are the required journal entries: Date Account Dr Cr Merchandise inventory $6