Home /

Expert Answers /

Economics /

the-following-graph-plots-the-long-run-phillips-curve-lrpc-and-short-run-phillips-curve-srpc1-pa799

(Solved): The following graph plots the long-run Phillips curve (LRPC) and short-run Phillips curve (SRPC1 ...

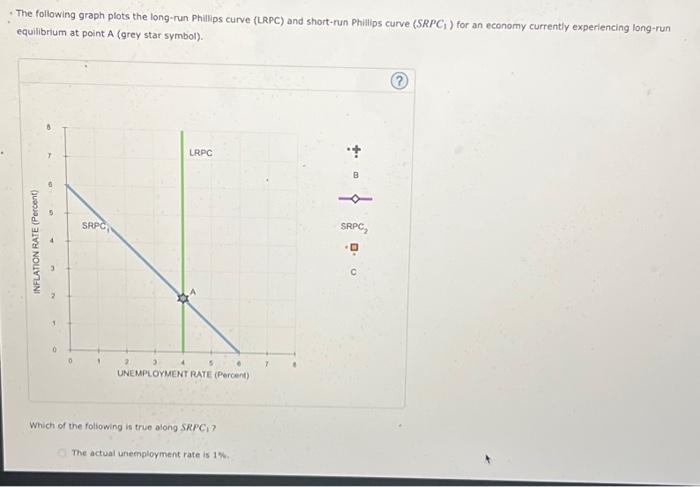

The following graph plots the long-run Phillips curve (LRPC) and short-run Phillips curve for an economy currently experiencing long-run equilibrium at point A (grey star symbol). Which of the foliowing is true along SRPC, ? The actual unetmployment rate is .

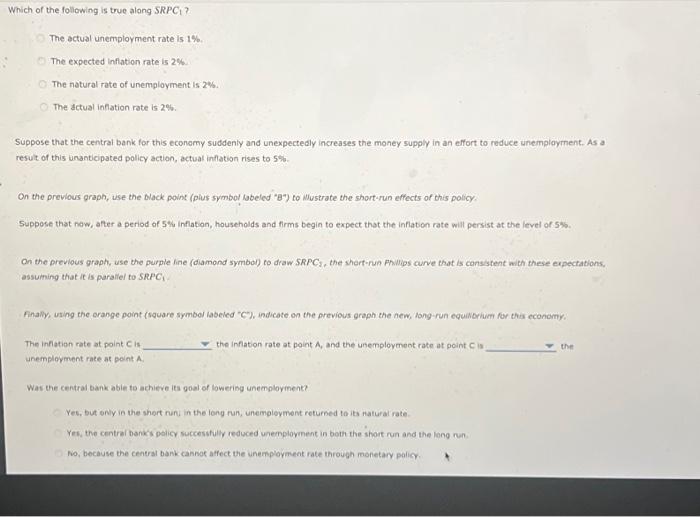

Which of the following is true along ? The actual unemployment rate is . The expected inflation rate is : The notural rate of unemployment is . The fctuat infiation rate is . Suppose that the central bank for this economy suddenly and unexpectedly increases the money supply in an effort to reduce unemployment. As a result of this unanticipated policy action, actual inflation rises to . On the previous graph, use the Back polnt (plus symbol labeled " 8 ") to Mustrate the short-run effects of this policy. Suppose that now, after a period of inflation, households and firms begin to expect that the inflation rate will persist at the level of . On the previous graph, use the purple fine (diamond symbol) to draw , the short-run Phillos curve that is cansistent with these expectations, assuming that it is parailel to . Finally, using the orange point (square symbol labeled " "), indicote on the previous graph the new, long-run equikorium for tha economy. The inflation rate at point is the inflation rate at point , and the unemployment rate at point is the unemplovment rate at point . Was the central bank abie to achieve its goal of loweriog unemployment? Yes, but ony is the shert run, in the long run, unemployment returned to its natural rate. Yes, the centrel bank's policy successfully reduced unemployment in both the short run and the long run. No, because the centrat bank cannot affect the unemployment rate through monetary polier.

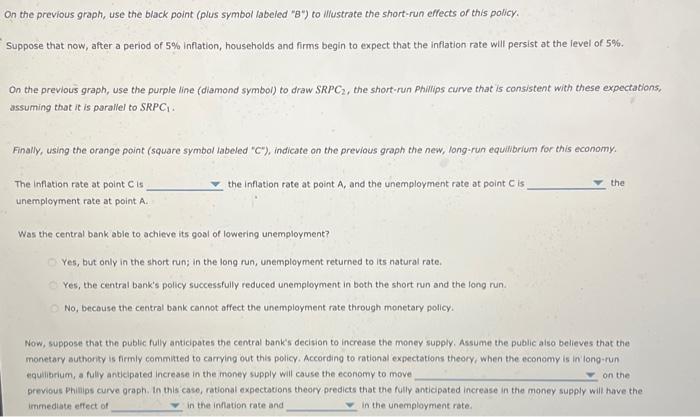

On the previous graph, use the black point (plus symbol babeled " 8 ") to Whistrate the short-run effects of this policy. Suppose that now, after a period of inflation, households and firms begin to expect that the inflation rate will persist at the ievel of . On the previous graph, use the purple line (diamond symbol) to draw , the short-run Phillips curve that is consistent with these expectations, assuming that it is parallel to . Finally, using the orange point (square symbol labeled " ), indicate on the previous graph the new, long-run equilibrium for this economy. The inflation rate at point is the inflation rate at point , and the unemployment rate at point is the unemployment rate at point . Was the central bank able to achieve its goal of lowering unemployment? Yes, but only in the short run; in the long run, unemployment returned to its natural rate. Yes, the central bank's policy successfully reduced unemployment in both the short run and the long run. No, because the central bank cannot affect the unemployment rate through monetary policy. Now, suppose that the public fully anticipates the central bank's decision to increase the money supply. Assume the public aiso believes that the monetary authority is firmly commited to carrying out this policy. According to rational expectations theory, when the economy is in long-run equilibrium, a fully anticlpated increase in the money supply will cause the economy to move on the previous Phillips curve graph. In this case, rational expectations theory predicts that the fully anticipated increase in the money supply will have the immediate effect of in the inlation rate and In the unemployment rate.