Home /

Expert Answers /

Finance /

the-dupont-equation-shows-the-relationships-among-asset-management-debt-management-and-ratios-ma-pa643

(Solved): The DuPont equation shows the relationships among asset management, debt management, and ratios. Ma ...

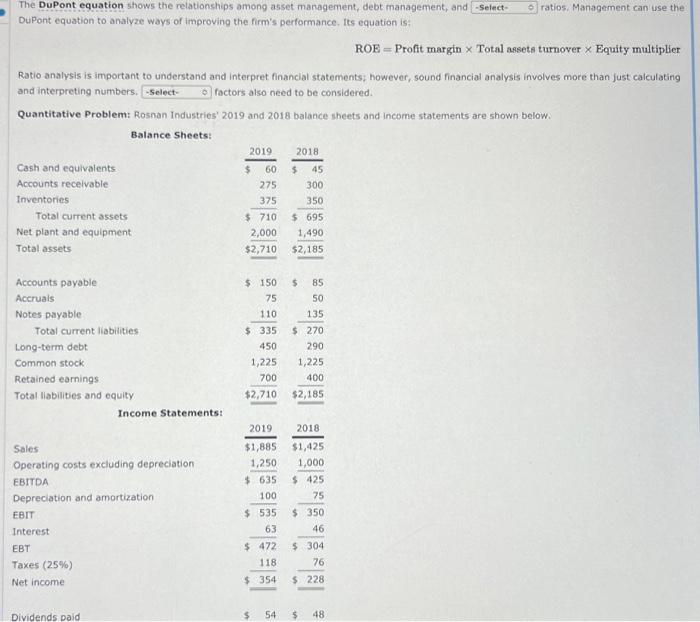

The DuPont equation shows the relationships among asset management, debt management, and ratios. Management can use the DuPont equation to analyze ways of improving the firm's performance. Its equation is: ROE Profit margin Total assets tumover Equity multiplier Ratio analysis is important to understand and interpret financial statements; however, sound financial analysis involves more than just calculating and interpreting numbers. foctors also need to be considered. Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below.

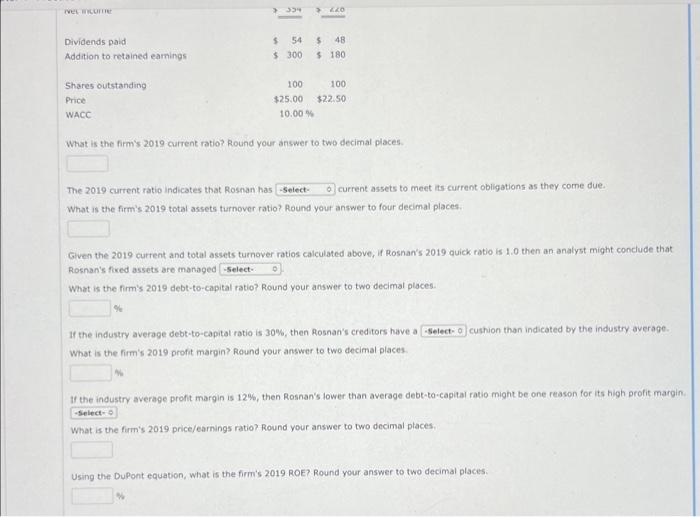

What is the firm's 2019 current ratio? Round your answer to two decimal places. The 2019 current ratio indicates that Rosnan has current assets to meet its current obligations as ther come due. What is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places. Given the 2019 current and total assets tumover ratios calculated above, if Rosnan's 2019 quick ratio is 1.0 then an analyst might conclude that Rosnan's ficed assets are managed What is the firm's 2019 debt-to-capital ratio? Round your answer to two decimal places. If the industry average debt-to-capitat ratio is , then Rosnan's creditors have a cushion than indicated by the industry average. What is the firm's 2019 profit margin? Round your answer to two decimal places. If the industry average profit margin is , then Roshan's lower than average debt-to-capital ratio might be one reason for its high profit margin What is the firm's 2019 price/earnings ratio? Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2019 ROE? Round your answer to two decimal places.