Home /

Expert Answers /

Finance /

the-correlation-between-the-fund-returns-is-0-12-a-1-what-are-the-investment-proportions-i-pa534

(Solved): The correlation between the fund returns is \( 0.12 \). a-1. What are the investment proportions i ...

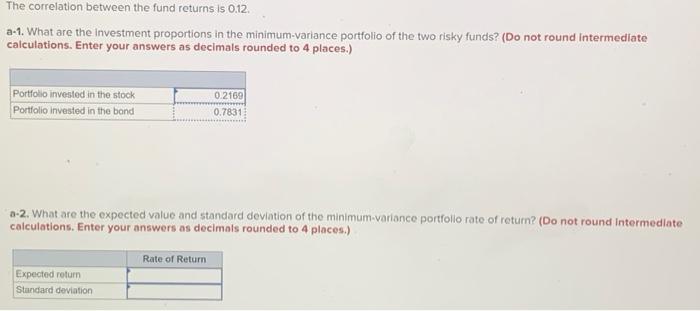

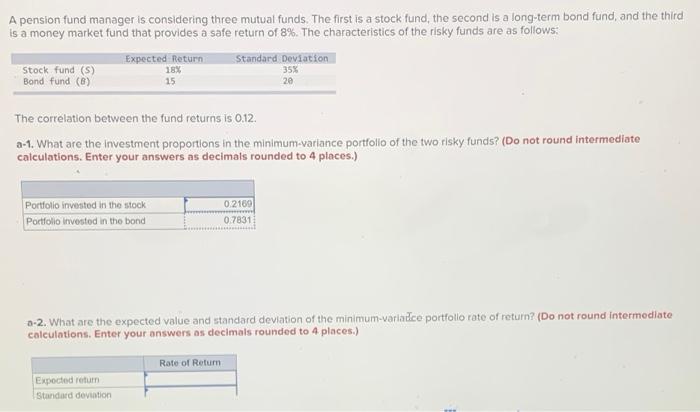

The correlation between the fund returns is \( 0.12 \). a-1. What are the investment proportions in the minimum-variance portfolio of the two risky funds? (Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.) a-2. What are the expected value and standard deviation of the minimum-variance portfolio rate of return? (Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.)

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the thire is a money market fund that provides a safe return of \( 8 \% \). The characteristics of the risky funds are as follows: The correlation between the fund returns is \( 0.12 \). a-1. What are the investment proportions in the minimum-variance portfollo of the two risky funds? (Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.) a-2. What are the expected value and standard deviation of the minimum-varlatice portfollo rate of return? (Do not round intermediate calculations. Enter your answers as decimals rounded to 4 places.)

Expert Answer

Standard Deviation of Stock Fund(S) =35% Standard Deviation of Bond Fund(B) =20% Correlation between the