Home /

Expert Answers /

Finance /

the-calculation-of-wacc-involves-calculating-the-weighted-average-of-the-required-rates-of-return-pa126

(Solved): The calculation of WACC involves calculating the weighted average of the required rates of return ...

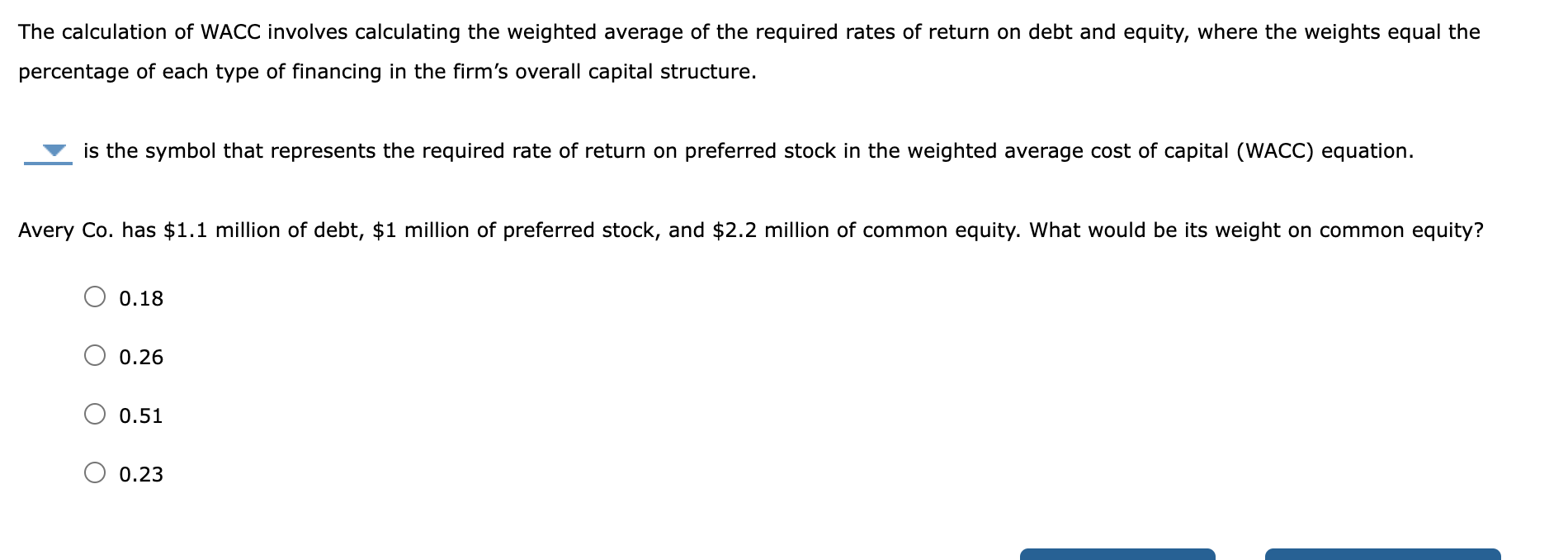

The calculation of WACC involves calculating the weighted average of the required rates of return on debt and equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the required rate of return on preferred stock in the weighted average cost of capital (WACC) equation. Avery Co. has \( \$ 1.1 \) million of debt, \( \$ 1 \) million of preferred stock, and \( \$ 2.2 \) million of common equity \( 0.18 \) \( 0.26 \) \( 0.51 \) \( 0.23 \)

Expert Answer

The required return on prefer sto