Home /

Expert Answers /

Finance /

the-black-scholes-option-pricing-model-opm-was-developed-in-1973-the-creation-of-the-black-scho-pa916

(Solved): The Black-Scholes option pricing model (OPM) was developed in 1973. The creation of the Black-Scho ...

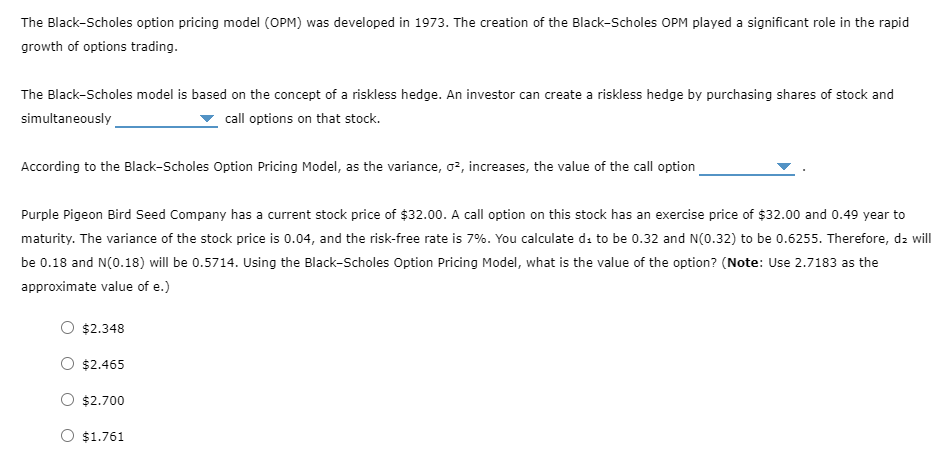

The Black-Scholes option pricing model (OPM) was developed in 1973. The creation of the Black-Scholes OPM played a significant role in the rapid growth of options trading. The Black-Scholes model is based on the concept of a riskless hedge. An investor can create a riskless hedge by purchasing shares of stock and simultaneously call options on that stock. According to the Black-Scholes Option Pricing Model, as the variance, \( \sigma^{2} \), increases, the value of the call option Purple Pigeon Bird Seed Company has a current stock price of \( \$ 32.00 \). A call option on this stock has an exercise price \( \$ 32.00 \) and maturity. The variance of the stock price is \( 0.04 \), and the risk-free rate is \( 7 \% \). You calculate \( \mathrm{d}_{1} \) to be \( 0.32 \) and \( N(0.32) \) to be \( 0.6255 \). Theref \( \mathrm{d}_{2} \) wil be \( 0.18 \) and \( N(0.18) \) will be \( 0.5714 \). Using the Black-Scholes Option Pricing Model, what is the value of the option? (Note: Use \( 2.7183 \) as the approximate value of e.) \[ \$ 2.348 \] \[ \begin{array}{l} \$ 2.465 \\ \$ 2.700 \end{array} \] \( \$ 1.761 \)

Expert Answer

a. The derivation of the Black-Scholes Option Pricing Model rests on the concept of a riskless h