Home /

Expert Answers /

Finance /

the-afn-equation-and-the-financial-statement-forecasting-approach-both-assume-that-assets-grow-at-r-pa785

(Solved): The AFN equation and the financial statement-forecasting approach both assume that assets grow at r ...

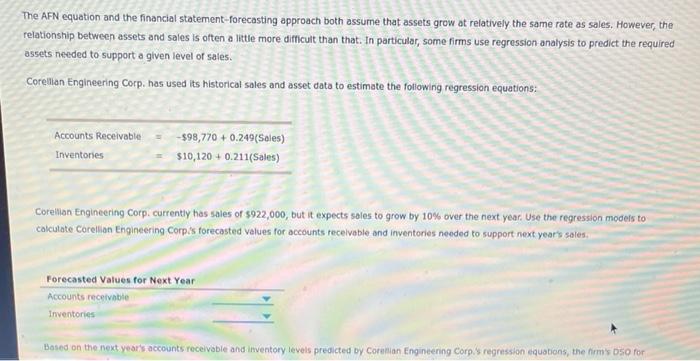

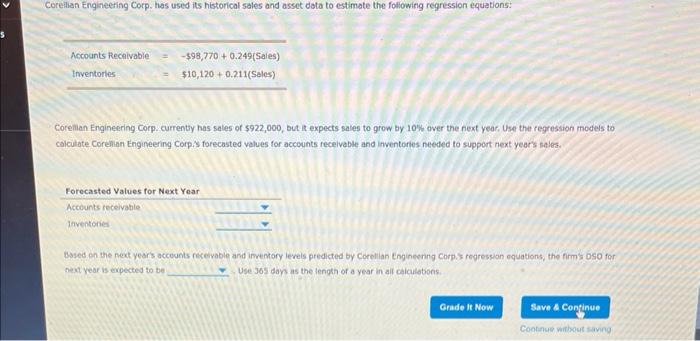

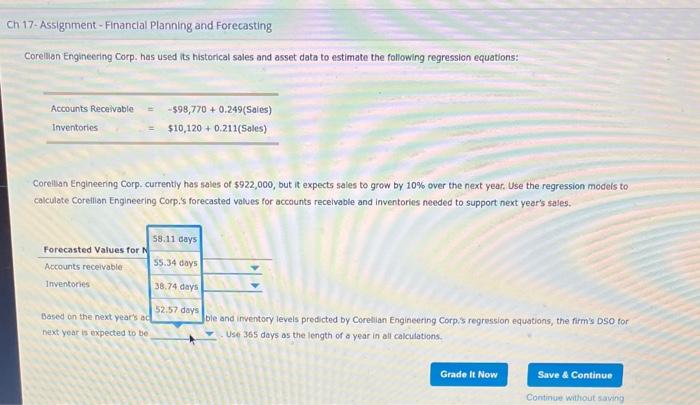

The AFN equation and the financial statement-forecasting approach both assume that assets grow at relatively the same rate as sales. However, the relationship between assets and sales is often a little more difficult than that. In particular, some firms use regression analysis to predict the required assets needed to support a given level of sales. Corellan Engineering Corp. has used its historical sales and asset data to estimate the following regression equations: \( \begin{array}{ll}\text { Accounts Receivable } & =-\$ 98,770+0.249(\text { Sales) } \\ \text { Inventories } & =\$ 10,120+0.211(\text { Sales) }\end{array} \) Corellian Engineering Corp. currently has sales of 5922,000 , but it expects sales to grow by \( 10 \% \) over the next year. Use the regression models to calculate Corellion Engineering Corpis forecasted values for accounts recelvable and inventories needed to support next year's sales. Forecasted Values for Next Year Accounts receivabie Ifventories Bosed on the next year's accounts receivable and imventory levels predicted by Coresian Engineening Corg.'s regrassion equations, the firm's D5 O for

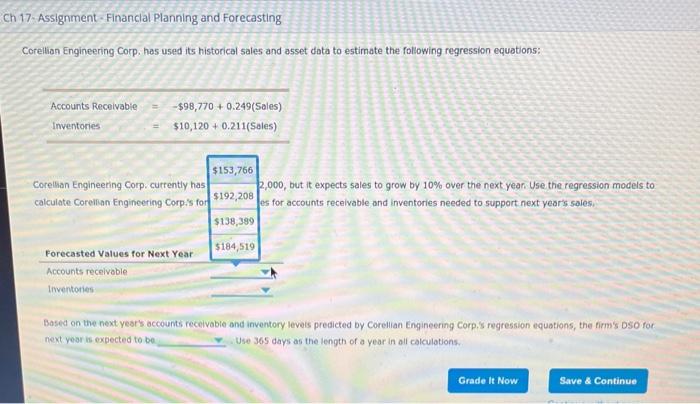

Ch 17. Assignment-Financlal Planning and Forecasting Corellian Engineering Corp, has used its historical sales and asset data to estimate the following regression equations: \[ \begin{array}{ll} \text { Accounts Recoivable } & =-\$ 98,770+0.249 \text { (Sales) } \\ \text { Inventories } & =\$ 10,120+0.211 \text { (Sales) } \end{array} \] calculate Coreilian Engineering Corpis for 5192,208 os for accounts receivable and inventories needed to support next year's sales: Forecasted Values for Next Year 5184,519 Accounts recelvoble tiventories Bosed on the next year's accounts receivabie and inventory leveis predicted by Corellan Engineering Corp,'s regression equations, the firm's Dso for next year is expected to be Use 365 days as the length of a year in all calculotions. Grade It Now Save 4 Continue

Ch 17- Assignment - Financial Planning and Forecasting Corelian Engineering Corp. has used its historical sales and asset data to estimate the following regression equations: \[ \begin{array}{ll} \text { Accounts Recaivable } & =-598,770+0.249 \text { (Saies) } \\ \text { Inventories } & =\$ 10,120+0.211 \text { (Sales) } \end{array} \] Corellan Engineering Corp. currently has sales of 5922,000 , but it expects sales to grow by \( 10 \% \) over the next year. Use the regression models to calculate Corellian Engineering Corp.'s forecasted values for accounts recelvable and inventories needed to support next year's sales. hext year is expected to be Use 365 days as the length of a year in all calculations. Grade it Now Save a Continue Continue without saying

Expert Answer

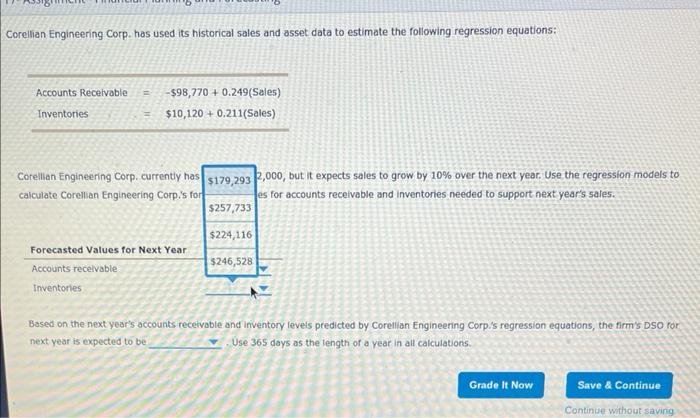

Current Sales =$922000 Growth per year(g) =10% Sales forecasted next year=Current Sales?(1+g)=$922,000×(1+10%)=$1,014,200.00