Home /

Expert Answers /

Accounting /

taxpayer-and-spouse-have-agi-of-500-000-during-the-year-taxpayer-and-spouse-have-qbi-fro-pa463

(Solved): Taxpayer and Spouse have AGI of \( \$ 500,000 \). During the year, Taxpayer and Spouse have QBI fro ...

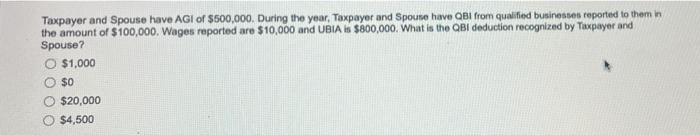

Taxpayer and Spouse have AGI of \( \$ 500,000 \). During the year, Taxpayer and Spouse have QBI from quaified businesses reported to them in the amount of \( \$ 100,000 \). Wages reported are \( \$ 10,000 \) and UBIA is \( \$ 800,000 \). What is the QBI deduction recognized by Taxpayer and Spouse? \[ \begin{array}{l} \$ 1,000 \\ \$ 0 \\ \$ 20,000 \\ \$ 4,500 \end{array} \]

Expert Answer

Taxpayer and Spouse have AGI of $500,000. During the year, Taxpayer and Spouse have QBI from qualified businesses reported to them in the amount of $100,000. Wages