Home /

Expert Answers /

Accounting /

taxpayer-age-66-is-married-but-will-file-as-married-separate-taxpayer-has-three-dependent-chi-pa181

(Solved): Taxpayer, age 66 , is married, but will file as married separate. Taxpayer has three dependent chi ...

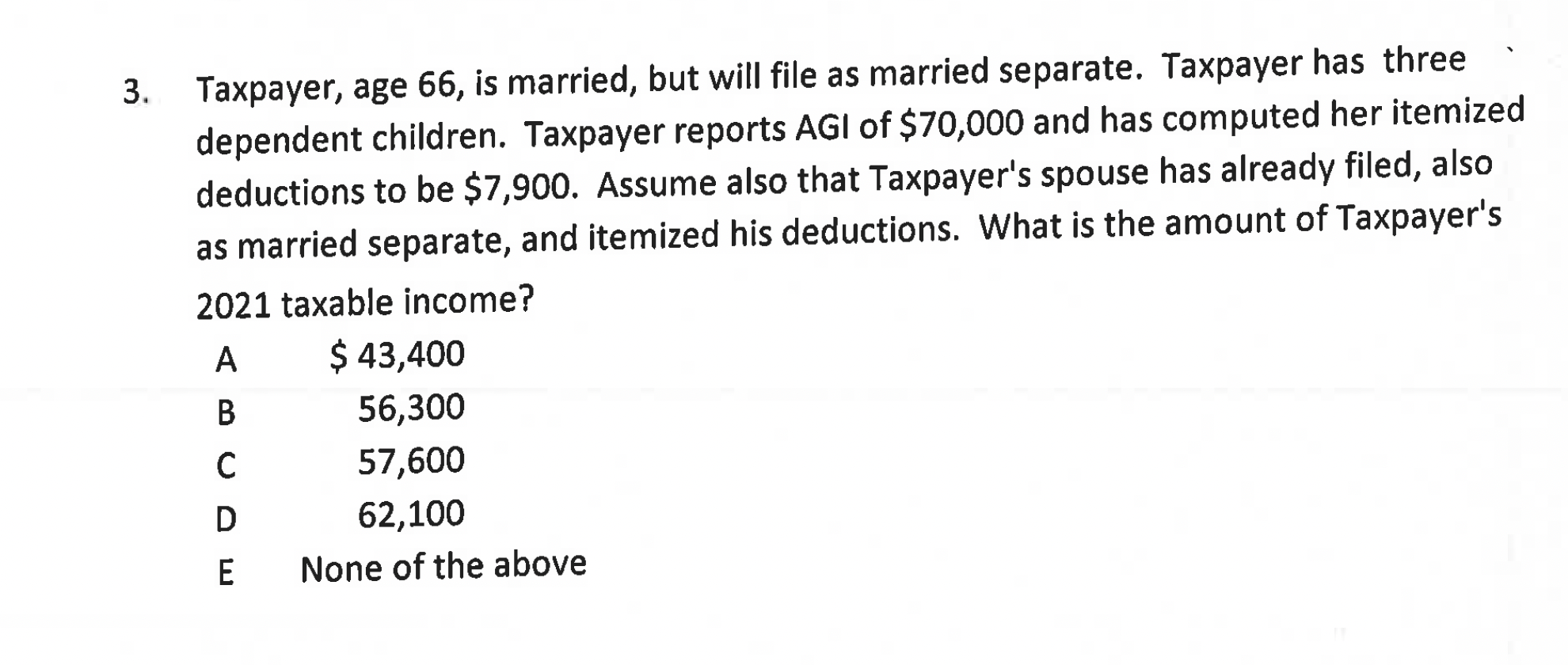

Taxpayer, age 66 , is married, but will file as married separate. Taxpayer has three dependent children. Taxpayer reports AGI of \( \$ 70,000 \) and has computed her itemized deductions to be \( \$ 7,900 \). Assume also that Taxpayer's spouse has already filed, also as married separate, and itemized his deductions. What is the amount of Taxpayer's

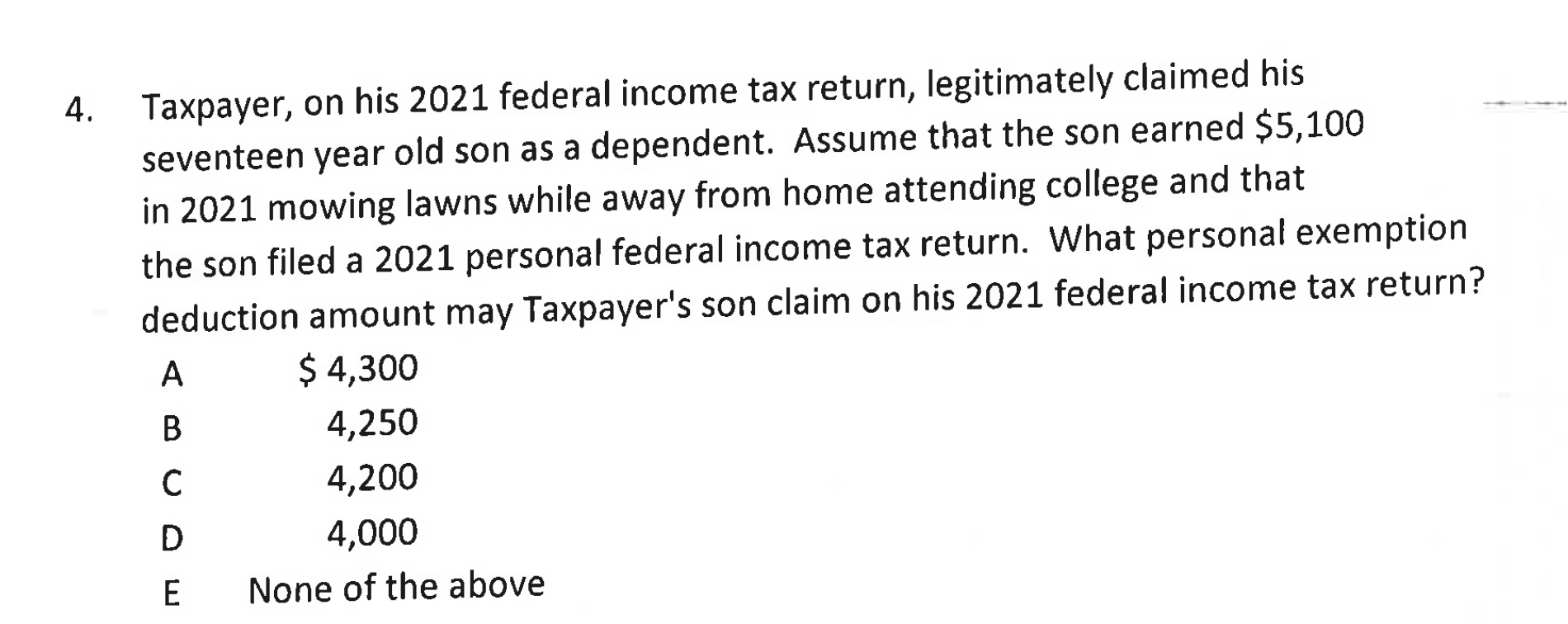

4. Taxpayer, on his 2021 federal income tax return, legitimately claimed his seventeen year old son as a dependent. Assume that the son earned \( \$ 5,100 \) in 2021 mowing lawns while away from home attending college and that the son filed a 2021 personal federal income tax return. What personal exemption deduction amount may Taxpayer's son claim on his 2021 federal income tax return?