Home /

Expert Answers /

Accounting /

tanner-unf-corporation-acquired-as-an-investment-260-million-of-5-bonds-dated-july-1-on-july-1-pa621

(Solved): Tanner-UNF Corporation acquired as an investment $260 million of 5% bonds, dated July 1, on July 1 ...

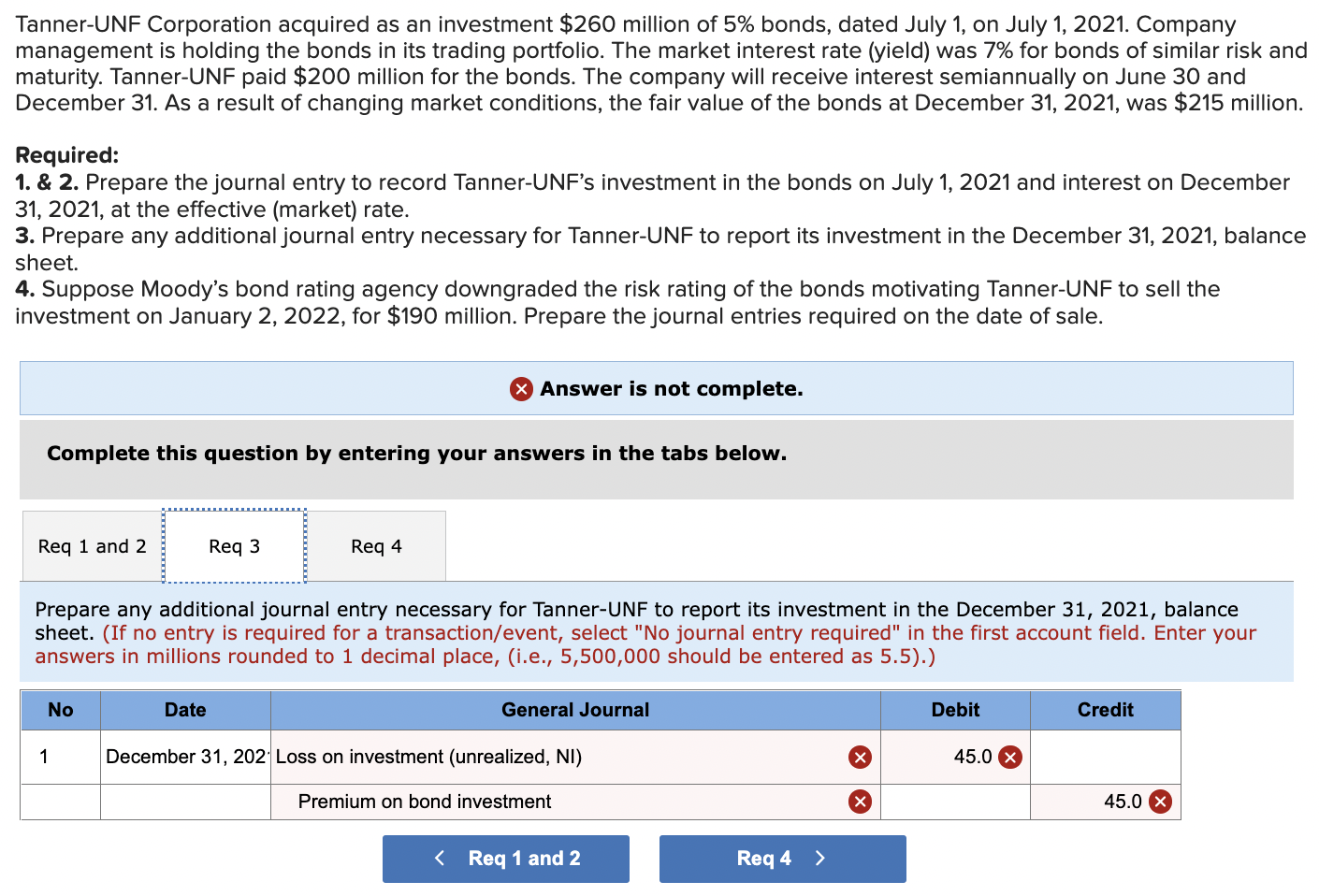

Tanner-UNF Corporation acquired as an investment $260 million of 5% bonds, dated July 1, on July 1, 2021. Company management is holding the bonds in its trading portfolio. The market interest rate (yield) was 7% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $215 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate. 3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2021, balance sheet. 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022, for $190 million. Prepare the journal entries required on the date of sale. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2021, balance sheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) No Date General Journal Debit Credit December 31, 202 Loss on investment (unrealized, NI) × Premium on bond investment Req 4 > 1 < Req 1 and 2 45.0 45.0 X

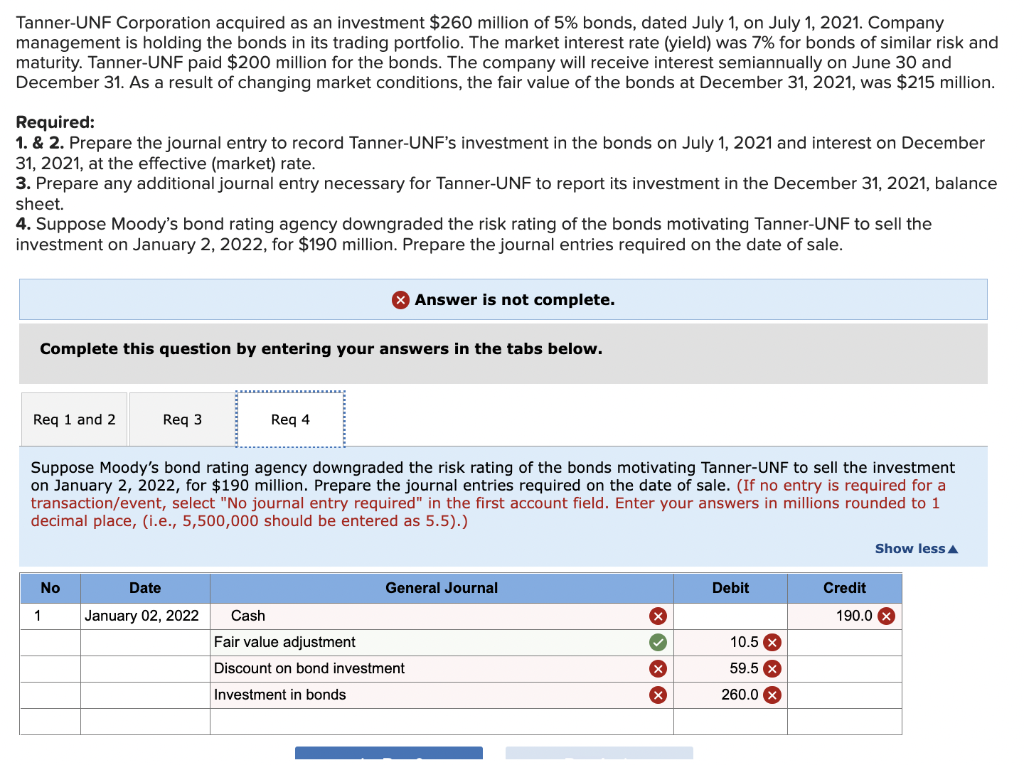

Tanner-UNF Corporation acquired as an investment $260 million of 5% bonds, dated July 1, on July 1, 2021. Company management is holding the bonds in its trading portfolio. The market interest rate (yield) was 7% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $215 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate. 3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2021, balance sheet. 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022, for $190 million. Prepare the journal entries required on the date of sale. X Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Req 4 Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2022, for $190 million. Prepare the journal entries required on the date of sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).) Show less A No Date General Journal Debit Credit January 02, 2022 Cash Fair value adjustment Discount on bond investment Investment in bonds 1 10.5 x 59.5 x 260.0 X 190.0 x