Home /

Expert Answers /

Accounting /

tamarisk-company-began-operations-in-2025-and-determined-its-ending-inventory-at-cost-and-at-lcnrv-pa347

(Solved): Tamarisk Company began operations in 2025 and determined its ending inventory at cost and at LCNRV ...

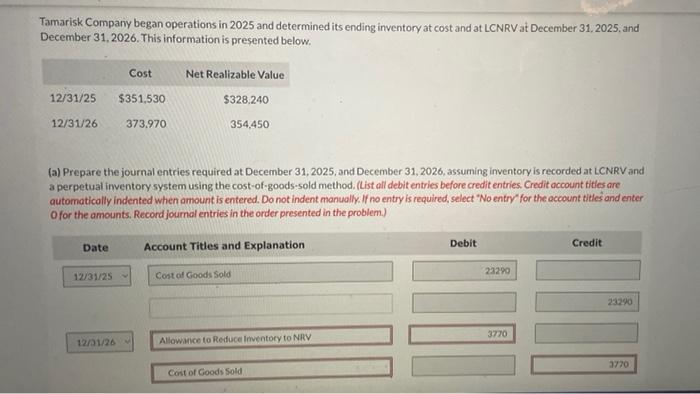

Tamarisk Company began operations in 2025 and determined its ending inventory at cost and at LCNRV at December 31,2025 , and December 31, 2026. This information is presented below. (a) Prepare the journal entries required at December 31, 2025, and December 31, 2026, assuming inventory is recorded at LCNRV and a perpetual irventory system using the cost-of-goods-sold method. (List all debit entries before credit entries. Credit occount titles are automaticolly indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the occount titles and enter O for the amounts. Record joumal entries in the order presented in the problem.)

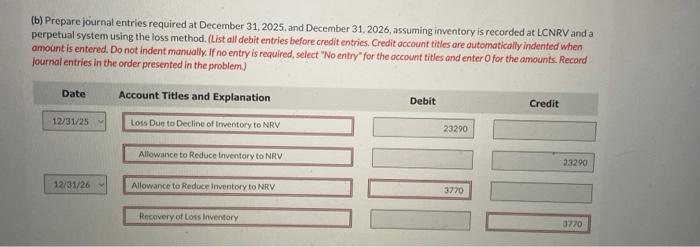

(b) Prepare journal entries required at December 31, 2025, and December 31, 2026, assuming inventory is recorded at LCNRV and a perpetual system using the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record fournal entries in the order presented in the problem.

Expert Answer

A. 12/31/25: COST OF GOODS SOLD=COST OF INVENTORY? LCNRV=351,530?328,240=$23,290 12/31/26 COST OF GOODS SOLD=COST OF INVENTORY? LCNRV=373,970?354,450=