Home /

Expert Answers /

Algebra /

suppose-you-are-25-years-old-and-would-like-to-retire-at-age-60-furthermore-you-would-like-to-have-pa583

(Solved): Suppose you are 25 years old and would like to retire at age 60. Furthermore, you would like to have ...

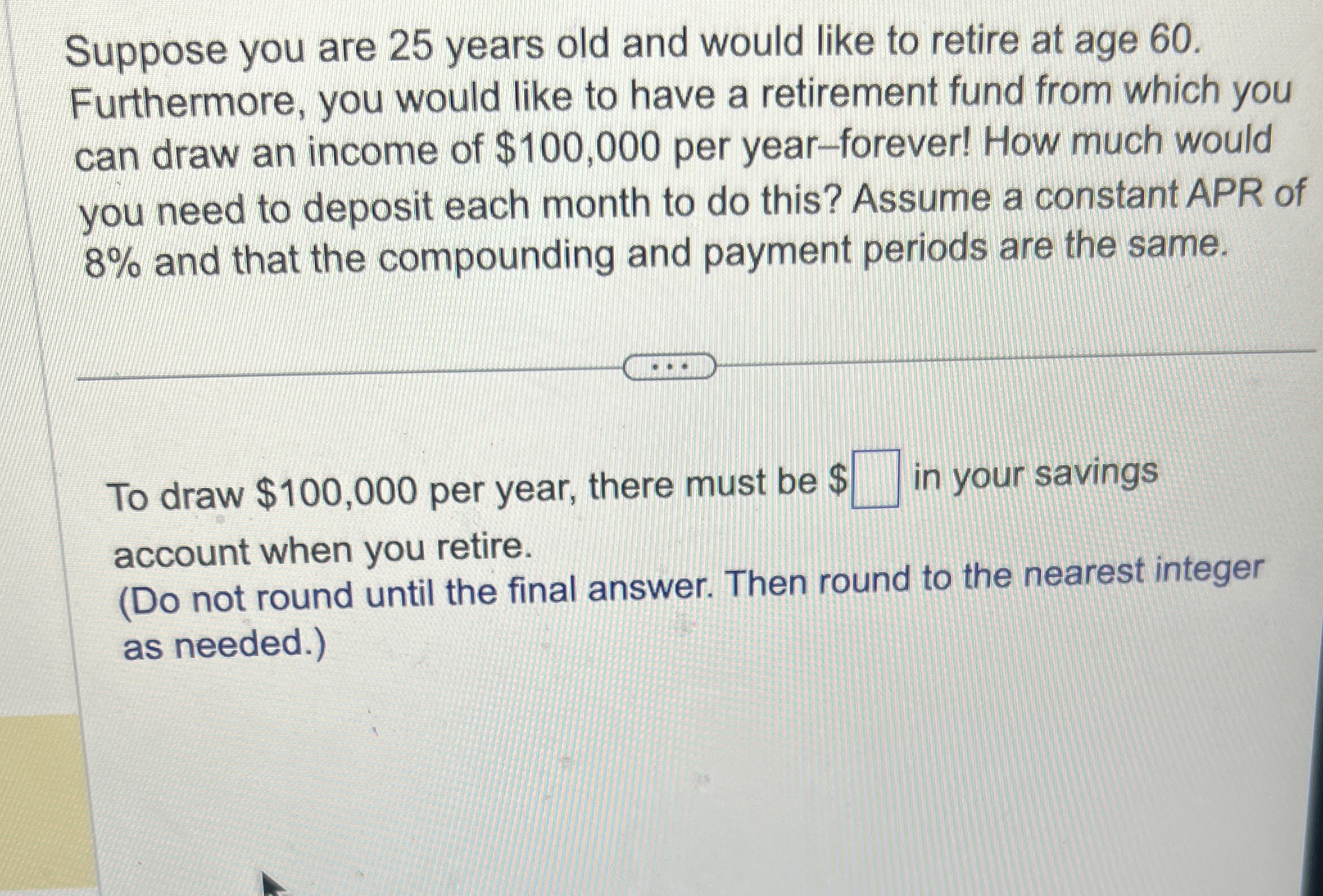

Suppose you are 25 years old and would like to retire at age 60. Furthermore, you would like to have a retirement fund from which you can draw an income of

$100,000per year-forever! How much would you need to deposit each month to do this? Assume a constant APR of

8%and that the compounding and payment periods are the same. To draw

$100,000per year, there must be

$in your savings account when you retire. (Do not round until the final answer. Then round to the nearest integer as needed.)