Home /

Expert Answers /

Finance /

suppose-the-returns-on-long-term-corporate-bonds-and-t-bills-are-normally-distributed-assume-for-a-pa547

(Solved): Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Assume for a ...

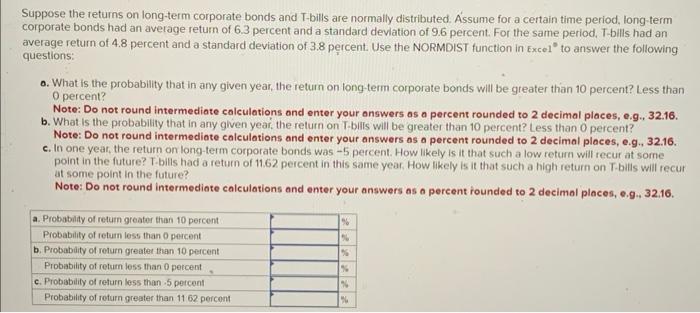

Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Assume for a certain time period, long-term corporate bonds had an average return of \( 6.3 \) percent and a standard devlation of \( 9.6 \) percent. For the same period, T-bills had an average return of \( 4.8 \) percent and a standard deviation of \( 3.8 \) percent. Use the NORMDIST function in Exce1" to answer the following questions: 0. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., \( 32.16 \). b. What is the probability that in any given year, the return on T-bilis will be greater than 10 percent? Less than 0 percent? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., \( 32.16 \). c. In one year, the return on long-term corporate bonds was \( -5 \) percent. How likely is it that such a low return will recur at some point in the future? T-bills had a return of \( 11.62 \) percent in this same year, How likely is it that such a high return on T-bills will recur at some point in the future? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.9., \( 32.16 \).

Expert Answer

Excel presentation as all answers are asked in excel form : A B C D 1 LONG TERM CORPORATE BOND 2 AVERAGE RETURN = 6.3 3 SD = 9.6 4 T BILLS 5 AVERAGE R