Home /

Expert Answers /

Finance /

suppose-that-you-buy-a-tips-inflation-indexed-bond-with-a-2-year-maturity-and-a-real-coupon-of-5-pa181

(Solved): Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a (real) coupon of 5 ...

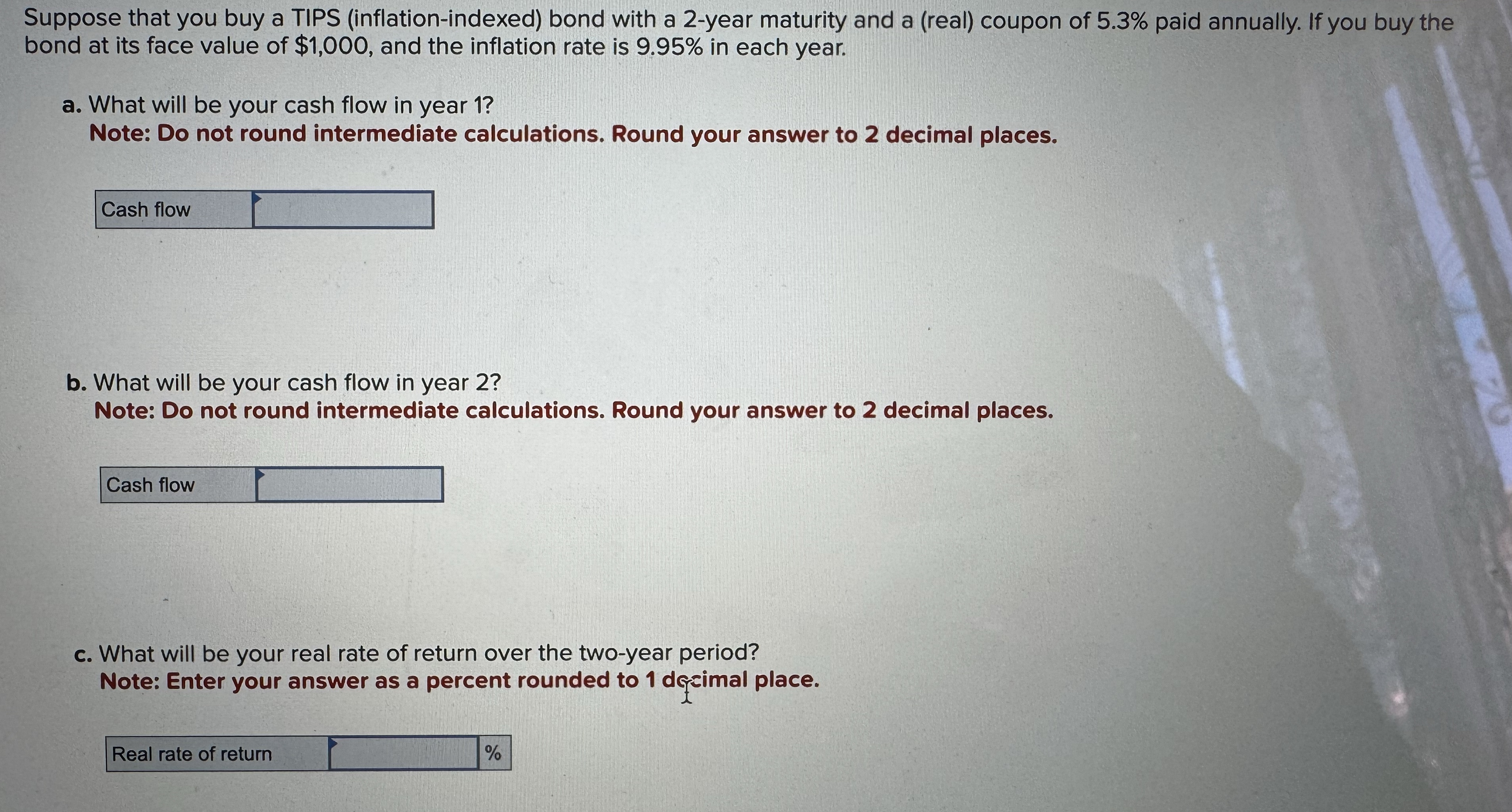

Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a (real) coupon of

5.3%paid annually. If you buy the bond at its face value of

$1,000, and the inflation rate is

9.95%in each year. a. What will be your cash flow in year 1? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Cash flow b. What will be your cash flow in year 2? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Cash flow c. What will be your real rate of return over the two-year period? Note: Enter your answer as a percent rounded to 1 dg?ximal place. Real rate of return