Home /

Expert Answers /

Accounting /

supplier-of-a-broad-range-of-components-to-the-worldwide-automobile-and-light-truck-market-cap-is-pa765

(Solved): supplier of a broad range of components to the worldwide automobile and light truck market. CAP is ...

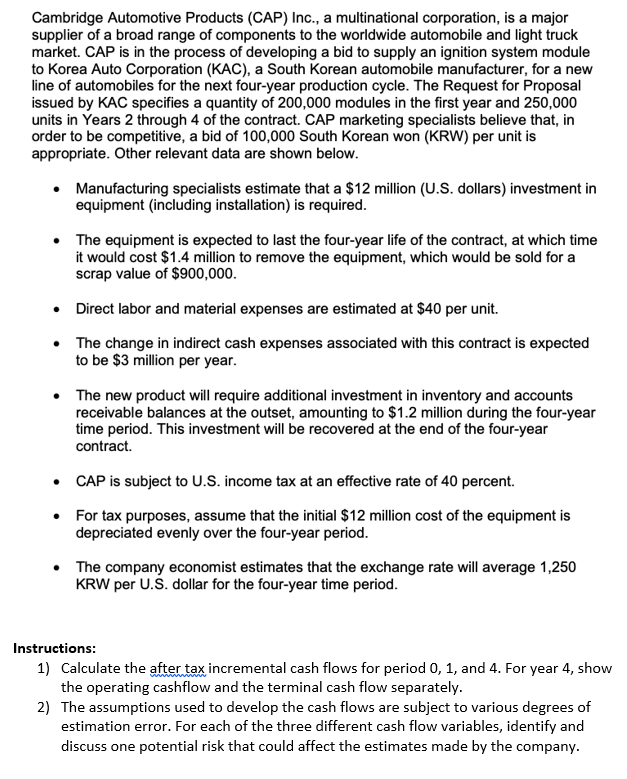

supplier of a broad range of components to the worldwide automobile and light truck market. CAP is in the process of developing a bid to supply an ignition system module to Korea Auto Corporation (KAC), a South Korean automobile manufacturer, for a new line of automobiles for the next four-year production cycle. The Request for Proposal issued by KAC specifies a quantity of 200,000 modules in the first year and 250,000 units in Years 2 through 4 of the contract. CAP marketing specialists believe that, in order to be competitive, a bid of 100,000 South Korean won (KRW) per unit is appropriate. Other relevant data are shown below. - Manufacturing specialists estimate that a million (U.S. dollars) investment in equipment (including installation) is required. - The equipment is expected to last the four-year life of the contract, at which time it would cost million to remove the equipment, which would be sold for a scrap value of . - Direct labor and material expenses are estimated at per unit. - The change in indirect cash expenses associated with this contract is expected to be million per year. - The new product will require additional investment in inventory and accounts receivable balances at the outset, amounting to million during the four-year time period. This investment will be recovered at the end of the four-year contract. - CAP is subject to U.S. income tax at an effective rate of 40 percent. - For tax purposes, assume that the initial million cost of the equipment is depreciated evenly over the four-year period. - The company economist estimates that the exchange rate will average 1,250 KRW per U.S. dollar for the four-year time period. Instructions: 1) Calculate the after tax incremental cash flows for period 0 , 1, and 4 . For year 4 , show the operating cashflow and the terminal cash flow separately. 2) The assumptions used to develop the cash flows are subject to various degrees of estimation error. For each of the three different cash flow variables, identify and discuss one potential risk that could affect the estimates made by the company.

Expert Answer

In this question, CAP is selling its products to KAC and we are required to calculate the cash flows for various years. We can do it as follows:Firstl