Home /

Expert Answers /

Accounting /

sullivan-39-s-island-company-began-operating-a-subsidiary-in-a-foreign-country-on-january-1-2020-by-pa308

(Solved): Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by ...

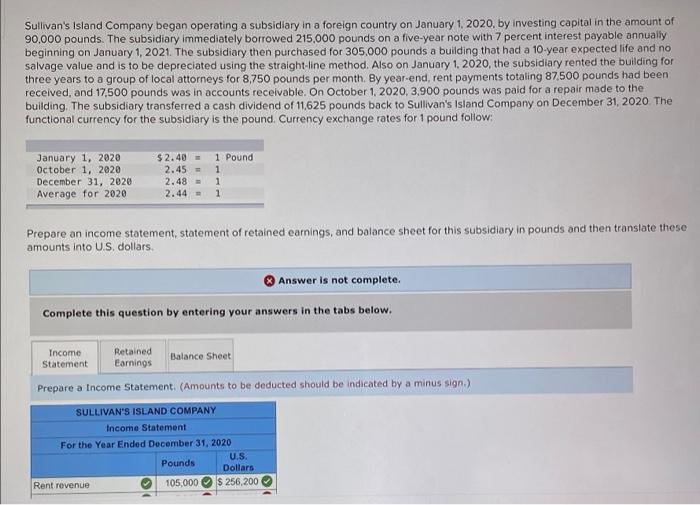

Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 90,000 pounds. The subsidiary immediately borrowed 215,000 pounds on a five-year note with 7 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 305,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method. Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8,750 pounds per month. By year-end, rent payments totaling 87,500 pounds had been received, and 17,500 pounds was in accounts receivable. On October 1, 2020, 3,900 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 11,625 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound. Currency exchange rates for 1 pound follow: January 1, 2020 October 1, 2020 December 31, 2020 Average for 2020 Income Statement $2.40 = 2.45 = 2.48 2.44 = Prepare an income statement, statement of retained earnings, and balance sheet for this subsidiary in pounds and then translate these amounts into U.S. dollars. 1 Pound 1 1 Answer is not complete. Complete this question by entering your answers in the tabs below. Retained Earnings Rent revenue 1 Balance Sheet Prepare a Income Statement. (Amounts to be deducted should be indicated by a minus sign.) SULLIVAN'S ISLAND COMPANY Income Statement i For the Year Ended December 31, 2020 U.S. Pounds Dollars 105,000 $ 256,200

Expert Answer

Solution Answer 1. SULLIVAN'S ISLAND COMPANY Income Statement For the year ended december 31, 2020 Pounds US dollars Rent revenue (8750*12) 105000 $256200 (105000*$2.44) Less; Expenses Interest expenses ($215000*7%) 15050 $36722 (15050*$2.44) Repair