Home /

Expert Answers /

Finance /

stocks-a-b-and-c-have-expected-returns-of-25-percent-25-percent-and-20-percent-respectively-wh-pa648

(Solved): Stocks A, B, and C have expected returns of 25 percent, 25 percent, and 20 percent, respectively, wh ...

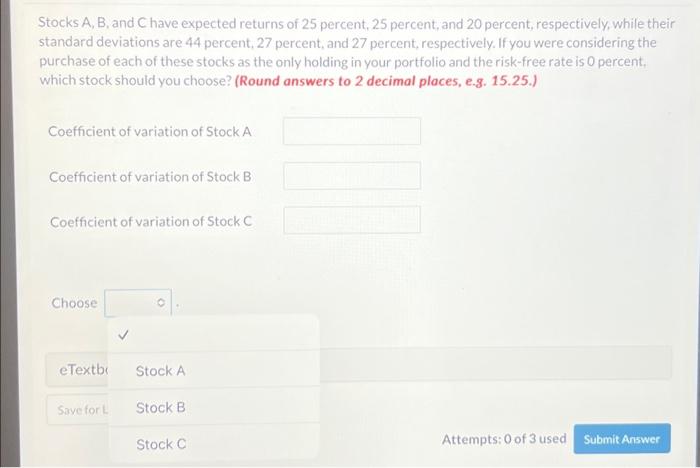

Stocks A, B, and C have expected returns of 25 percent, 25 percent, and 20 percent, respectively, while their standard deviations are 44 percent, 27 percent, and 27 percent, respectively. If you were considering the purchase of each of these stocks as the only holding in your portfolio and the risk-free rate is 0 percent, which stock should you choose? (Round answers to 2 decimal places, e.g. 15.25.) Coefficient of variation of Stock A Coefficient of variation of Stock B Coefficient of variation of Stock C Choose eTextb Save for L Stock A Stock B Stock C Attempts: 0 of 3 used Submit Answer

Stocks A, B, and C have expected returns of 25 percent, 25 percent, and 20 percent, respectively, while their standard deviations are 44 percent. 27 percent, and 27 percent, respectively. If you were considering the purchase of each of these stocks as the only holding in your portfolio and the risk-free rate is 0 percent, which stock should you choose? (Round answers to 2 decimal places, e.g. 15.25.) Coefficient of variation of Stock A Coefficient of variation of Stock B Coefficient of variation of Stock C Choose Stock B Stock C