Home /

Expert Answers /

Finance /

stock-investment-beta-standard-deviation-perpetualcold-refrigeration-co-prc-3-500-1-00-15-00-pa793

(Solved): Stock Investment Beta Standard Deviation Perpetualcold Refrigeration Co. (PRC) $3,500 1.00 15.00% ...

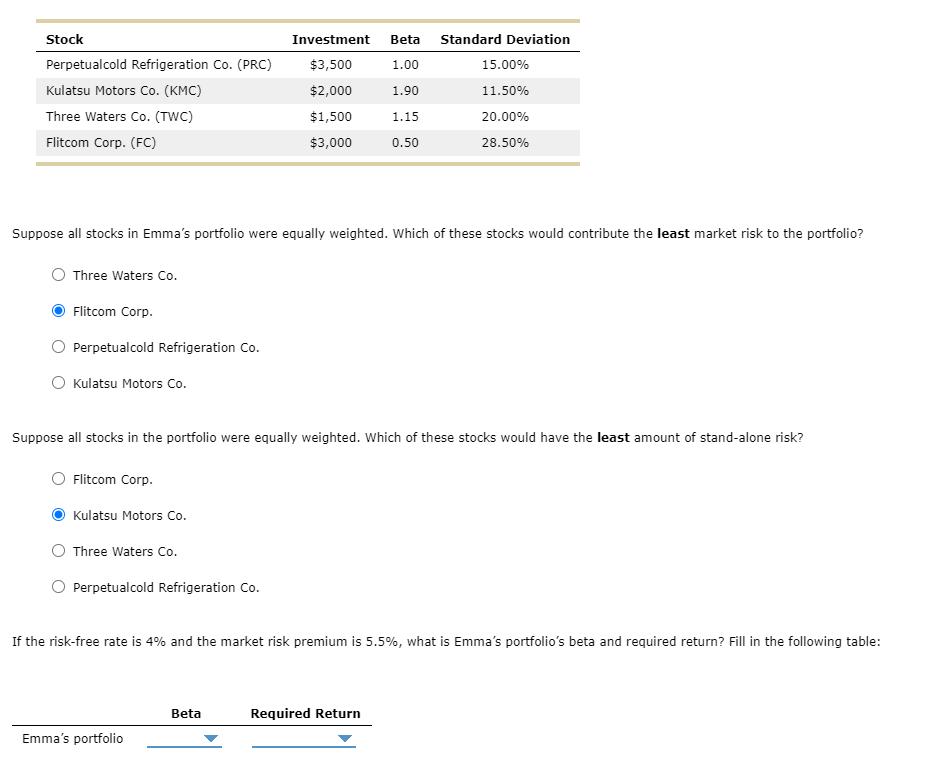

Stock Investment Beta Standard Deviation Perpetualcold Refrigeration Co. (PRC) $3,500 1.00 15.00% Kulatsu Motors Co. (KMC) $2,000 1.90 11.50% Three Waters Co. (TWC) $1,500 1.15 20.00% Flitcom Corp. (FC) $3,000 0.50 28.50% Suppose all stocks in Emma's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Three Waters Co. Flitcom Corp. Perpetualcold Refrigeration Co. Kulatsu Motors Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Flitcom Corp. Kulatsu Motors Co. Three Waters Co. Perpetualcold Refrigeration Co. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Emma's portfolio's beta and required return? Fill in the following table: Beta Required Return Emma's portfolio