(Solved): Steve Collins runs a restaurant called the SC Steak House in London, which has been in business for ...

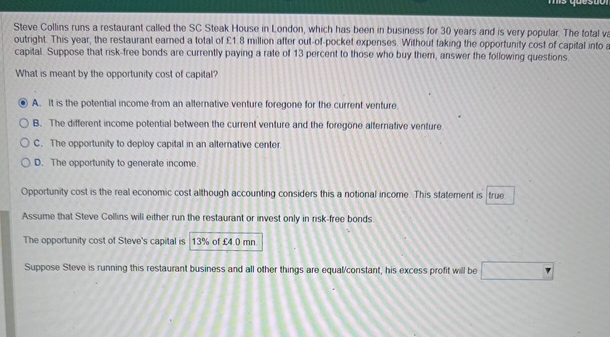

Steve Collins runs a restaurant called the SC Steak House in London, which has been in business for 30 years and is very popular. The total ve outright. This year, the restaurant earned a total of

£1.8million after out-of-pocket expenses. Without taking the opporfunity cost of capital into a capital. Suppose that risk-free bonds are currently paying a rate of 13 percent to those who buy them, answer the following questions. What is meant by the opportunity cost of capital? A. It is the potential income from an altemative venture foregone for the current venture, B. The different income potential between the current venture and the foregone alternative venture C. The opportunity to deploy capital in an alternative center D. The opportunity to generate income. Opportunity cost is the real economic cost although accounting considers this a notional income. This statement is

?Assume that Steve Collins will either run the restaurant or invest only in risk-free bonds The opportunity cost of Steve's capital is

?Suppose Steve is running this restaurant business and all other things are equal/constant, his excess profit will be

?