Home /

Expert Answers /

Accounting /

statement-of-cash-flows-the-comparative-balance-sheet-of-whitman-co-at-december-31-20y2-and-20y1-pa745

(Solved): Statement of Cash Flows The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, ...

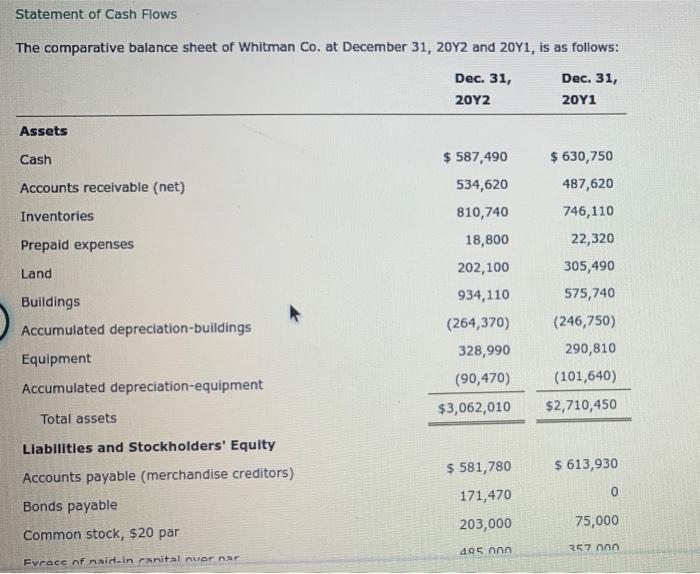

Statement of Cash Flows The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows: Dec. 31, Dec. 31, 20Y2 20Y1 Assets Cash $ 587,490 $ 630,750 Accounts receivable (net) 534,620 487,620 Inventories 810,740 746,110 Prepaid expenses 18,800 22,320 Land 202,100 305,490 Buildings 934,110 575,740 Accumulated depreciation-buildings (264,370) (246,750) Equipment 328,990 290,810 Accumulated depreciation-equipment (90,470) (101,640) $3,062,010 $2,710,450 Total assets Liabilities and Stockholders' Equity $ 581,780 $ 613,930 Accounts payable (merchandise creditors) 0 171,470 Bonds payable 203,000 75,000 Common stock, $20 par 495 000 357 000 Evroce of naid-in ranital nuor nar

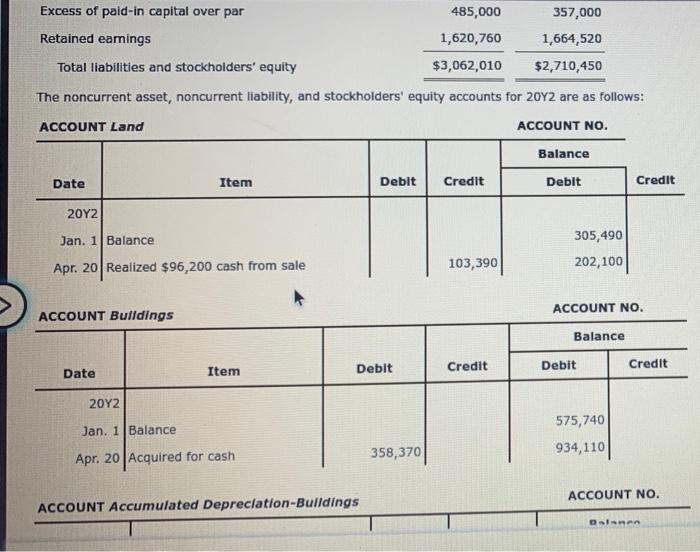

Excess of paid-in capital over par 485,000 357,000 Retained earnings 1,620,760 1,664,520 Total liabilities and stockholders' equity $3,062,010 $2,710,450 The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Land ACCOUNT NO. Balance Date Item Debit Credit Debit Credit 2012 Jan. 1 Balance Apr. 20 Realized $96,200 cash from sale ACCOUNT Buildings Date Item 20Y2 Jan. 1 Balance Apr. 20 Acquired for cash ACCOUNT Accumulated Depreciation-Buildings Debit 358,370 103,390 Credit 305,490 202,100 ACCOUNT NO. Balance Debit 575,740 934,110 Credit ACCOUNT NO. Dalanen

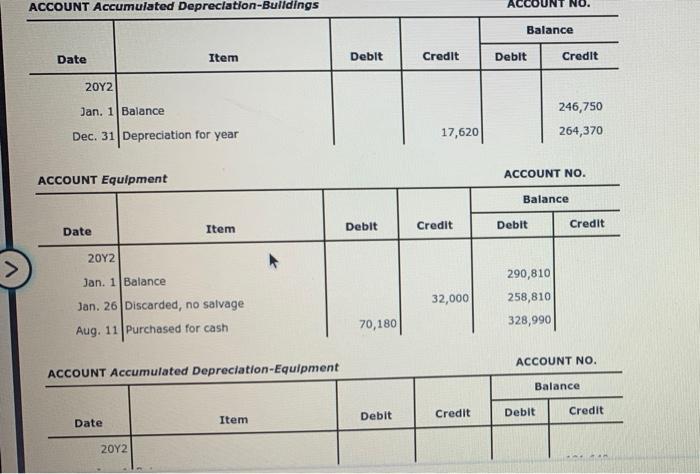

ACCOUNT Accumulated Depreciation-Buildings Date Item 2012 Jan. 1 Balance Dec. 31 Depreciation for year ACCOUNT Equipment Date Item 20Y2 Jan. 1 Balance Jan. 26 Discarded, no salvage Aug. 11 Purchased for cash ACCOUNT Accumulated Depreciation-Equipment Date Item 2012 Debit Debit 70,180 Debit Credit 17,620 Credit 32,000 Credit ACCOUNT NO. Balance Debit ACCOUNT NO. Balance Debit Credit 246,750 264,370 Debit Credit 290,810 258,810 328,990 ACCOUNT NO. Balance Credit

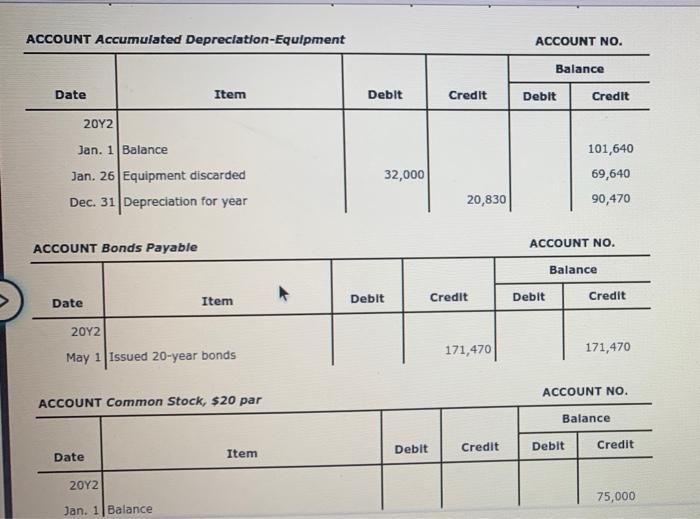

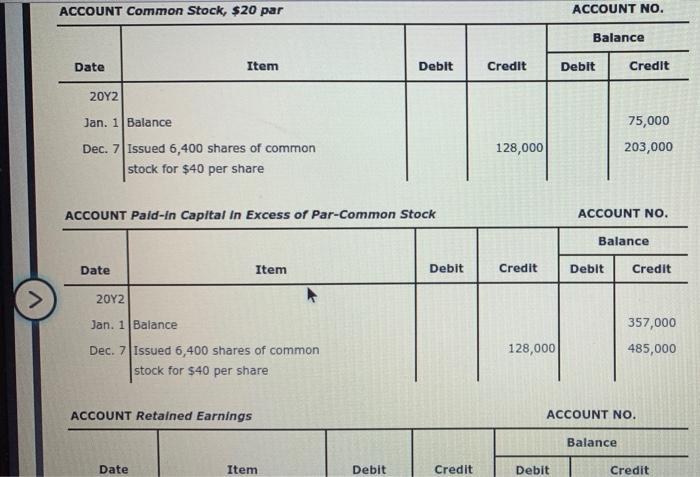

ACCOUNT Accumulated Depreciation-Equipment Date Item 2012 Jan. 1 Balance Jan. 26 Equipment discarded Dec. 31 Depreciation for year ACCOUNT Bonds Payable Date Item 2012 May 1 Issued 20-year bonds ACCOUNT Common Stock, $20 par Date Item 2012 Jan. 1 Balance ? Debit 32,000 Debit Debit Credit 20,830 Credit 171,470 Credit ACCOUNT NO. Balance Debit ACCOUNT NO. Balance Debit Credit 101,640 69,640 90,470 Credit 171,470 ACCOUNT NO. Balance Debit Credit 75,000

> ACCOUNT Common Stock, $20 par Date Item Debit 20Y2 Jan. 1 Balance Dec. 7 Issued 6,400 shares of common stock for $40 per share ACCOUNT Pald-in Capital In Excess of Par-Common Stock Date Item Debit 2012 Jan. 1 Balance Dec. 7 Issued 6,400 shares of common stock for $40 per share ACCOUNT Retained Earnings Date Item Debit Credit Credit 128,000 Credit 128,000 ACCOUNT NO. Balance Debit Credit 75,000 203,000 ACCOUNT NO. Balance Debit Debit Credit 357,000 485,000 ACCOUNT NO. Balance Credit

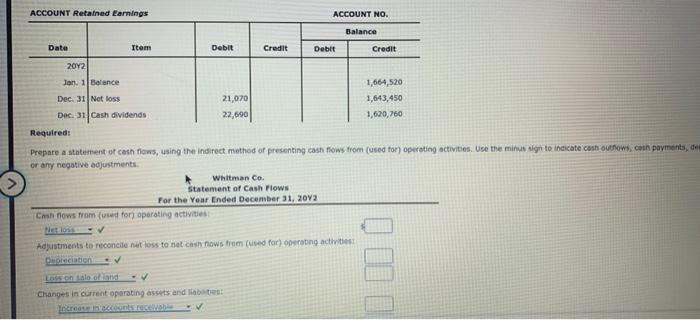

ACCOUNT Retained Earnings Date Item Debit Credit ACCOUNT NO. Balance Debit Credit 2012 Jan. 1 Balance 1,664,520 1,643,450 Dec. 31 Net loss 21,070 22,690 Dec. 31 Cash dividends 1,620,760 Required: Prepare a statement of cash flows, using the indirect method of presenting cash flows from (used for) operating activities. Use the minus sign to indicate cash outhows, cash payments, del or any negative adjustments. Whitman Co. Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from (used for) operating activities Adjustments to reconcile net loss to net cash flows from (used for) operating activities: Depreciation - V Loss on sale of land -V Changes in current operating assets and liabilities: Increase in accounts receivable

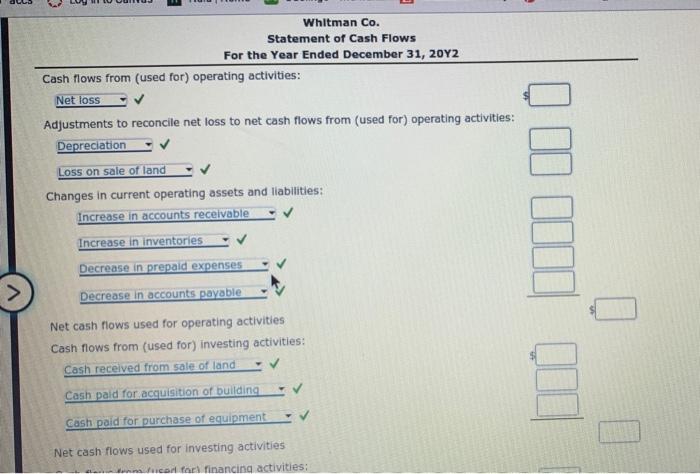

> Whitman Co. Statement of Cash Flows For the Year Ended December 31, 20Y2 Cash flows from (used for) operating activities: Net loss Adjustments to reconcile net loss to net cash flows from (used for) operating activities: Depreciation Loss on sale of land Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Decrease in prepaid expenses Decrease in accounts payable Net cash flows used for operating activities Cash flows from (used for) investing activities: Cash received from sale of land Cash paid for acquisition of building V Cash paid for purchase of equipment Net cash flows used for investing activities from fused for financing activities: 000000

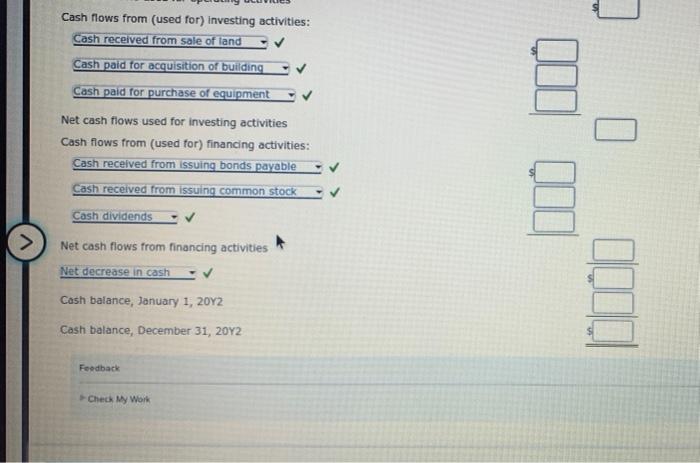

Cash flows from (used for) investing activities: Cash received from sale of land Cash paid for acquisition of building Cash paid for purchase of equipment Net cash flows used for investing activities Cash flows from (used for) financing activities: Cash received from issuing bonds payable Cash received from issuing common stock Cash dividends Net cash flows from financing activities Net decrease in cash Cash balance, January 1, 2012 Cash balance, December 31, 20Y2 Feedback Check My Work 8