Home /

Expert Answers /

Accounting /

specifically-you-must-address-the-following-rubric-criteria-accuracy-prepare-entries-that-are-ac-pa551

(Solved): Specifically, you must address the following rubriccriteria:Accuracy: Prepare entries that are ac ...

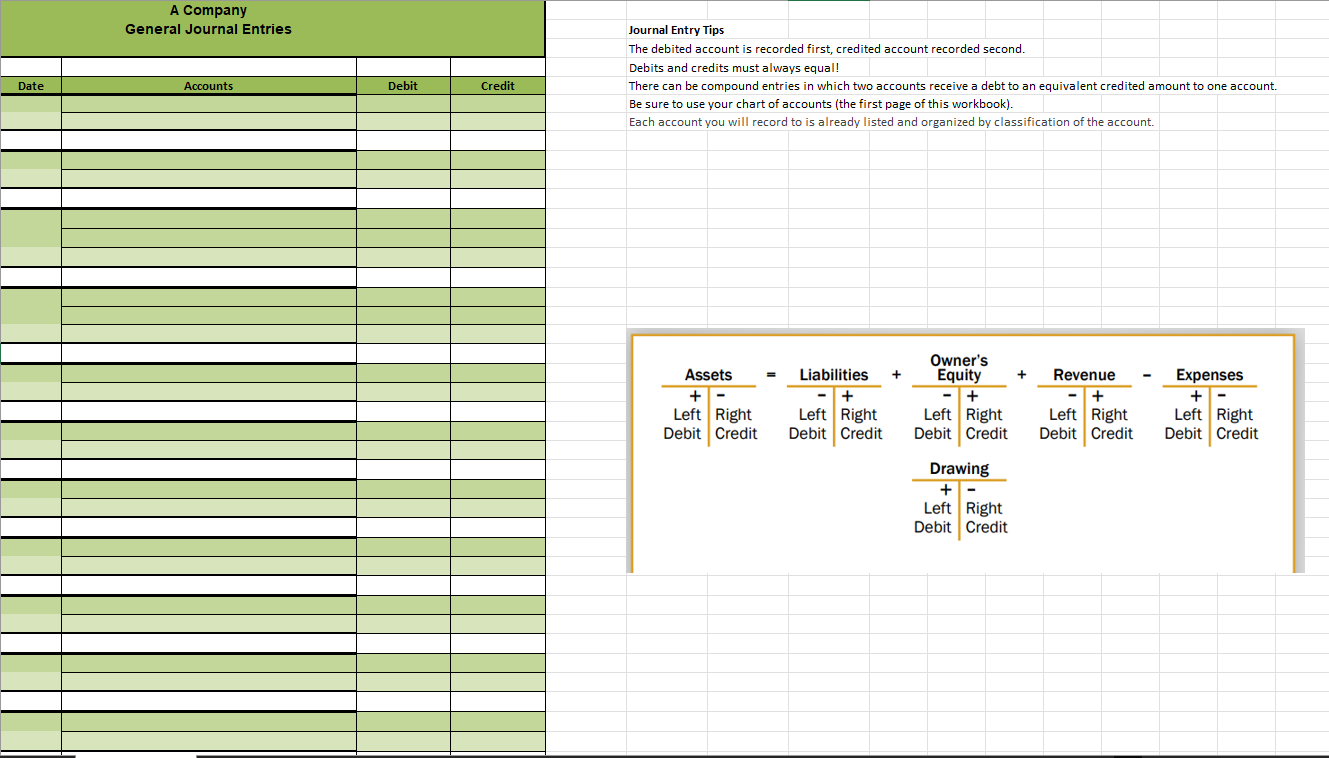

Specifically, you must address the following rubric criteria:

- Accuracy: Prepare entries that are accurate in that they fully reflect the appropriate information.

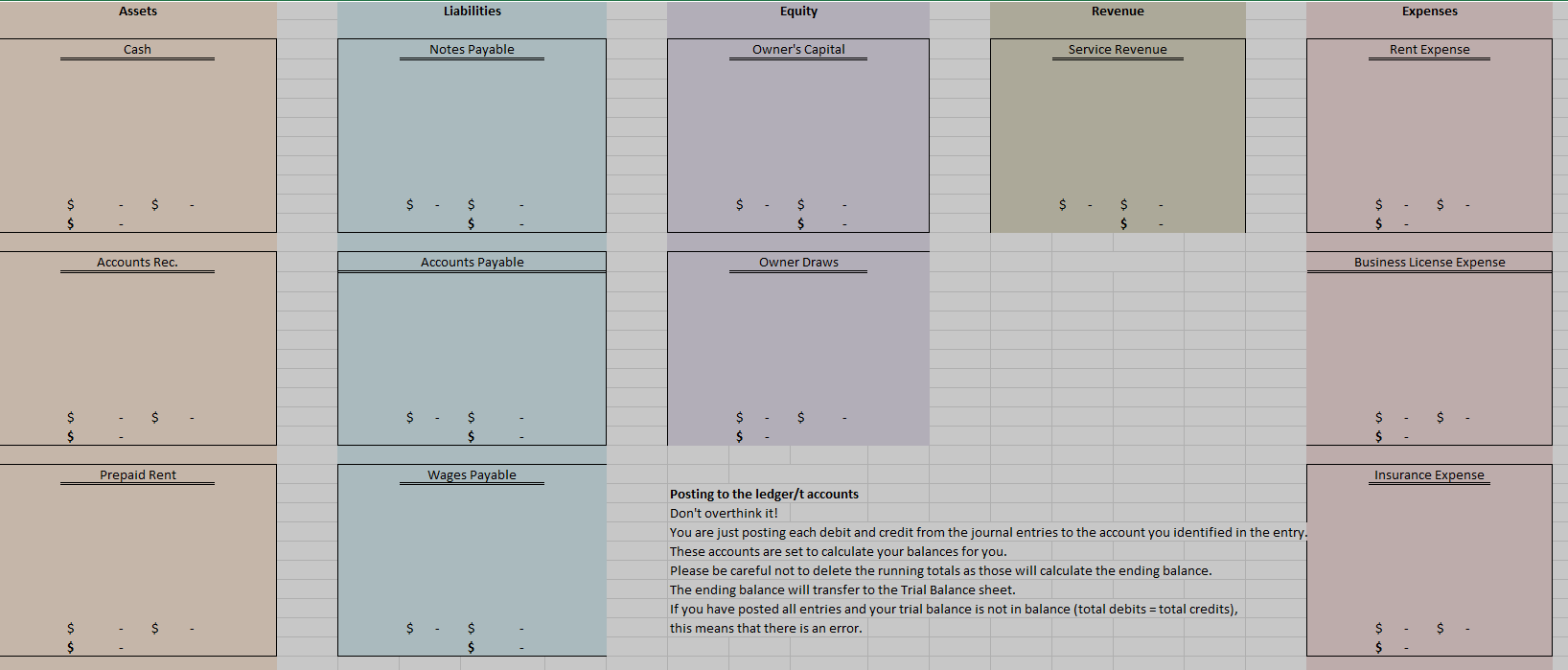

- Completeness: Prepare entries that are complete for each month, including transferring posted entries to T accounts.

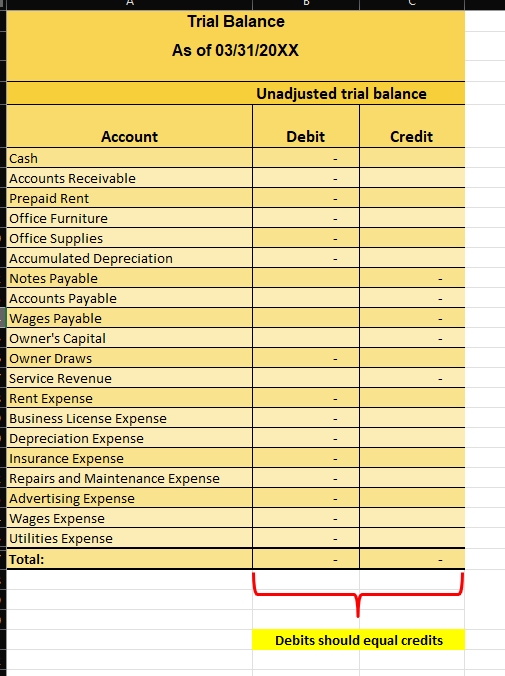

- Unadjusted Trial Balance: Prepare the unadjusted trial balance portion of the “Trial Balance” tab of the company accounting workbook, ensuring that the total debits and credits match.

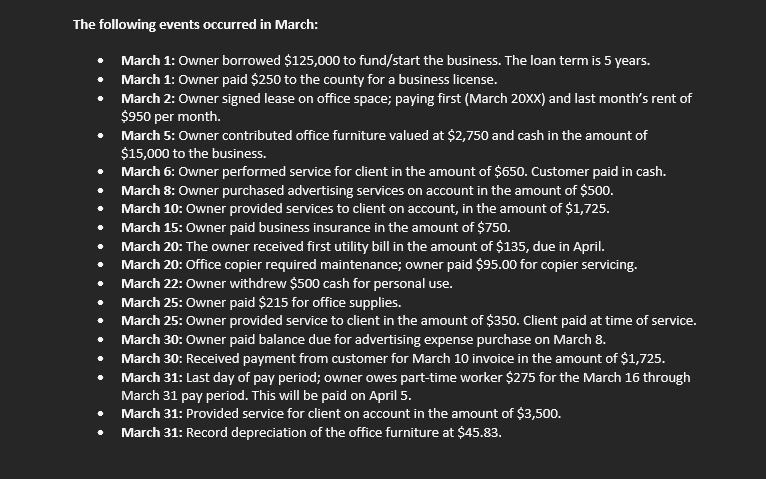

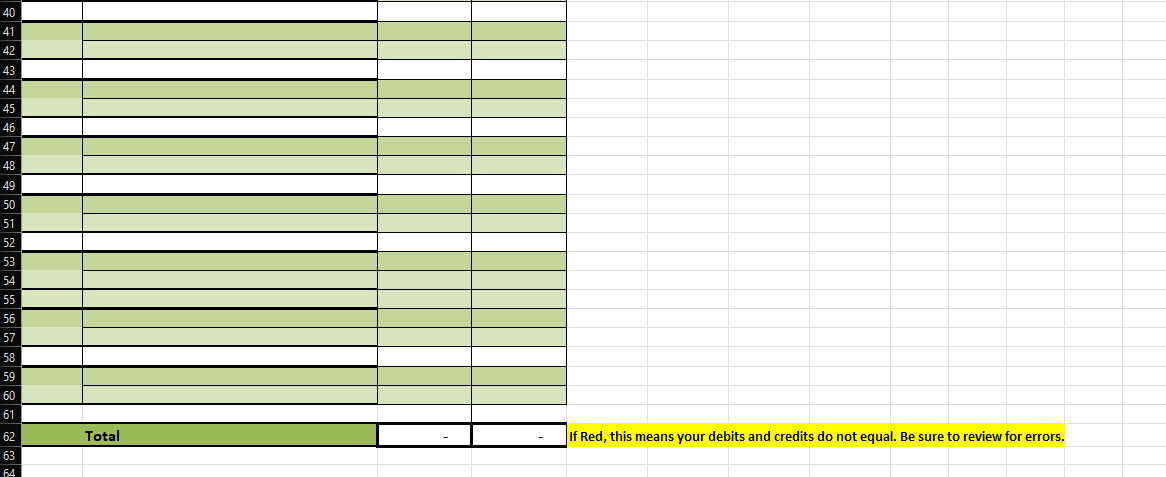

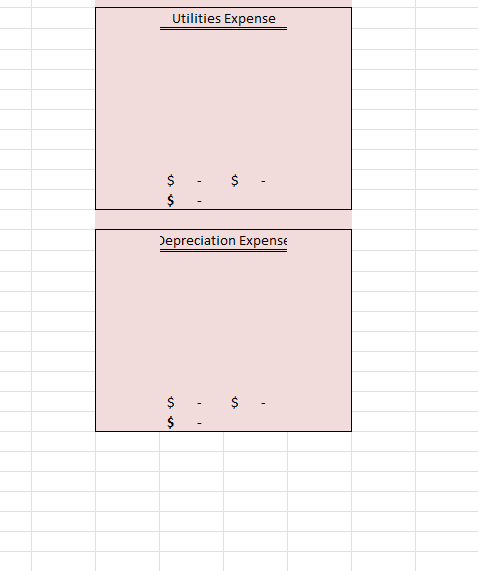

The following events occurred in March: - March 1: Owner borrowed \( \$ 125,000 \) to fund/start the business. The loan term is 5 years. - March 1: Owner paid \$250 to the county for a business license. - March 2: Owner signed lease on office space; paying first (March 20XX) and last month's rent of \( \$ 950 \) per month. - March 5: Owner contributed office furniture valued at \( \$ 2,750 \) and cash in the amount of \( \$ 15,000 \) to the business. - March 6: Owner performed service for client in the amount of \( \$ 650 \). Customer paid in cash. - March 8: Owner purchased advertising services on account in the amount of \( \$ 500 . \) - March 10: Owner provided services to client on account, in the amount of \( \$ 1,725 . \) - March 15: Owner paid business insurance in the amount of \$750. - March 20: The owner received first utility bill in the amount of \$135, due in April. - March 20: Office copier required maintenance; owner paid \( \$ 95.00 \) for copier servicing. - March 22: Owner withdrew \$500 cash for personal use. - March 25: Owner paid \$215 for office supplies. - March 25: Owner provided service to client in the amount of \( \$ 350 \). Client paid at time of service. - March 30: Owner paid balance due for advertising expense purchase on March \( 8 . \) - March 30: Received payment from customer for March 10 invoice in the amount of \( \$ 1,725 . \) - March 31: Last day of pay period; owner owes part-time worker \$275 for the March 16 through March 31 pay period. This will be paid on April \( 5 . \) - March 31: Provided service for client on account in the amount of \( \$ 3,500 . \) - March 31: Record depreciation of the office furniture at \( \$ 45.83 . \) A Companv If Red, this means your debits and credits do not equal. Be sure to review for errors. Owner Draws Posting to the ledger/t accounts Don't overthink it! You are just posting each debit and credit from the journal entries to the account you identified in the entry. These accounts are set to calculate your balances for you. Please be careful not to delet the e running totals as those will calculate the ending balance. The ending balance will transfer to the Trial Balance sheet. If you have posted all entries and your trial balance is not in balance (total debits = total credits), this means that there is an error. Trial Balance As of \( 03 / 31 / 20 \mathrm{XX} \) Debits should equal credits