Home /

Expert Answers /

Advanced Math /

solve-the-following-in-the-format-template-provided-below-please-abc-company-makes-one-product-and-pa442

(Solved): SOLVE THE FOLLOWING IN THE FORMAT TEMPLATE PROVIDED BELOW PLEASE!!!ABC Company makes one product and ...

SOLVE THE FOLLOWING IN THE FORMAT TEMPLATE PROVIDED BELOW PLEASE!!!

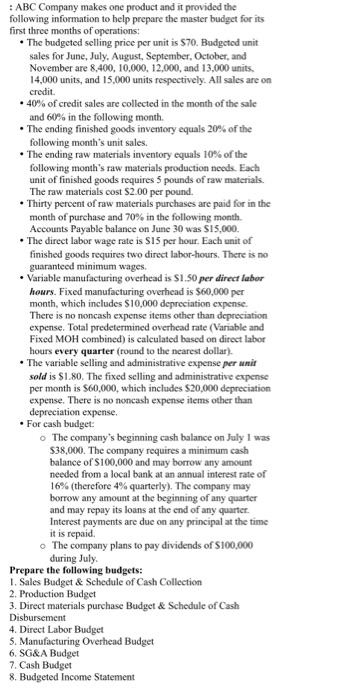

ABC Company makes one product and it provided the following information to help prepare the master budget for its first three months of operations:

- ??The budgeted selling price per unit is $70. Budgeted unit sales for June, July, August, September, October, and November are 8,400, 10,000, 12,000, and 13,000 units, 14,000 units, and 15,000 units respectively. All sales are on credit.

- ??40% of credit sales are collected in the month of the sale and 60% in the following month.

- ??The ending finished goods inventory equals 20% of the following month's unit sales.

- ??The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials.

The raw materials cost $2.00 per pound. - ??Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month.

Accounts Payable balance on June 30 was $15,000. - ??The direct labor wage rate is $15 per hour. Each unit of finished goods requires two direct labor-hours. There is no guaranteed minimum wages.

- ??Variable manufacturing overhead is $1.50 per direct labor hours. Fixed manufacturing overhead is $60,000 per month, which includes $10,000 depreciation expense.

There is no noncash expense items other than depreciation expense. Total predetermined overhead rate (Variable and Fixed MOH combined) is calculated based on direct labor hours every quarter (round to the nearest dollar). - ??The variable selling and administrative expense per unit sold is $1.80. The fixed selling and administrative expense per month is $60,000, which includes $20,000 depreciation expense. There is no noncash expense items other than depreciation expense.

- ??For cash budget:

- ??The company's beginning cash balance on July 1 was $38,000. The company requires a minimum cash balance of $100,000 and may borrow any amount needed from a local bank at an annual interest rate of 16% (therefore 4% quarterly). The company may borrow any amount at the beginning of any quarter and may repay its loans at the end of any quarter.

Interest payments are due on any principal at the time it is repaid. - ??The company plans to pay dividends of $100,000

during July.

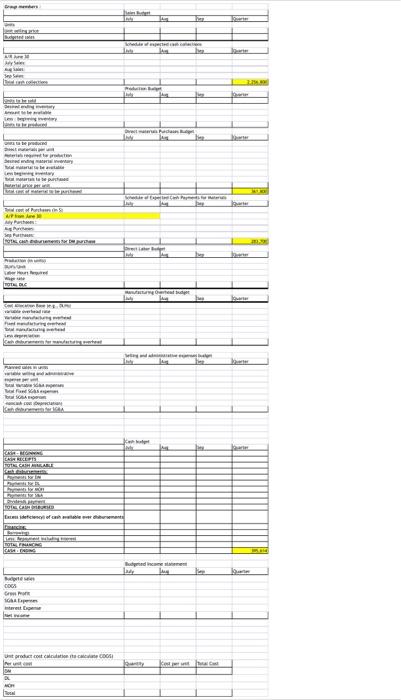

Prepare the following budgets:

- ???Sales Budget & Schedule of Cash Collection

- ???Production Budget

- ???Direct materials purchase Budget & Schedule of Cash

- Disbursement

- ???Direct Labor Budget

- ???Manufacturing Overhead Budget

- ???SG&A Budget

- ???Cash Budget

- ???Budgeted Income Statement

\begin{tabular}{|c|c|c|c|} \hline bone mendurs & & & \\ \hline & & 4 & \\ \hline & & & \\ \hline factinguse & & 1 & 1 \\ \hline & & & \\ \hline & & & \\ \hline & Lith. & & lon \\ \hline & & & \\ \hline & & & \\ \hline Eqanei & & & \\ \hline The lent & & & \\ \hline & & L & 1 \\ \hline & & ing & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & Rachath nece & 1 \\ \hline & & & thet \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & inerimh hare & \\ \hline & lats & & ber. \\ \hline & & & \\ \hline dithen dee in & & & \\ \hline & & & \\ \hline & & & \\ \hline & & 1 & 1 \\ \hline & & & \\ \hline & & & ter. \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline whe ule & & & \\ \hline gork bee & & 1 & 1 \\ \hline & & & hes: \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & 1 & 1. & 1 \\ \hline & vetary and a & & \\ \hline & laty & & tet \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & ber. \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Fancis. & & & \\ \hline & & & \\ \hline & & & \\ \hline note enteras & & & \\ \hline chat ireses: & & & \\ \hline & Mudphnd ins & ce ationnen & \\ \hline & lady. & her. & Hes. \\ \hline & & & \\ \hline cock & & & \\ \hline form Murr & & & \\ \hline & & & \\ \hline intrent Choper & & & \\ \hline Lel winer & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline 5 & & & \\ \hline a & & & \\ \hline whr & & & \\ \hline Gocel & & 1 & 1 \\ \hline \end{tabular}

first three months of operations: - The budgeted selling price per unit is . Budgetod unit sales for June, July, August, September, October, and November are , and 13,000 units. 14,000 units, and 15,000 units respectively. All sales are on credit. - of credit sales are collected in the month of the sale and in the following month. - The ending finished goods inventory equals of the following month's unit sales. - The ending raw materials inventory equals of the following month's raw materials production needs. Eact unit of finished goods requires 5 pounds of raw materiaks. The raw materials cost per pound. - Thirty percent of raw materials purchases are paid for in the month of purchase and in the following month. Accounts Payable balance on June 30 was . - The direct labor wage rate is per hour. Each unit of finished goods requires two direet labor-hours. There is no guaranteed minimum wages. - Variable manufacturing overhead is per direct labor hours. Fixed manufacturing overhead is per month, which includes depreciation expense. There is no noncash expense items other than depreciation expense. Total predetermined overhead rate (Variable and Fixed MOH combined) is calculated based on direct labor hours every quarter (round to the nearest dollar). - The variable selling and administrative expense per unit sold is . The fixed selling and administrative expense per month is , which includes depreciation expense. There is no noncash expense items other than depreciation expense. - For cash budget: - The company's beginning cash balance on July 1 was . The company requires a minimum cash balance of and may borrow any amount needed from a local bank at an annual interest rate of (therefore quarterly). The company may borrow any amount at the beginning of any quarter and may repay its loans at the end of any quarter. Interest payments are due on any principal at the time it is repaid. - The company plans to pay dividends of during July. Prepare the following budgets: 1. Sales Budget \& Schedule of Cash Collection 2. Production Budget 3. Direct materials purchase Budget \& Schedule of Cash Disbursement 4. Direct Labor Budget 5. Manufacturing Overhead Budget 6. SG\&A Budget 7. Cash Budget 8. Budgeted Income Statement.