Home /

Expert Answers /

Accounting /

smart-company-prepared-its-annual-financial-statements-dated-december-31-2020-the-company-applie-pa503

(Solved): Smart Company prepared its annual financial statements dated December 31,2020 . The company applie ...

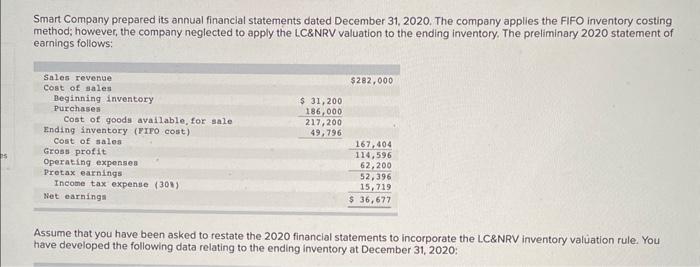

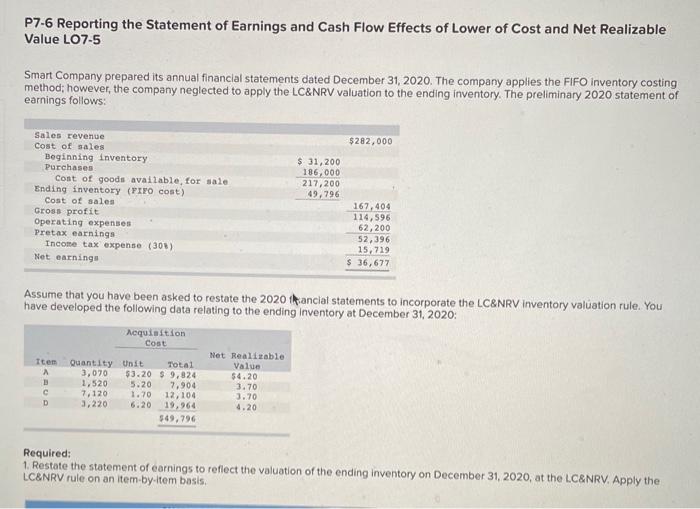

Smart Company prepared its annual financial statements dated December 31,2020 . The company applies the FiFO inventory costing method; however, the company neglected to apply the LC\&NRV valuation to the ending inventory. The preliminary 2020 statement of earnings follows: Assume that you have been asked to restate the 2020 financial statements to incorporate the LC\&NRV inventory valuation rule. You have developed the following data relating to the ending inventory at December 31, 2020:

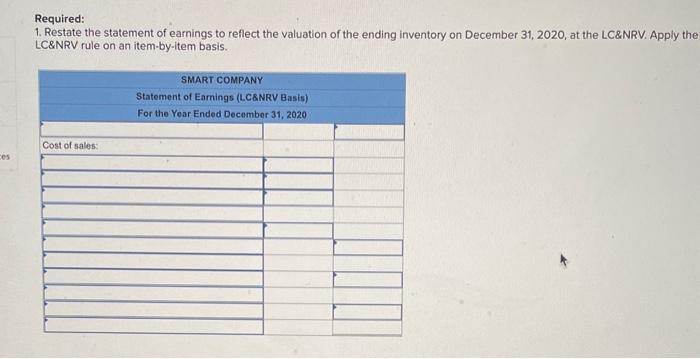

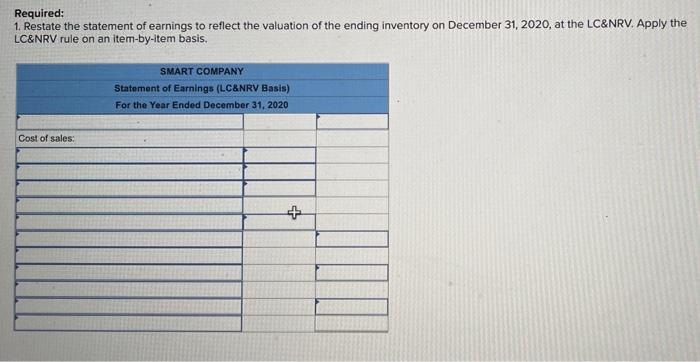

Required: 1. Restate the statement of earnings to reflect the valuation of the ending inventory on December 31, 2020, at the LC\&NRV. Apply the LC\&NRV rule on an item-by-item basis.

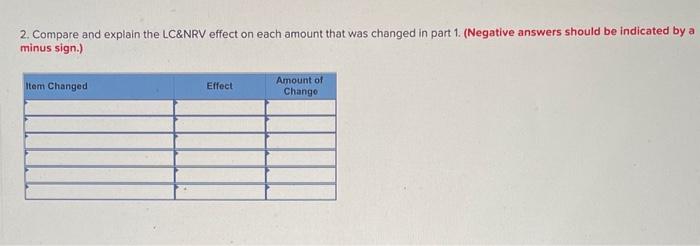

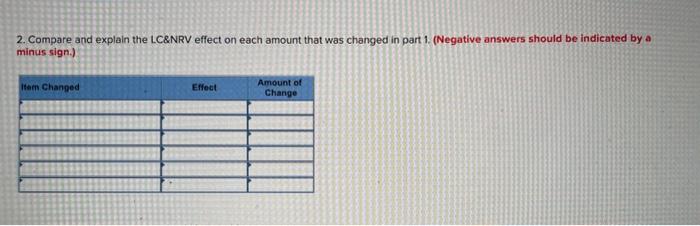

2. Compare and explain the LC\&NRV effect on each amount that was changed in part 1. (Negative answers should be indicated by a minus sign.)

P7-6 Reporting the Statement of Earnings and Cash Flow Effects of Lower of Cost and Net Realizable Value LO7-5 Smart Company prepared its annual financial statements dated December 31,2020 . The company applies the FIFO inventory costing method; however, the company neglected to apply the LC\&NRV valuation to the ending inventory. The preliminary 2020 statement of earnings follows: Assume that you have been asked to restate the 2020 fhisancial statements to incorporate the LC\&NRV inventory val?ation rule. You have developed the following data relating to the ending inventory at December 31,2020 : Required: 1. Restate the statement of earnings to reflect the valuation of the ending inventory on December 31,2020 , at the L.C\&NRV. Apply the LCENRV rule on an item-by-ltem bosis.

Required: 1. Restate the statement of earnings to reflect the valuation of the ending inventory on December 31, 2020, at the LC\&NRV. Apply the LC\&NRV rule on an item-by-item basis.

2. Compare and explain the LC\&NRV effect on each amount that was changed in part 1. (Negative answers should be indicated by a minus sign.)