(Solved): Show the steps: (a) In three-months, you client anticipates borrowing USD 800,000 for a period of s ...

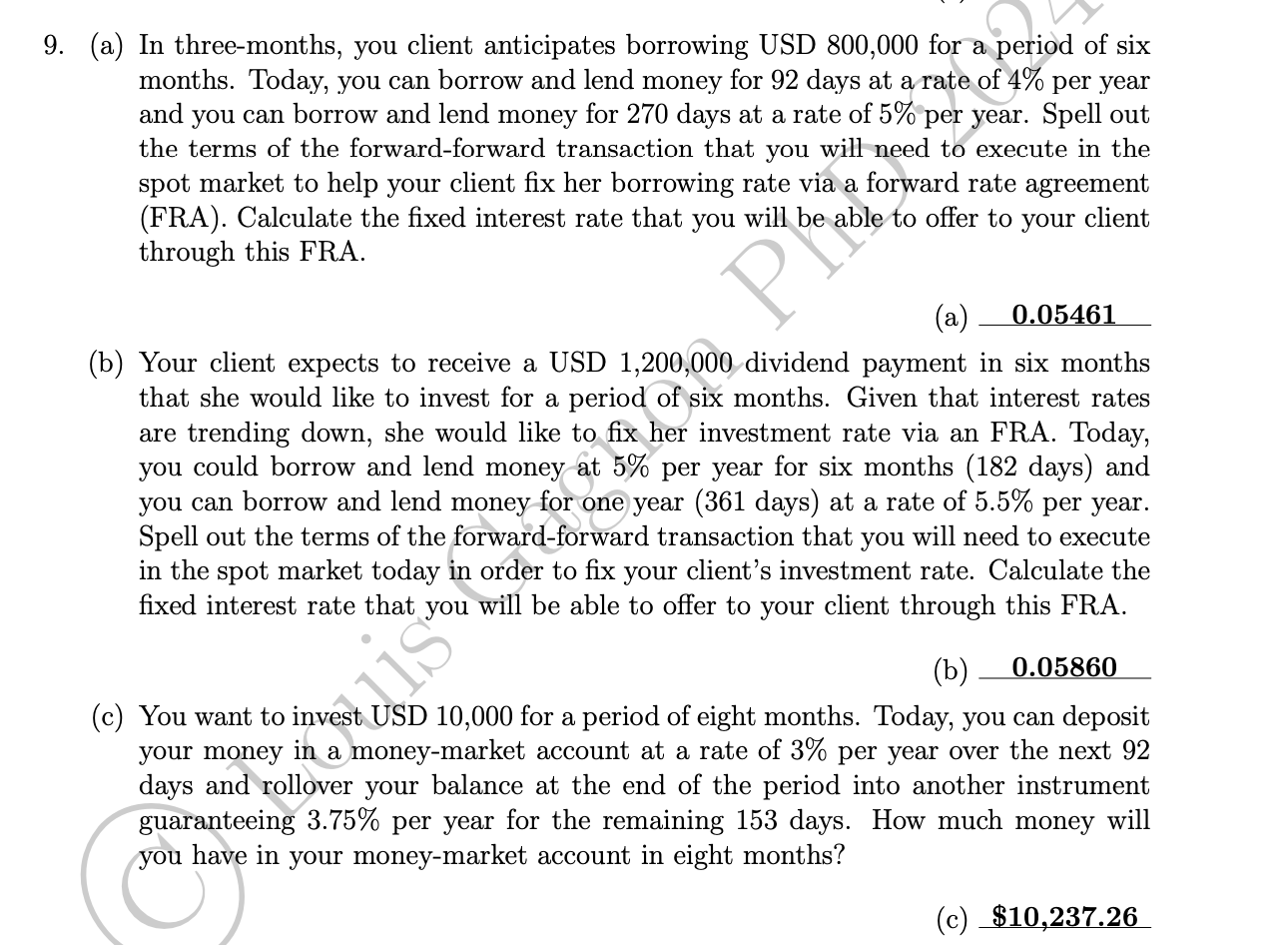

Show the steps: (a) In three-months, you client anticipates borrowing USD 800,000 for a period of six months. Today, you can borrow and lend money for 92 days at a rate of 4% per year and you can borrow and lend money for 270 days at a rate of 5% per year. Spell out the terms of the forward-forward transaction that you will need to execute in the spot market to help your client fix her borrowing rate via a forward rate agreement (FRA). Calculate the fixed interest rate that you will be able to offer to your client through this FRA. (a) (b) Your client expects to receive a USD 1,200,000 dividend payment in six months that she would like to invest for a period of six months. Given that interest rates are trending down, she would like to fix her investment rate via an FRA. Today, you could borrow and lend money at 5% per year for six months (182 days) and you can borrow and lend money for one year (361 days) at a rate of 5.5% per year. Spell out the terms of the forward-forward transaction that you will need to execute in the spot market today in order to fix your client's investment rate. Calculate the fixed interest rate that you will be able to offer to your client through this FRA. (b) (c) You want to invest USD 10,000 for a period of eight months. Today, you can deposit your money in a money-market account at a rate of 3% per year over the next 92 days and rollover your balance at the end of the period into another instrument guaranteeing 3.75% per year for the remaining 153 days. How much money will you have in your money-market account in eight months? (c) $10,237.26