Home /

Expert Answers /

Accounting /

sep-a-calendar-year-corporation-reported-918-000-net-income-before-tax-on-its-current-y-pa259

(Solved): SEP, a calendar year corporation, reported \( \$ 918,000 \) net income before tax on its current y ...

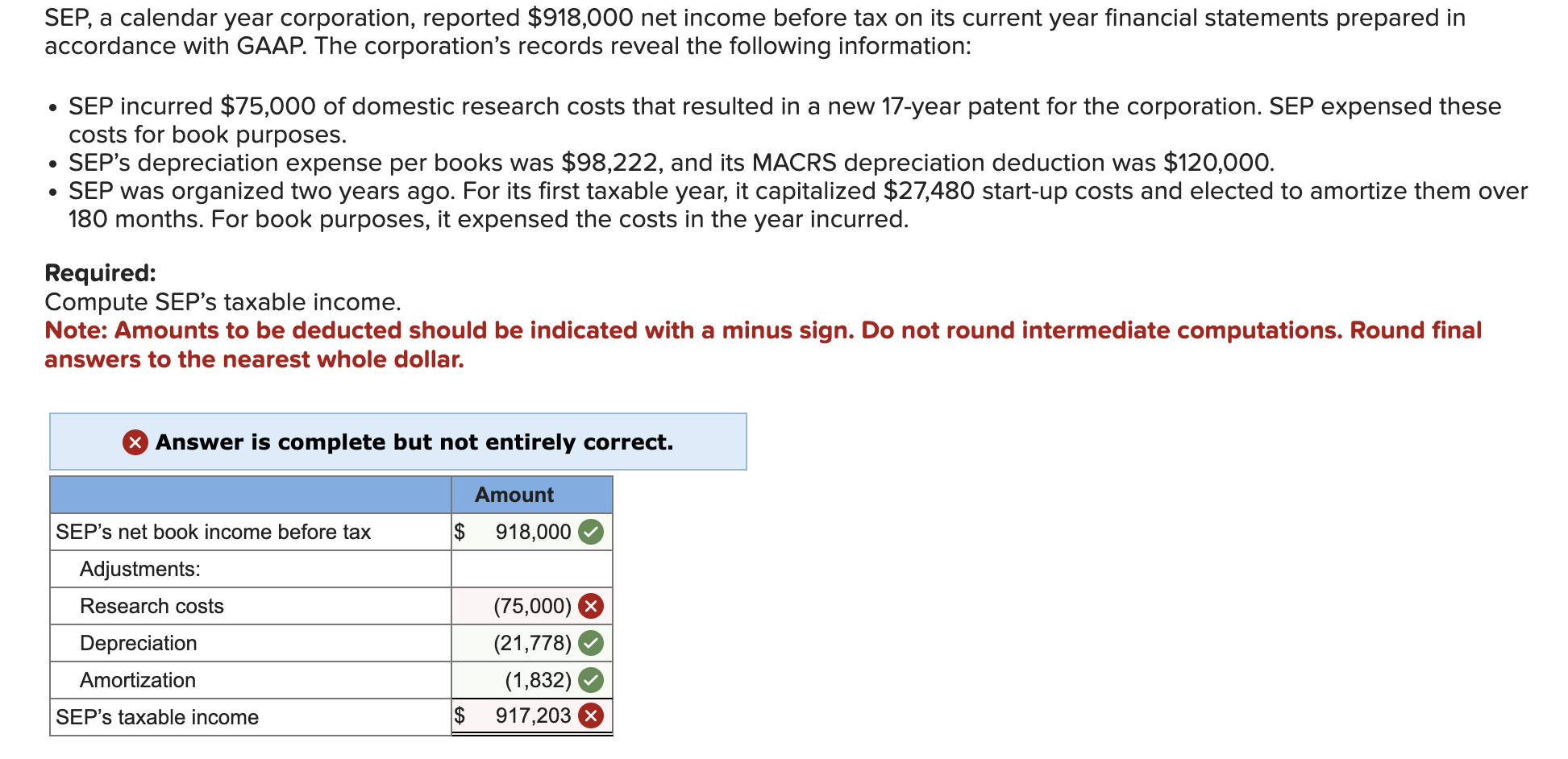

SEP, a calendar year corporation, reported \( \$ 918,000 \) net income before tax on its current year financial statements prepared in accordance with GAAP. The corporation's records reveal the following information: - SEP incurred \( \$ 75,000 \) of domestic research costs that resulted in a new 17-year patent for the corporation. SEP expensed these costs for book purposes. - SEP's depreciation expense per books was \( \$ 98,222 \), and its MACRS depreciation deduction was \( \$ 120,000 . \) - SEP was organized two years ago. For its first taxable year, it capitalized \( \$ 27,480 \) start-up costs and elected to amortize them over 180 months. For book purposes, it expensed the costs in the year incurred. Required: Compute SEP's taxable income. Note: Amounts to be deducted should be indicated with a minus sign. Do not round intermediate computations. Round final answers to the nearest whole dollar. Answer is complete but not entirely correct.

Expert Answer

CALCULATION AMOUNT ($) SEP's net book income before tax 91