Home /

Expert Answers /

Accounting /

selected-unadjusted-account-balances-at-december-31-2023-are-shown-below-for-demron-servicing-acc-pa788

(Solved): Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing. Acc ...

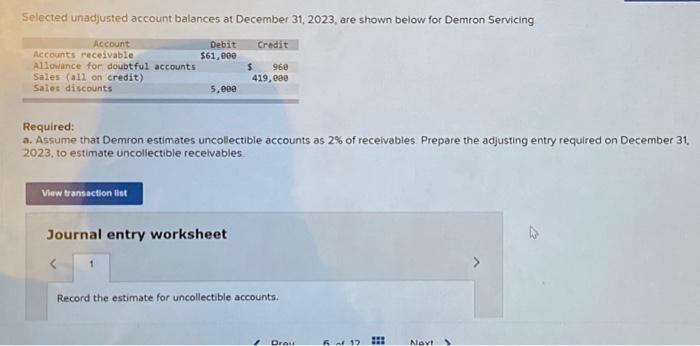

Selected unadjusted account balances at December 31, 2023, are shown below for Demron Servicing. Account Accounts receivable Allowance for doubtful accounts Sales (all on credit) Sales discounts View transaction list Debit $61,000 < 5,000 Required: a. Assume that Demron estimates uncollectible accounts as 2% of receivables. Prepare the adjusting entry required on December 31, 2023, to estimate uncollectible receivables. Journal entry worksheet 1 Credit $ 960 419,000 Record the estimate for uncollectible accounts. 1 Prev 6 of 12 www www Next 7

Selected unadjusted account balances at December 31,2023 , are shown below for Demron Servicing Required: a. Assume that Demron estimates uncollectible accounts as of receivables. Prepare the adjusting entry required on December 31 , 2023, to estimate uncollectible recelvables.

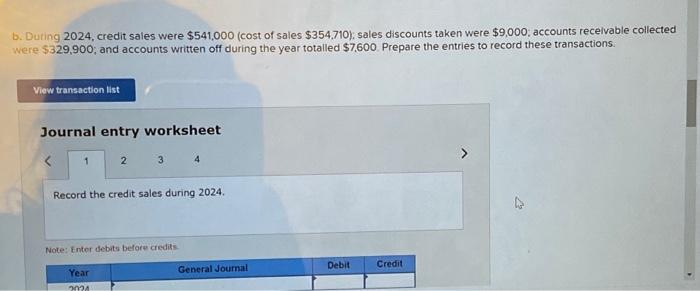

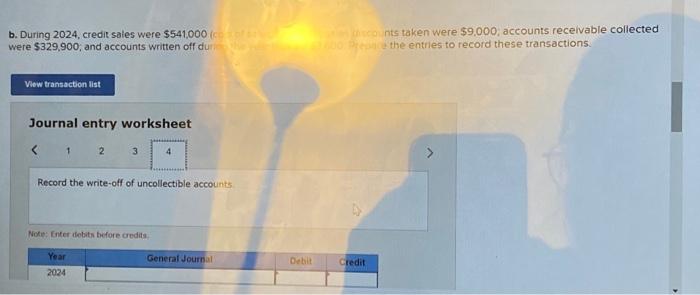

b. During 2024 , credit sales were (cost of sales ), sales discounts taken were , accounts recelvable collected were ; and accounts written off during the year totalled . Prepare the entries to record these transactions. Journal entry worksheet | 14 Note: Entor debits before credis:

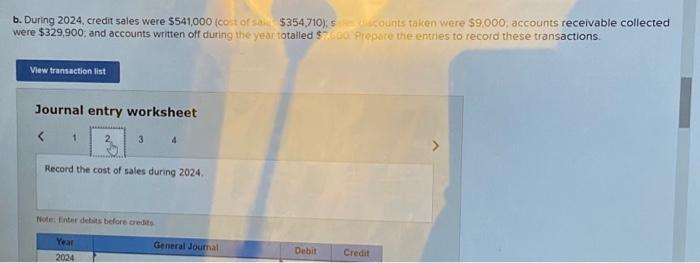

b. During 2024, credit sales were (cot of a ), counts taken were , accounts receivable collected were , and accounts written off during the year totalled ; pur plepare the entries to record these transactions. Journal entry worksheet Record the cost of sales during 2024. Nole: Enter detists before oredas.

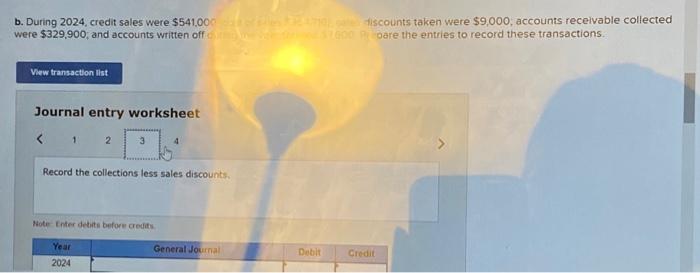

b. During 2024, credit sales were : Aliscounts taken were , accounts recelvable collected were ; and accounts written off oare the entries to record these transactions. Journal entry worksheet Record the collections less sales discounts. Note-Enter debits before credits.

b. During 2024 , credit sales were ints taken were , accounts recelvable collected were ; and accounts written off du it the entries to record these transactions. Journal entry worksheet Record the write-off of uncollectible accounts Note: finter debits before oredits.

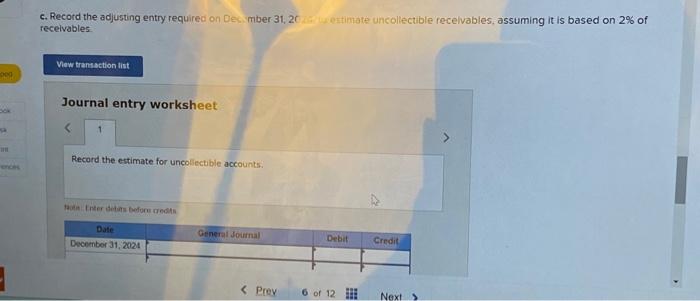

c. Record the adjusting entry required on Dec. mber . . extimate uncollectible recelvables, assuming it is based on of recelvables:

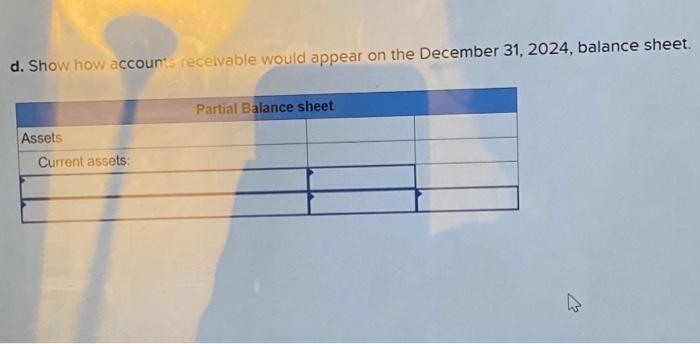

d. Show how accounts recelvable would appear on the December 31, 2024, balance sheet.