Home /

Expert Answers /

Accounting /

requirements-1-what-is-the-npv-of-each-project-assume-neither-project-has-a-residual-value-round-pa397

(Solved): Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round ...

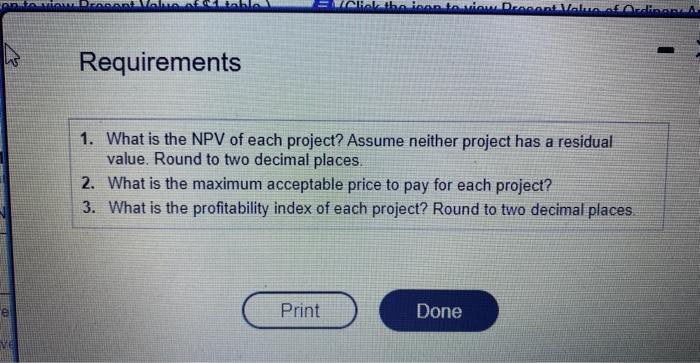

Requirements 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? 3. What is the profitability index of each project? Round to two decimal places.

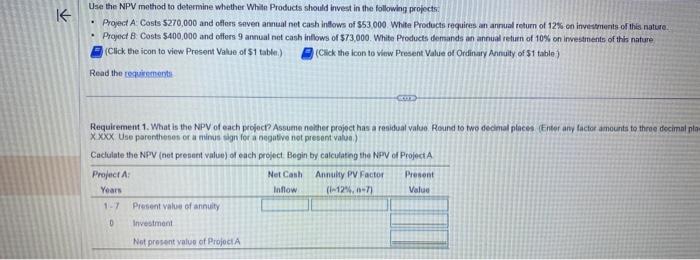

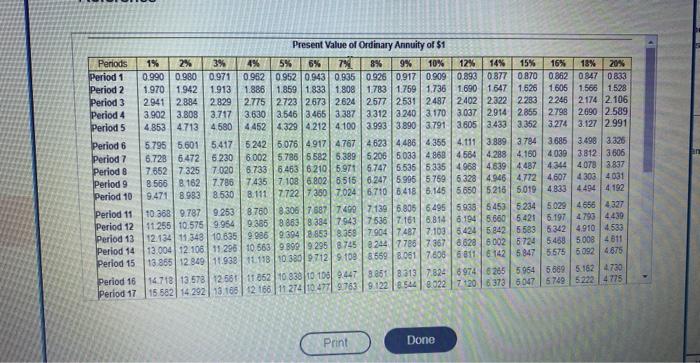

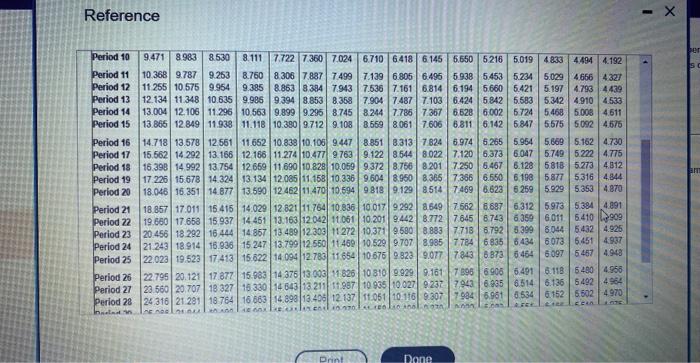

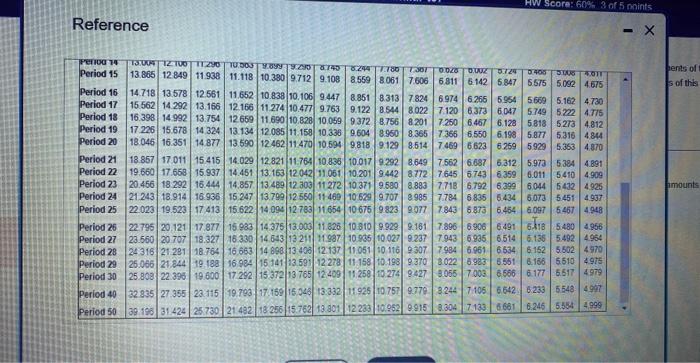

Use the NPV method to determine whether Whitn Products should invest in the following propocts: - Project A: Costs 5270,000 and offers saven annual net cash intlows of 353,000 . White Products requires an anrual return of 125 - cn investments of this nature. - Proyect B. Costs \( \$ 400,000 \) and offers 9 annual not cash intlows of \( \$ 73,000 \). White Products derrands an annual return of \( 10 \% \) on investinents of this nature (Click the icon to view Present Value of \( \$ 1 \) table.) (Cuck the icon to view Present Value of Ordinary Annuity of \( \$ 1 \) table) Read the requitement: Requirement 1. What is the NPV of each project? Assuene nether project has a residual value. Round to two decimal pheces (Enter any lactor amounts to throe docimal ni \( \times \times \times \times \) Use parentheses of a mimis sign for a negative not present value.) Caclulate the NPY (net present value) of each project Bogin by calculating the NFPV of Project A

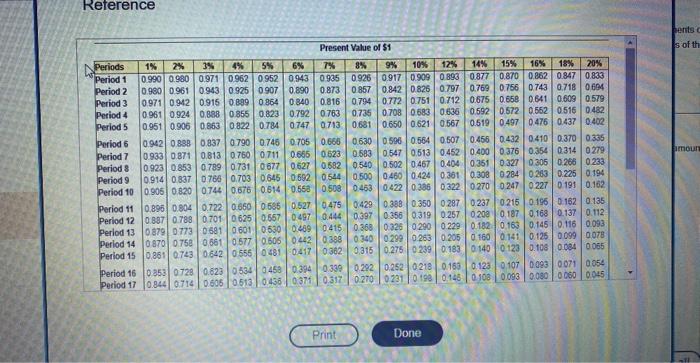

Reterence

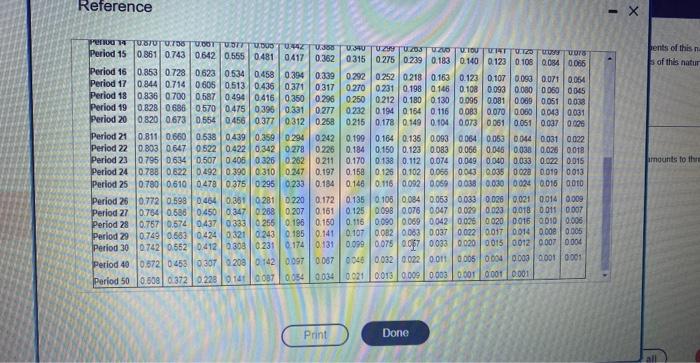

Reference

Present Value of Ordinary Annuity of \$1 Print Done

Reference

Reference

Expert Answer

Net present value for Project A Time Cash flows Multiply: Annuity PV factor Present value Present value of annuity 1 to 7 $53,000 4.564 $241,892 Inves